Phalcon Explorer now supports Plasma, the purpose-built L1 for stablecoins. You can analyze payment flows, debug smart contracts, and trace fund movements on the world's first stablecoin-native blockchain. Access comprehensive transaction analysis, real-time monitoring, and advanced debugging tools on Plasma today.

Why stablecoins need purpose-built infrastructure

Stablecoins are emerging as the backbone of the next-generation global payment system. The market is moving toward trillions of dollars value. We're seeing stablecoins fundamentally change how money moves globally.

Most blockchains weren't designed with stablecoins in mind. They treat stablecoins as just another token type. But stablecoins need specialized infrastructure. They need near-instant settlement, fee-free transfers, and institutional-grade security. Plasma provides exactly that.

Plasma is revolutionizing the stablecoin ecosystem as a high-performance Layer 1 blockchain specifically engineered for digital dollar infrastructure. In a world where stablecoins are becoming essential financial rails, Plasma delivers the focused approach needed for global payment volumes.

What is Plasma network

Plasma is a Layer 1 blockchain purpose-built for global stablecoin payments. Unlike general-purpose blockchains, Plasma optimizes every aspect of its architecture for stablecoin operations. This focused approach enables unprecedented performance for payment applications.

The network launched with over $7 billion in stablecoin deposits and supports 25+ different stablecoins. Plasma ranks as the 4th largest network by USDT balance. The chain has attracted diverse partnerships including Yellow Card, Privy, Rain, Fireblocks, and Mansa. Major investors like Bitfinex, Founders Fund, Framework, Flow Traders, and DRW back the project.

Here's what makes Plasma different. The network handles over 1,000 transactions per second. Block times stay under 1 second. USDT transfers cost zero dollars in fees. The system maintains full EVM compatibility. And Plasma includes a native Bitcoin bridge for direct BTC operations.

Key features of Plasma network

Plasma combines several innovations that make it ideal for stablecoin infrastructure.

Purpose-Built for Stablecoins

Every layer is optimized for digital dollar operations. From consensus to execution, Plasma enables sub-second finality and fee-free transfers. The network provides native support for stablecoin use cases at the protocol level. You get built-in stablecoin infrastructure with integrated liquidity pools and native payment operations.

Deep Liquidity and Native Features

Plasma launched with approximately $2 billion in USDT available from day one. This deep liquidity means you can build applications knowing capital is ready to move. The network supports over 200 payment methods across 100+ countries and currencies. You don't need to bootstrap liquidity or wait for adoption.

Full EVM Compatibility

You can deploy contracts using the same tools and workflows you already know. Foundry, Hardhat, MetaMask, and all major EVM infrastructure work out of the box. There's no need for bridging layers, custom compilers, or modified contract patterns. Your existing Solidity code works without changes.

Native Bitcoin Bridge

Plasma includes a trust-minimized bridge for Bitcoin. You can move BTC directly into the EVM environment without relying on centralized custodians. This unlocks new applications at the intersection of stablecoins and the world's largest digital asset. You get BTC-backed stablecoins, trustless collateral, and Bitcoin-denominated finance in a single environment.

Stablecoin-Native Contracts

Plasma maintains protocol-governed contracts tailored for stablecoin applications. These include zero-fee USDT transfers through dedicated paymaster contracts, custom gas tokens that let users pay fees in stablecoins instead of native tokens, and confidential payments for privacy-preserving transfers. These contracts are security-audited and designed to work directly with smart account wallets.

Why you need transaction analysis on Plasma

Plasma's stablecoin-first design creates unique requirements for developers, compliance teams, and financial operators.

For Payment Platform Developers

When you're building global payment infrastructure, you need deep visibility into transaction flows. You need to debug fee-free transfer logic and understand how paymasters sponsor gas. You want to trace payment routes across multiple stablecoin types. You need to verify that cross-border settlements execute correctly. And you need to optimize smart contract interactions for high-volume payment scenarios.

For DeFi Protocol Builders

Building on Plasma means working with deep stablecoin liquidity. You need to understand how your lending protocols interact with multiple stablecoins. You want to trace collateral movements across DeFi primitives. You need to debug yield-generating strategies safely. You want to monitor liquidity pool performance. And you need to verify that BTC bridge operations execute correctly.

For Financial Institutions

Traditional finance is moving onchain. You need to analyze settlement finality for institutional transactions. You want to track treasury operations across multiple accounts. You need to verify escrow contract logic before deploying millions in value. You want to monitor payment streaming for payroll and recurring settlements. And you need detailed transaction records for reconciliation and reporting.

For Stablecoin Issuers

If you're issuing stablecoins on Plasma, you need comprehensive monitoring. You want to track minting and burning operations. You need to verify reserves match circulating supply. You want to monitor redemption flows. You need to analyze transaction velocity and holder distribution. And you want to ensure your stablecoin contracts perform as expected under high volume.

What Phalcon Explorer brings to Plasma developers

We built Phalcon Explorer to provide comprehensive transaction analysis for blockchains that matter. Plasma's focus on stablecoin infrastructure makes it a perfect fit for our tools.

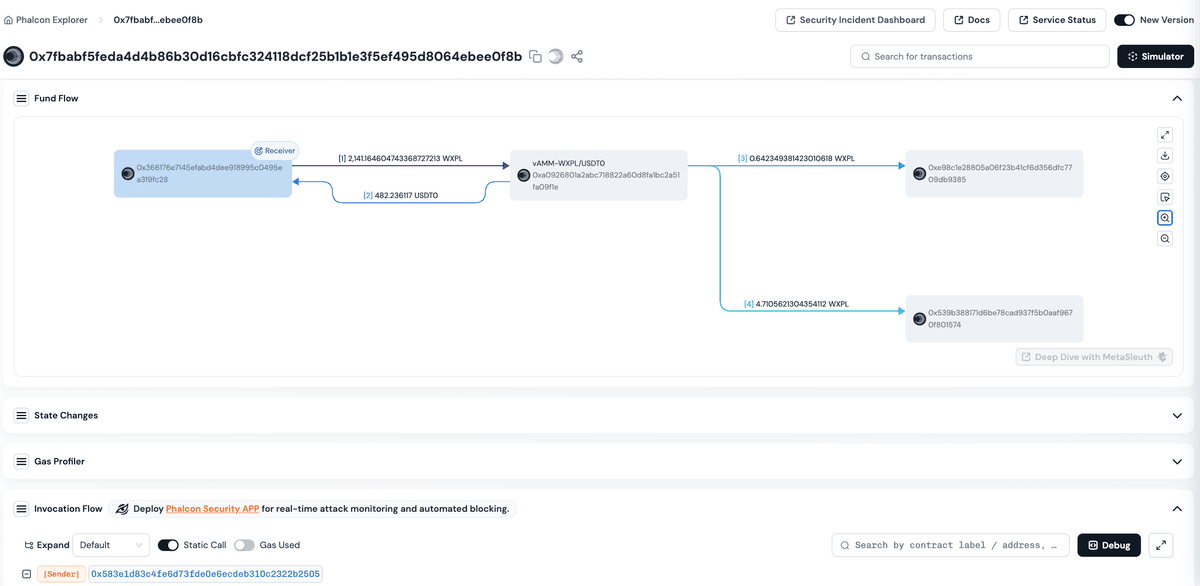

*You can click the picture below and have a test drive.

Comprehensive Payment Flow Analysis

We make Plasma's stablecoin transactions easy to understand. You get complete visualization of payment routes from sender to recipient, including all intermediate steps. We show you exactly how paymasters sponsor gas for fee-free transfers. You can track balance changes for every stablecoin involved in a transaction. We decode all payment-related events into human-readable format. And you see the full context of multi-step settlement flows.

Advanced Smart Contract Debugging

We provide tools specifically designed for financial contract development. You can step through verified contract code line by line to understand execution. We show you storage changes for critical financial state variables. You see gas consumption patterns even when fees are sponsored. We provide detailed revert reasons when transactions fail. And you can analyze how your contracts interact with Plasma's native stablecoin features.

Multi-Stablecoin Transaction Tracking

Plasma supports 25+ stablecoins. We help you make sense of complex multi-currency flows. You can track USDT, USDC, and other stablecoins in a single transaction view. We show you exchange rates and conversion steps. You see how custom gas tokens get used for fee payments. We track cross-stablecoin swaps and settlements. And you can analyze liquidity flows across different stablecoin pools.

Testing and Simulation Tools

Before you deploy payment infrastructure, you need to test thoroughly. You can simulate transactions to preview outcomes before execution. We help you test complex payment flows safely. You can validate multi-party settlement logic. We show you how confidential payment features affect transaction visibility. And you can debug edge cases without risking real funds.

Building the future of payments on Plasma

The combination of Plasma's purpose-built infrastructure and Phalcon Explorer's comprehensive analysis tools creates the ideal environment for building next-generation stablecoin applications.

Global Remittance Networks

You can leverage Plasma's fee-free architecture to enable instant cross-border transfers. Build platforms that connect local fiat on-ramps with Plasma's stablecoin rails. Enable migrant workers to send money home instantly without fees. With our monitoring tools, you can track payment flows across corridors and ensure regulatory compliance. You see exactly how money moves from sender to recipient across multiple jurisdictions.

Merchant Payment Infrastructure

Deploy point-of-sale systems that settle in real time. Plasma's sub-second finality means merchants receive funds instantly. The native stablecoin optimization ensures price stability. Use our simulation tools to test complex loyalty programs and multi-currency settlement logic before going live. You can verify that split payments work correctly. You can track merchant payouts in real time.

Institutional Settlement Systems

Create B2B payment rails that handle millions in daily volume with programmatic compliance. Plasma's deep liquidity pools ensure efficient large-value transfers. The native Bitcoin bridge opens opportunities for crypto-to-stablecoin settlement flows. Monitor every transaction with our enterprise-grade tools to maintain institutional SLAs. You get the detailed reporting financial institutions demand.

Micropayment Platforms

With zero transaction fees, sub-dollar payments become economically viable. Build streaming payment applications for content creators. Create pay-per-use APIs or IoT device networks where traditional payment rails fail. Debug complex payment splitting logic with our transaction traces to ensure creators get compensated accurately. You can verify that micropayments aggregate and settle correctly.

Yield-Generating Stablecoin Products

Develop DeFi protocols that maximize stablecoin yields through Plasma's integrated infrastructure. Create automated market makers, lending pools, or structured products that benefit from the network's stablecoin-first design. Test complex DeFi strategies safely using our analysis tools before deploying millions in TVL. You can verify that your yield calculations execute correctly.

Programmable Escrow Services

Build trustless escrow systems for freelance platforms, real estate transactions, or supply chain payments. These systems release funds based on smart contract conditions. Plasma's EVM compatibility means you can port existing escrow logic while benefiting from instant, free settlement. Simulate edge cases and dispute scenarios with our tools to ensure bulletproof contract logic.

Who's building on Plasma with Phalcon Explorer

Major stablecoin infrastructure providers have committed to Plasma. These teams need reliable transaction analysis.

Payment platforms like Yellow Card are building on Plasma to serve users across Africa. Privy provides wallet infrastructure for seamless stablecoin onboarding. Rain delivers compliant fiat on-ramps and off-ramps. Fireblocks offers institutional-grade custody solutions. Mansa builds financial infrastructure for emerging markets.

These teams rely on comprehensive transaction analysis to build, debug, and optimize their payment applications. They need to understand complex multi-party flows. They need to verify compliance with financial regulations. And they need tools that work at the scale Plasma enables.

Start analyzing Plasma transactions today

We're live on Plasma from day one. You can start using Phalcon Explorer right now.

Getting Started Takes Minutes

Visit Phalcon Explorer at blocksec.com/explorer. Paste any transaction hash to see complete analysis instantly.

What You Get Today

We provide full transaction trace and debugging for all Plasma transactions. You can track balance changes across all 25+ supported stablecoins. We visualize payment flows from sender to recipient. We integrate with source code verification for deployed contracts. You get real-time block and transaction monitoring. We maintain complete historical data from genesis. And we provide API access for programmatic analysis.

Perfect For Your Use Case

Payment platform developers can debug fee-free transfer logic. Compliance teams can monitor large-value transfers. DeFi builders can analyze stablecoin liquidity flows. Financial institutions can verify settlement finality. Stablecoin issuers can track minting and redemption. Security researchers can audit smart contract interactions.

The infrastructure stablecoins deserve

Plasma's purpose-built blockchain combined with Phalcon Explorer's comprehensive analysis creates the foundation for the next generation of global payments. Whether you're building remittance networks for millions of users or institutional settlement systems for billions in daily volume, you now have the infrastructure and tools to do it right.

As stablecoins continue their trajectory toward becoming the primary medium of exchange in the digital economy, Plasma and Phalcon Explorer are providing the foundational infrastructure to make this vision a reality. You get the performance needed for global scale. You get the compliance tools required for institutional adoption. And you get the visibility necessary to build with confidence.

Start analyzing Plasma transactions today with Phalcon Explorer. We're the only blockchain explorer built for comprehensive stablecoin payment analysis.

About Phalcon Explorer

Phalcon Explorer is the industry-leading blockchain transaction analyzer. We provide payment platform developers, compliance teams, and financial institutions with unparalleled visibility into onchain activity. We support 15+ EVM chains including Ethereum, BSC, Arbitrum, Base, Monad, and now Plasma. Phalcon Explorer has become the essential tool for understanding complex payment flows, tracing fund movements, and debugging financial contracts.

Learn more:

- Website: blocksec.com/explorer

- Documentation: docs.blocksec.com

- Twitter: @BlockSecTeam

- Telegram: t.me/blocksecteam