Blockchain regulatory compliance is becoming increasingly challenging for crypto businesses worldwide. If you work in different regions, you encounter various regulations. Policies are updated frequently, and there are strict checks on transactions, users, and funds. What once felt manageable has become complex, time-consuming, and easy to get wrong.

When compliance slows your platform down, users feel it first. Long reviews, blocked deposits, and false alerts hurt trust and reduce activity. Many teams struggle to balance regulatory requirements with a smooth user experience.

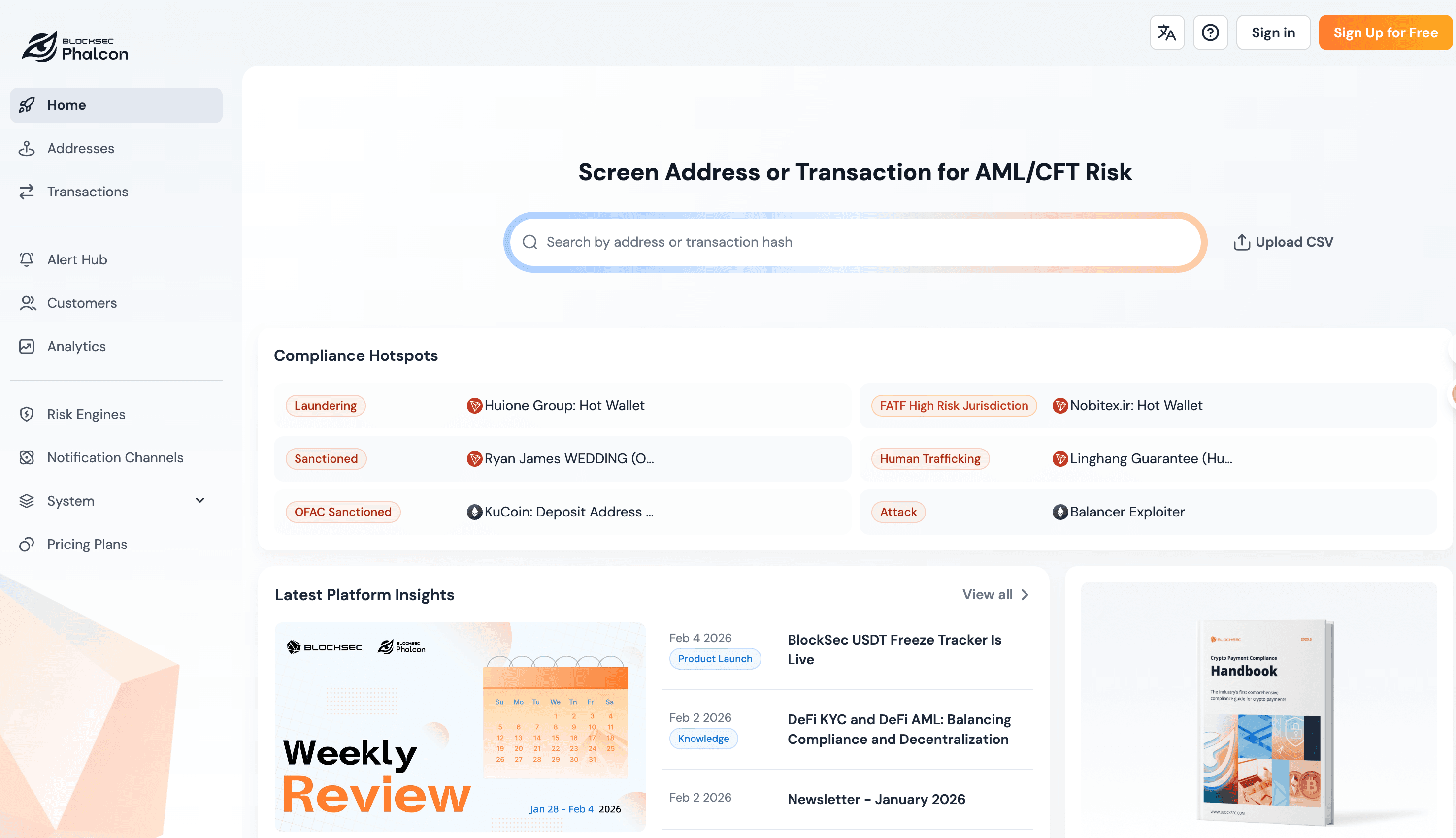

That is why we built Phalcon Compliance. It helps you meet blockchain regulatory compliance requirements in real time. This way, you stay compliant, move faster, and keep users satisfied.

Why Blockchain Regulatory Compliance Matters Now

Blockchain technology changed how money moves. It moves fast and across borders. This is great, but it means you have little time to check things. Old compliance rules were for slow systems. In blockchain, once money moves, it is hard to get back. You need a new way to find risks right away.

Compliance is not just a legal paper anymore. It is a growth engine for your business. If your compliance is strong, you can launch products faster and enter new countries with confidence. It helps you gain trust from big partners and regulators.

If you cannot show strong blockchain regulatory compliance, you might lose banking partners or access to whole regions. Weak controls can lead to big fines or a bad name that takes years to fix. For most crypto businesses, compliance must support your daily growth, not stop it.

Why Traditional Compliance Tools Fail in Blockchain

Most traditional compliance tools were built for banks and payment processors. Their design does not match how blockchain systems work today.

1. Static rules don't match how blockchain works

Fixed rules create false positives and often overlook real risks. On-chain behavior changes fast, and static patterns cannot keep up.

2. Manual reviews slow down operations

Traditional banking workflows rely on human checks. This delays deposits and withdrawals and still fails to catch complex fund flows.

3. Account-level thinking misses on-chain risk

Traditional tools focus on user accounts. Blockchain risk exists at the address and transaction level, across chains and protocols.

4. No real-time awareness

Blockchain transactions settle quickly. Detecting risk after funds move is often too late.

Traditional tools don't work for today's blockchain regulatory compliance due to these limits.

Turn Compliance Into One Simple Page

We talk to hundreds of teams, and the fear is always the same: "Where do we even start?" Managers need a clear, global view of their risk.

Imagine a single digital dashboard. On this page, you see every country where your business moves money. Phalcon Compliance gives you this view. The dashboard updates automatically, so you don't have to track things by hand or guess anymore.

It shows you the AML focus and the reporting rules for each region. The colors change based on live data. This gives leaders a clear picture of where the real blockchain regulatory compliance risk sits. In this world, compliance is no longer just a reaction. It is a must-have for your business to grow safely.

The latest version of Phalcon Compliance was released last month. Read the full article to learn about the key feature highlights.

The latest version of Phalcon Compliance was released last month. Read the full article to learn about the key feature highlights.

What Modern Blockchain Regulatory Compliance Means

Today, blockchain regulatory compliance is more than just knowing who a user is (KYC). Regulators want you to track where money comes from. They want to know how it moves on-chain. They also need to see if money is linked to bad activity.

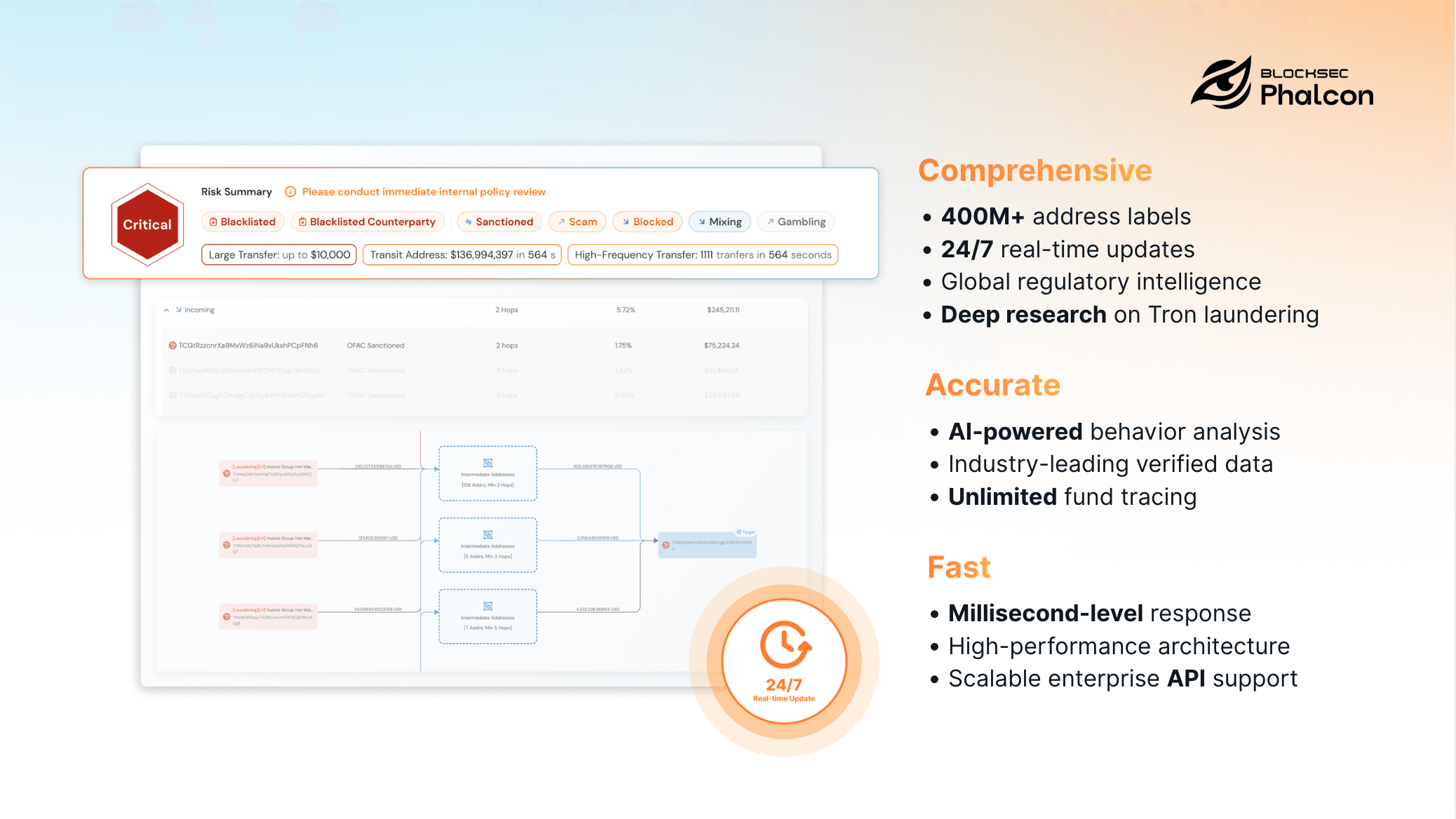

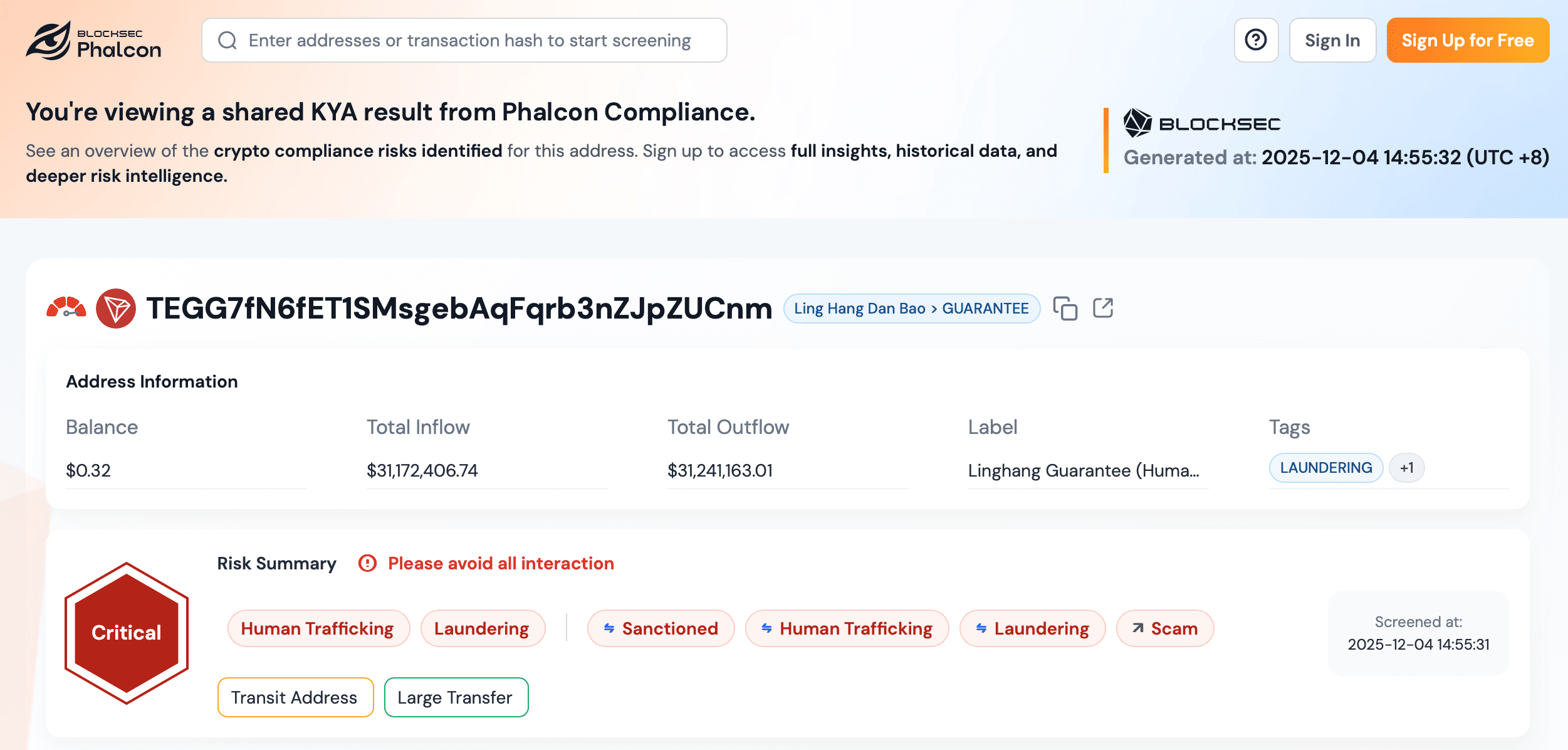

Real risk rarely shows up in one transaction. Money often goes through many addresses, bridges, mixers, and DeFi apps before it reaches you. Looking at just one address does not tell the full story. You need to see the whole path of the money. You need to see how it interacts with other things. This is what blockchain-native compliance does.

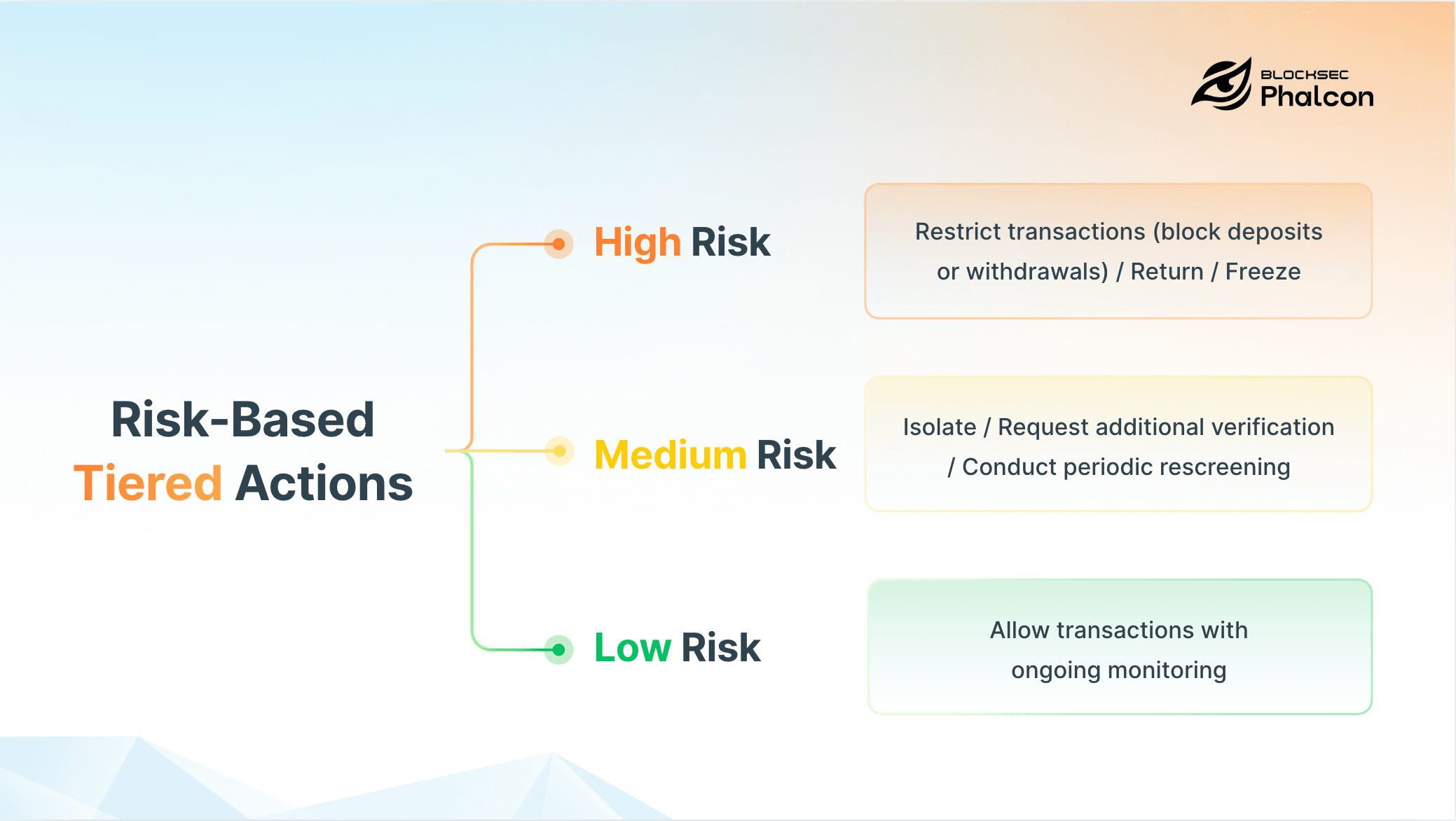

For example, a deposit might look fine at first. But if you follow its path, you might see it came from a mixer or a bad group. Without tools that trace paths automatically, you can miss this risk. Modern rules also want you to use a risk-based approach. This means you don't treat every transaction the same. Low-risk activity should be fast. High-risk activity needs more checks or reports.

Phalcon Compliance works this way. It checks addresses and transactions fast. It uses different risk levels based on who is involved, what they do, and where the money goes. Normal users move fast. Risky activity gets stopped or checked before it causes problems. This is what blockchain regulatory compliance looks like in practice today.

This approach aligns with how regulators think about blockchain technology today. The goal is not to block innovation, but to manage systemic risk. Regulators look for fast detection, simple decision rules, and records that are easy to audit. These records must clarify the reasons for actions taken.

As a result, compliance teams must now understand blockchain mechanics, transaction graphs, and evolving threat patterns. Compliance is no longer only a legal function. It has become technical, data-driven, and closely connected to blockchain security.

Phalcon Compliance sits at this intersection. It transforms raw on-chain data into clear compliance signals. Teams can act on these signals right away. This is what blockchain regulatory compliance looks like in practice today.

How BlockSec Phalcon Compliance Solves These Problems

BlockSec Phalcon Compliance is built specifically for blockchain regulatory compliance. It analyzes addresses, transactions, and fund flows in real time. This is better than using static rules.

1. Real-time on-chain analysis instead of static rules

Phalcon Compliance analyzes addresses, transactions, and fund flows in real time. Risk decisions are based on live on-chain behavior, not fixed assumptions.

2. Clear and actionable risk insights

Compliance teams can immediately see who they are dealing with and where funds come from. This makes it easier to identify risk early and respond before it escalates.

3. Compliance without slowing operations

Phalcon Compliance works in milliseconds. Normal users pass with no friction. Risky activity is handled precisely. Teams meet regulatory expectations without blocking daily operations.

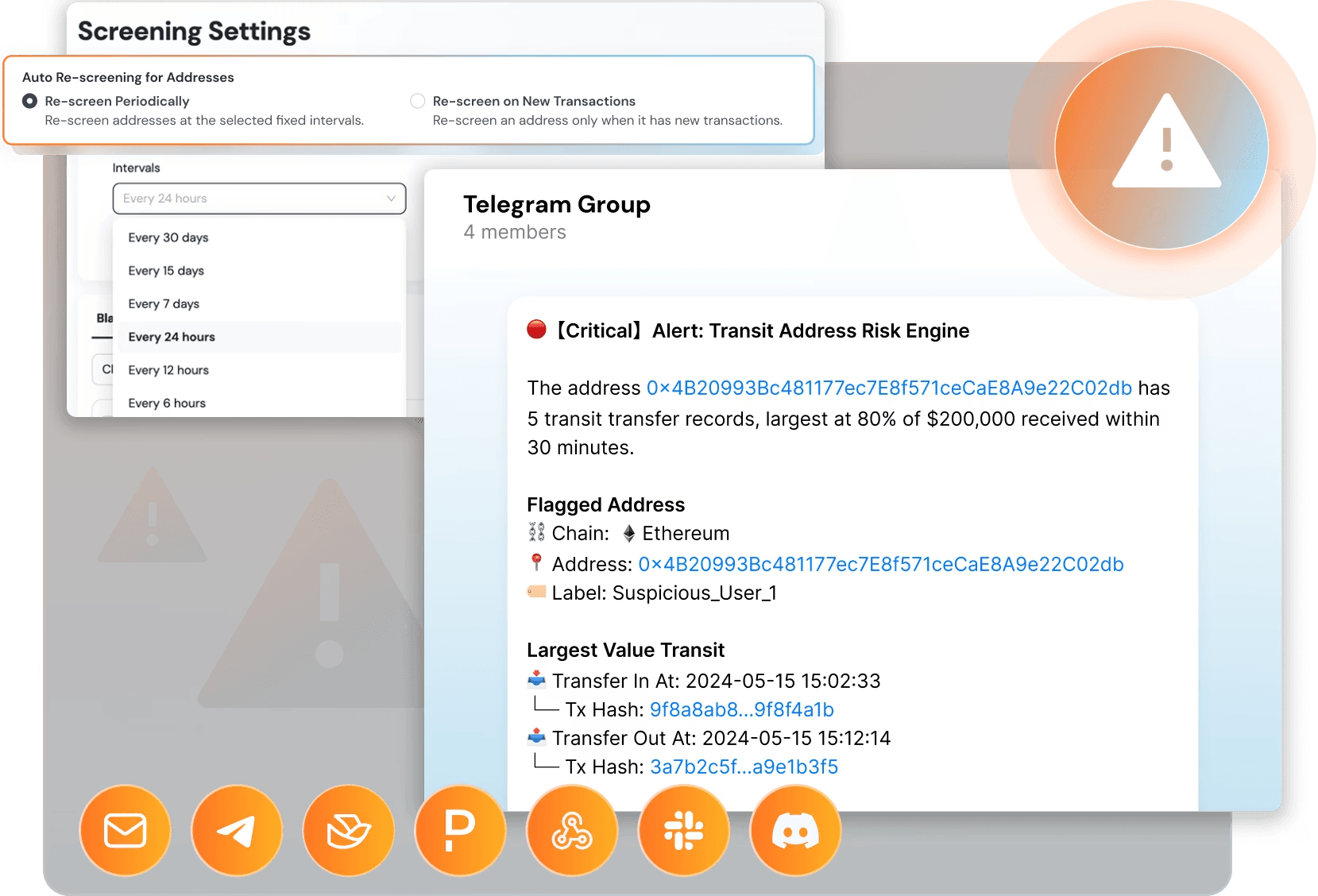

4. Continuously updated intelligence

Risk signals evolve as new behaviors appear on-chain. Compliance decisions are always based on current conditions, not outdated data. Click here to explore Phalcon Compliance product page.

5. From detection to response in one workflow

Phalcon Compliance bridges the gap between detection and action. It does this by merging blockchain security intelligence with compliance workflows. Teams no longer wait for post-incident reviews. They act before risk becomes loss.

This design reflects how blockchain regulatory compliance must operate in practice. Compliance is not a one-time check. It is a continuous process that adapts as on-chain behavior changes.

Real-Time Compliance for Deposits and Withdrawals

Blockchain regulatory compliance must work at machine speed. This is very important for fast payments. Deposits and withdrawals are the most risky points. This is where bad money often tries to enter or leave your platform.

Phalcon Compliance checks these transactions in real-time before they finish. It looks at address history and money paths very fast. Think about it: Ethereum makes a new block about every 12 seconds. Phalcon Compliance gives a risk score in about 100 milliseconds. That is only about 1% of the time for one block.

Imagine a subway car. Phalcon Compliance runs security checks while the doors are still open. Everyone gets through, and the train still leaves on time. This balance protects your platform without making your users wait.

Click here to learn about BlockSec blog / compliance cases.

Smarter Risk Control Without Hurting User Experience

One major challenge in blockchain compliance is finding a balance between control and user experience. Strict rules block good users. Loose rules fail to stop risk.

Phalcon Compliance uses tiered risk handling. Low-risk users pass quickly with minimal friction. Medium-risk activity is monitored and reviewed dynamically. High-risk transactions receive immediate attention and stronger controls.

From Two All-Nighters to One Click

For a compliance operator, the old way of working is painful. You have to copy addresses, paste them into spreadsheets, and search online for hours. You have to guess if a wallet belongs to a hacker.

With Phalcon Compliance, this work becomes a single action. When you find a risky transaction, you just click "Export SAR." A full report appears right away. It includes addresses, transaction hashes, and on-chain evidence.

Minutes later, your report is ready for regulators. This approach helps you handle serious risks quickly and stay confident. It turns a long, hard task into a simple part of your daily workflow.

Built for Global and Cross-Border Compliance

Crypto businesses work all over the world. Rules are different in every country. For example, in Europe, there is a rule called MiCA. In the US, the Bank Secrecy Act (BSA) and PSA in Singapore set the rules. There is also the FATF Travel Rule, which says you must share info about who is sending money.

Phalcon Compliance helps you meet these global rules. It uses smart logic to track risk across many different chains. This way, you always have a clear view, even when money moves between different crypto systems.

We also built a special protocol called X402. This is for AI agents that move money. An AI agent can call the X402 interface to get an instant KYA (Know Your Address) or KYT (Know Your Transaction) result. It is a "pay-per-request" system, so there are no long subscriptions. This makes blockchain regulatory compliance possible for both humans and machines in a fast-moving world.

Click here to read more about Agent-Native Crypto Compliance: Build KYA/KYT with X402.

Continuous Learning From Real Attacks

Blockchain threats evolve quickly. Static compliance data becomes outdated fast.

Phalcon Compliance is closely connected with BlockSec’s blockchain security research and real-time attack monitoring through Phalcon Security. This connection allows compliance rules to evolve based on real incidents, not assumptions.

When new attack patterns appear on-chain, insights are fed back into risk models and detection logic. This gives compliance teams access to up-to-date on-chain risk intelligence.

By learning directly from real-world exploits, Phalcon Compliance bridges the gap between blockchain security and regulatory compliance. This connection helps teams spot risks early. They can act before losses happen, not just after.

In-depth attack analysis article, e.g., Balancer exploit

This continuous learning loop is essential. Blockchain regulatory compliance cannot remain static in a dynamic threat environment. It must evolve alongside attacker behavior.

Conclusion: Compliance That Supports Growth

Compliance should not block innovation. It should protect users, support growth, and build trust.

BlockSec Phalcon Compliance helps crypto businesses handle blockchain rules easily. It ensures speed and a great user experience. By combining deep blockchain security expertise with practical compliance tools, we help teams stay compliant and competitive in a fast-changing industry.

If you’re building a crypto platform, exchange, or payment service, Phalcon Compliance keeps you safe and scalable. It prepares you for what’s next.

What You Should Do Next

If you have read this far, it may be time to see it yourself.

Open the Phalcon Compliance platform. Paste in any address. In under thirty seconds, you will see a full risk profile.

Download the report. Share it with your team. Decide if you want to connect the full system. Blockchain regulatory compliance can be complex, but the first step can be simple.

FAQ:

- What is blockchain regulatory compliance?

Blockchain regulatory compliance means following the laws that governments set for crypto businesses, like anti-money laundering (AML) and counter-terrorism financing (CTF) rules.

- Why is real-time monitoring important for compliance?

Real-time monitoring is important because blockchain transactions happen fast. If you don’t check for risks right away, the money could be gone before you even know there’s a problem.

- What is the "Travel Rule" in crypto?

The "Travel Rule" is a rule from the FATF that says crypto service providers must share details about the sender and receiver of transactions over a certain amount.

- How does Phalcon Compliance help with MiCA?

Phalcon Compliance helps by providing real-time data and audit logs. This helps meet the transparency and risk management requirements of the EU’s MiCA regulation.

- Can compliance actually help my business grow?

Yes! Good compliance builds trust with banks and partners, making it easier to launch new products and enter new markets.

- What is Know Your Transaction (KYT)?

KYT checks the behavior of money on the blockchain. It looks at where the money comes from to see if it’s linked to risky sources, unlike KYC, which focuses on who a person is.

- Why do traditional bank tools fail in the crypto world?

Traditional tools are slow and focus on bank accounts, not on-chain addresses or the complex money paths across different crypto protocols.

- What is a risk-based approach in compliance?

A risk-based approach means focusing your best controls on the highest-risk transactions while allowing low-risk transactions to pass through quickly.

- How does X402 help AI agents with compliance?

X402 is a protocol that allows AI agents to perform instant compliance checks (KYA/KYT) on a pay-per-request basis, without the need for a full subscription.

- How fast is Phalcon Compliance?

Phalcon Compliance returns a risk score in just 10Blockchain Regulatory Compliance0 milliseconds, which is only about 1% of the time it takes to create a new block on Ethereum.