When you search for blockchain legal compliance, most websites give you the same boring lists that make everything look safe. It is important, you can resort to authoritative blockchain legal compliance. But you also need to notice "Blockchain Legal Compliance Mirage." It looks safe path, but when you get closer, it disappears.

What is Blockchain Legal Compliance?

Blockchain legal compliance refers to the structured design, monitoring, and documentation of controls that align blockchain systems with applicable financial, securities, data, and cross-border regulations.

Usually, blockchain legal compliance looks complete on paper. But when regulators demand proof, trace fund flows, or question cross-border exposure, gaps appear. It means frozen accounts, delayed licenses, reputational risk, and board-level anxiety.

In practice, that means you need real-time monitoring and audit-ready evidence, which is exactly what Phalcon Compliance is built to provide.

With real-time transaction monitoring, intelligent address screening, customizable risk engines, and one-click STR/SAR reporting, you move from reactive defense to proactive control, and operate with clarity, auditability, and confidence, turning blockchain legal compliance into a competitive advantage.

The Hidden Truths of Blockchain Legal Compliance

In 2026, blockchain legal compliance is shaped by ten recurring friction points: court intervention rights, DAO liability, middleware exposure, jurisdiction conflicts, audit misconceptions, architectural compliance design, data privacy tension, RWA registration gaps, staged compliance strategy, and enterprise governance pressure.

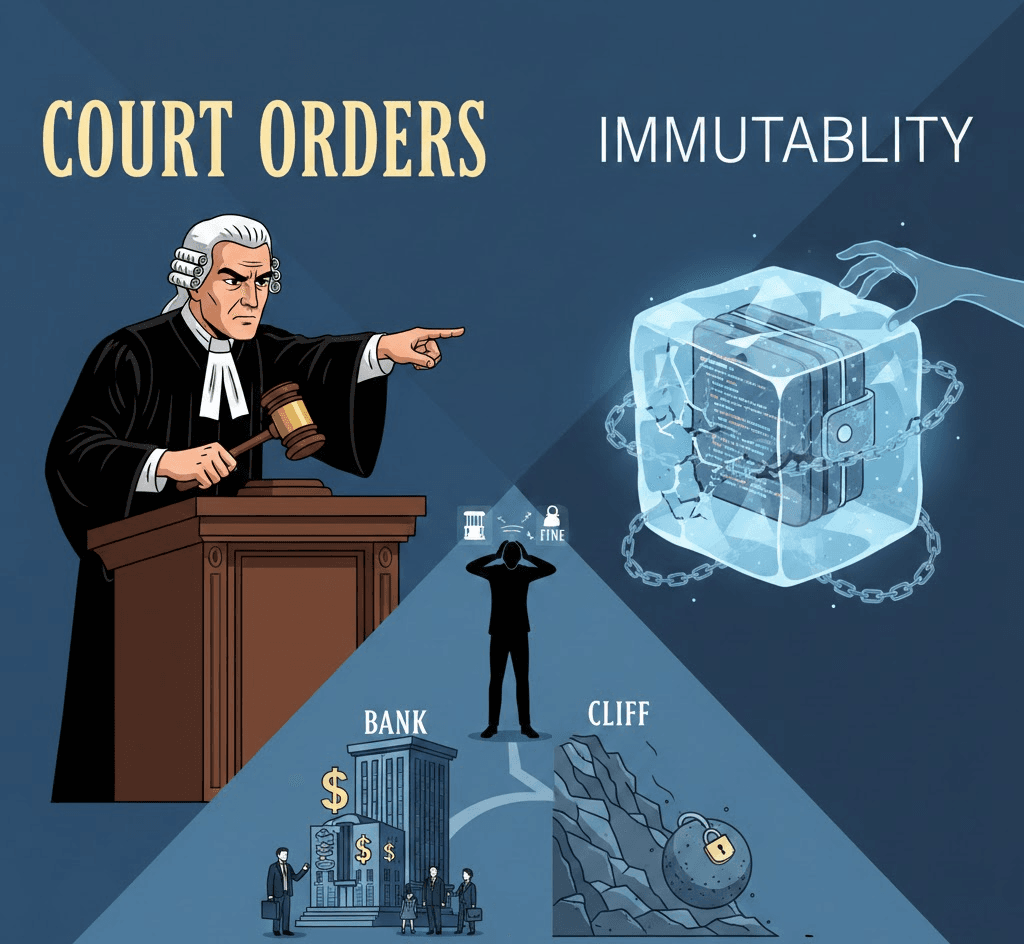

Court Orders vs. Immutability

Imagine a judge bangs their gavel and points at you. They say, "That wallet belongs to a thief. Freeze it right now!" In the world of blockchain legal compliance, this is the moment of truth. To a judge, a court order is a final command. They see you as the person who built the tool, so they expect you to have the remote control.

If you tell a judge, "I’m sorry, but my code is immutable and I physically cannot stop it," they won't think you are a genius. They will think you are hiding something. They might even hold you in "contempt of court," which can mean huge fines or even jail time for the developers. To the law, "I can't" sounds a lot like "I won't."

But here is the Technical Reality. Most people think "decentralized" means nobody has control. But often, that’s not true. Many projects use things called Admin Keys or Upgradable Contracts.

But there is a trap: if you have the power to freeze a thief's money, the law says you are now a "financial intermediary." That means you have to follow the same strict, expensive rules as a giant bank like JP Morgan. You lose your status as a "neutral software builder" and become a regulated money business.

So, what is the Compliance Conclusion? You are stuck between a rock and a hard place. If you keep the Admin Keys so you can follow court orders, you are legally a bank. This means you need a massive team of lawyers and expensive licenses just to stay open.

But if you throw the keys away to be "truly decentralized," you better be ready for a fight. You will have to prove to a judge that the protocol is truly out of your hands, like a stone rolling down a hill that nobody can stop.

Compliance takeaway: Decide early whether your protocol includes control points such as admin keys, pause functions, or upgrade mechanisms, and align that choice with your intended regulatory positioning.

Proof to keep: Maintain documented key custody policies, upgrade authority logs, governance voting records, and incident response documentation showing how intervention rights are exercised or permanently renounced.

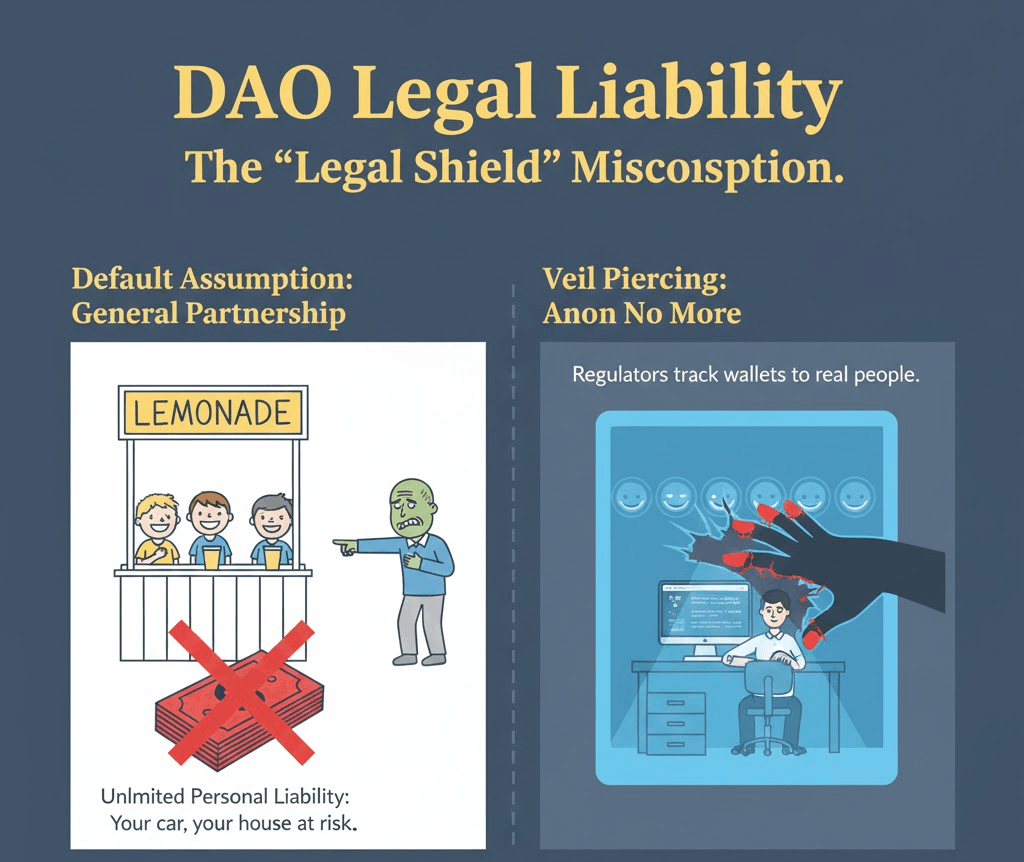

DAO Liability

A lot of people join a DAO (Decentralized Autonomous Organization) because they think it's a "legal shield." However, in the eyes of the law, if a group of people works together to make money but they don't register as a real company like an LLC (Limited Liability Company), the law makes a Default Assumption. It calls you a "General Partnership."

Think of a General Partnership like a group of friends who start a lemonade stand without a permit. If someone gets sick from the lemonade, the law doesn't care that there isn't a "company." It sazys every single friend who helped run the stand is 100% responsible for the medical bills.

In a DAO, if you don't have a formal legal "wrapper," the government sees you as a giant group of partners who are all on the hook for everything the DAO does. Here is how the Risk Path actually hits you as a token holder. You might think, "I only own 100 tokens and I just vote on proposals sometimes. I’m safe, right?" Not necessarily.

If your DAO does something illegal, like selling a token that should have been registered as a security, the government looks for someone to pay the fine. If the DAO treasury is empty or frozen, they can go after the people who voted for the bad idea.

They can say that by voting, you acted like a "manager" of the business. Suddenly, it’s not just the DAO’s money at risk; it’s your bank account, your car, and your house. Because you are a "General Partner," you aren't just responsible for your share. You could be held responsible for the whole debt.

Now, let’s talk about Veil Piercing. In a normal company, the "corporate veil" is like a magic wall that protects your personal stuff from the company’s problems. Many DAO members think their "anon" (anonymous) username is their wall. But regulators are getting very good at tracking wallets to real people.

The biggest Misconception is that being "decentralized" makes you invisible. It doesn't. If the law "pierces the veil," it means they are tearing down that wall. They will argue that the DAO was just a "front" and that the real people behind the screens are the ones who owe the money.

Compliance takeaway: Establish a formal legal wrapper and clearly define governance roles, voting thresholds, and liability boundaries before token distribution.

Proof to keep: Preserve incorporation documents, DAO governance charters, voting records, treasury control structures, and disclosures explaining the legal status of participants.

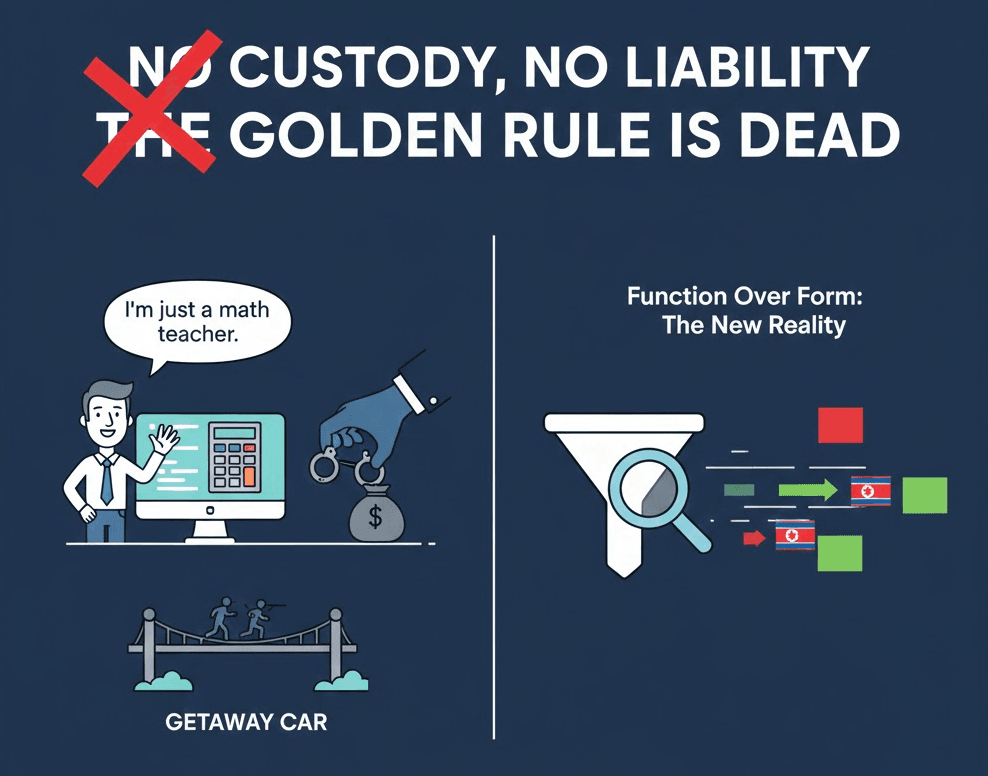

Bridges and Middleware

For a long time, there was a "golden rule" in crypto: "No custody, no liability." Developers believed that if they didn't hold the private keys to the users' money, they weren't responsible for what happened to it. If you just built a "bridge" or a "mixer" and let the code run itself, you were safe, right? Wrong. That golden rule is officially dead.

The government has shifted its focus. They are no longer just looking at who holds the money, but rather, who facilitates the movement of money. The most famous example is Tornado Cash. The developers argued they just wrote open-source code and didn't control the funds. But the US government didn't care. They saw the protocol as a tool that helped criminals hide billions of dollars. One of the founders was even convicted of "conspiracy to operate an unlicensed money transmitting business."

This sent a shockwave through the world of Blockchain Legal Compliance. It proved that being "non-custodial" is no longer a magic shield.

So, what is the new Rule of the Frontline?

If your software acts as a middleman, moving assets from Ethereum to Solana, or a protocol that bundles transactions, the law might see you as a Money Service Business (MSB). People were thinking in the past "I am just a math teacher providing a calculator." But now you are providing a getaway car.

Regulators now look at "Function over Form." If your bridge is used by people on a sanctions list (like groups from North Korea), the government will argue that you should have built a "filter" into your front-end or your smart contract to block them.

The biggest Myth to break is that "Middleware is invisible." In 2025 and 2026, we are seeing more "gateway" laws. These laws require anyone building "financial plumbing" to know who is using their pipes.

If you are building a bridge or a piece of middleware, you can't just have an irresponsible mindset to "deploy and forget." You need to think about Geofencing (blocking certain areas with suspicious activities) and Sanctions Screening right at the start.

Compliance takeaway: Implement sanctions screening, transaction monitoring, and geofencing controls at the protocol interface and operational layer from day one.

Proof to keep: Retain screening logs, sanctions list integration records, geolocation restriction data, suspicious transaction reports, and documented escalation procedures.

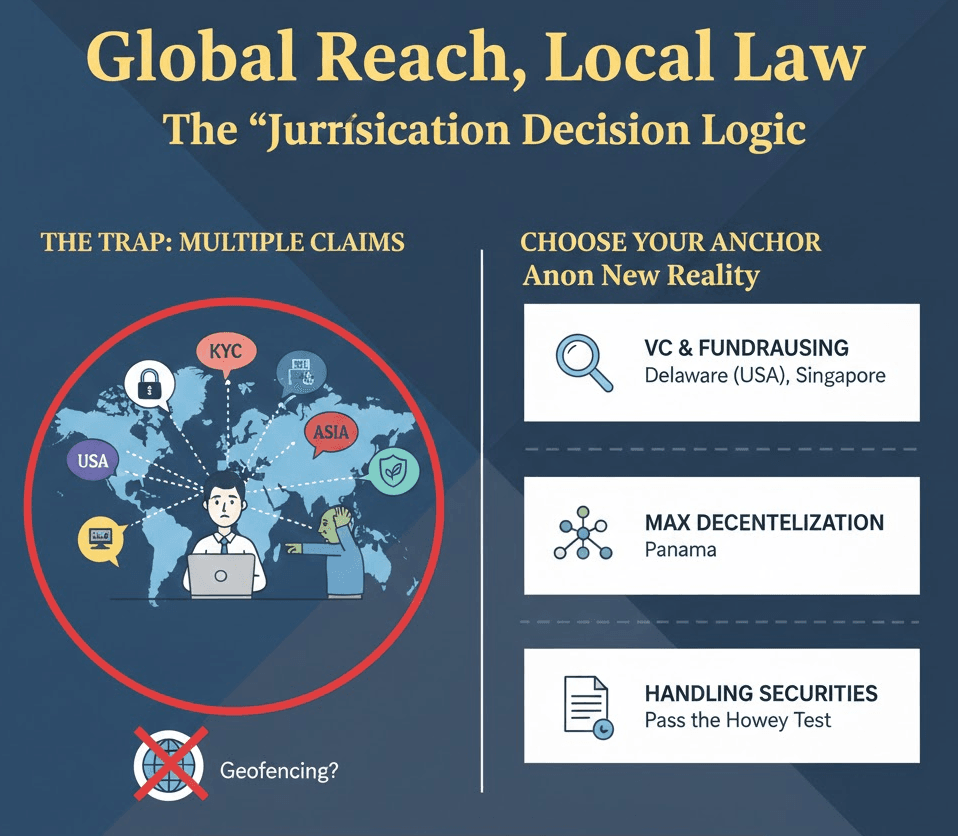

The Jurisdiction Decision Logic

Blockchains usually cross borders. Your protocol can be deployed in one country, hosted on servers in another, maintained by developers in three different time zones, and used by people from fifty more. From a technical view, that feels global and free. From a legal view, it can become a jurisdiction nightmare.

Here is the trap. Every country may claim authority over your project at the same time. If users from the United States interact with your platform, U.S. regulators may say their laws apply. If you collect data from European users, GDPR may apply. If tokens are traded in Asia, local securities or licensing rules may also apply. You may think you are “based” in one friendly jurisdiction, but regulators look at where your users are, not just where your company is registered.

Courts also ask practical questions. Where are the developers located? Where are the servers hosted? Where is marketing targeted? If your website is accessible worldwide and not geofenced, regulators can argue that you are intentionally offering services into their territory. Suddenly, you are not dealing with one regulator, but many.

This creates overlapping obligations and conflicting rules. One country may require strict KYC, while another restricts data sharing. One may treat your token as a commodity, another as a security. If you ignore this complexity, you risk enforcement from the most aggressive authority involved. Global access is powerful. But without a jurisdiction strategy, it can turn your project into a legal target everywhere at once.

If you cannot avoid global exposure, the next best move is to choose your legal anchor carefully.

Choosing Your Home Base

Don't pick a country just because it sounds "crypto-friendly." Pick it based on your exit strategy:

● For Venture Capital & Fundraising: Aim for Delaware (USA) or Singapore. These jurisdictions offer the corporate clarity that top-tier investors demand.

● For Maximum Decentralization: Explore Switzerland or Panama. These regions have mature laws regarding non-custodial software and foundation models.

● If Handling Securities: You must pass the "Howey Test" in the US or seek specific exemptions (like Reg D or Reg S). Without a clear path to compliance, your token is a ticking legal time bomb.

Compliance takeaway: Define your primary legal anchor and actively restrict unintended jurisdictional exposure through controlled market access.

Proof to keep: Keep jurisdiction analysis memos, IP blocking/geofencing logs, marketing targeting documentation, and records of user location risk assessments.

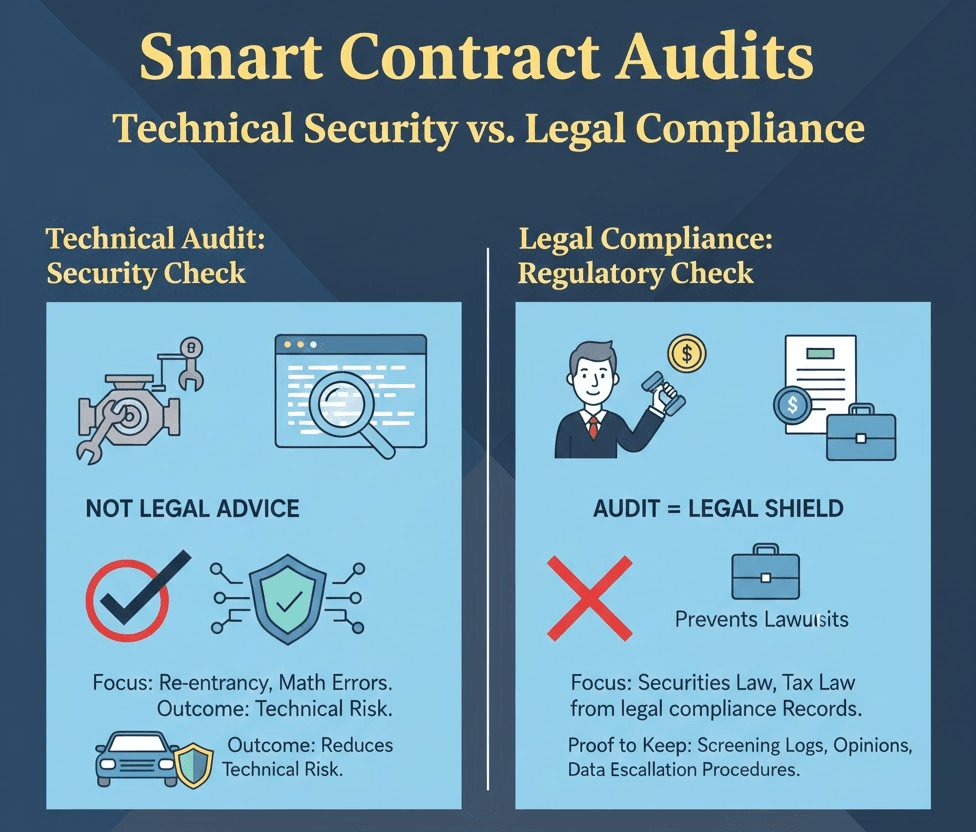

Smart Contract Audits

You’ve seen projects boast, “100% audited by a top firm!” It feels safe. If professionals reviewed the code, it must be legal, right? Not exactly. A smart contract audit checks technical security, not legal compliance. It’s like a mechanic confirming your car won’t explode, but not telling you whether it’s legal to speed through a school zone.

Auditors look for bugs such as re-entrancy or math errors. They do not assess whether your token is an unregistered security or whether your DAO violates tax laws. Code can work perfectly and still break the law. Many protocols were fully audited yet later shut down by regulators.

Read the disclaimers carefully. Audit reports usually state they are not legal advice and accept no liability. If you face enforcement, you cannot rely on an audit as a legal shield. A judge will see it as a technical review, not proof of compliance.

Treat audits like seatbelts. They reduce technical risk, but they do not prevent lawsuits. You need both technical security and Blockchain Legal Compliance expertise. Code safety and legal safety are not the same thing.

So if audits are not enough, what is? The answer is simple: compliance must be designed and continuously monitored.

Compliance takeaway: Separate technical security audits from legal compliance reviews and ensure both are independently addressed.

Proof to keep: Retain audit reports, legal opinions on token classification, remediation records, and documentation showing follow-up actions on identified risks.

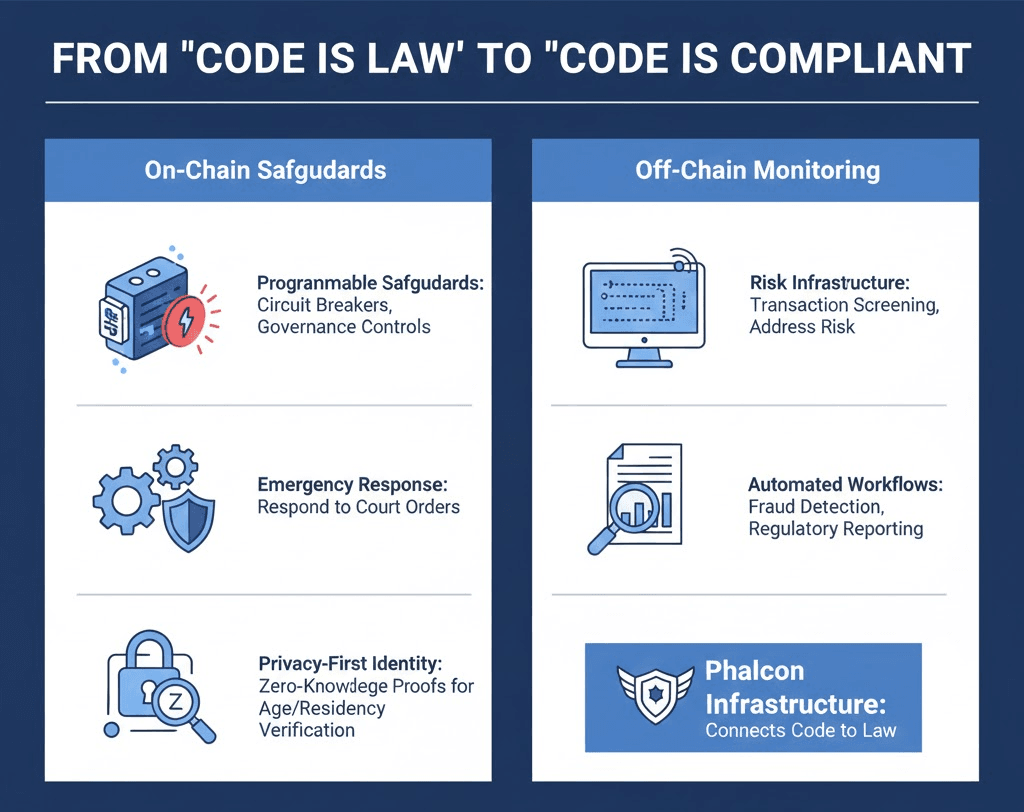

From "Code is Law" to "Code is Compliant"

On-chain, you can design programmable safeguards. Circuit breakers and governance controls allow you to respond to emergency court orders without collapsing the entire protocol.

Privacy-first identity models, such as Zero-Knowledge Proofs, can verify age or residency without permanently storing sensitive data on-chain. This helps reduce GDPR exposure while still meeting regulatory expectations.

But on-chain logic alone is not enough. Smart contracts cannot investigate fund history, detect complex laundering patterns, or generate regulatory reports. That responsibility lives off-chain, in your monitoring and risk infrastructure. Real-time transaction screening, address risk assessment, and automated reporting workflows are what turn compliance from theory into practice.

This is where compliance infrastructure like Phalcon Compliance becomes critical. It connects your protocol’s technical design with real-world regulatory requirements, allowing you to detect risk early, document actions clearly, and operate at scale without relying on hope or manual review.

Compliance takeaway: Embed programmable safeguards and off-chain monitoring systems that allow you to detect, respond, and document compliance risks in real time.

Proof to keep: Maintain transaction monitoring logs, alert resolution records, risk scoring outputs, STR/SAR filings, and documented governance-triggered interventions.

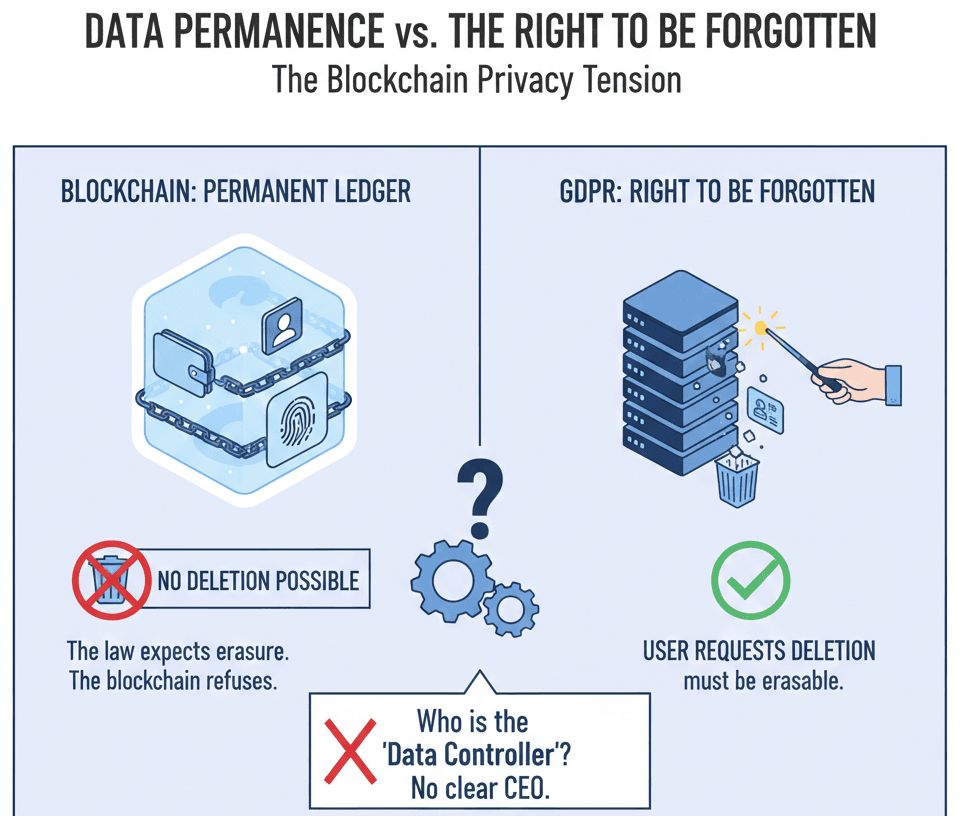

Data Permanence vs. The Right to Be Forgotten

Blockchains are designed to remember everything. For developers, this feels like security. For regulators, it can look like a legal problem. Especially in regions like the European Union, where privacy laws such as GDPR give people a powerful right: the “Right to Be Forgotten.”

Under GDPR, individuals can request that their personal data be erased. This works in traditional databases. A company can delete a record from its servers.

But what happens if personal data is embedded in an immutable blockchain? If a wallet address is linked to a real identity, and that link is stored permanently, how can it be erased? The law expects deletion. The blockchain refuses.

This creates a serious compliance tension. Regulators may ask: who is the “data controller”? Is it the developer who deployed the contract? The company running the front-end? The node operators validating transactions? Public blockchains do not have a clear CEO to hold accountable, yet privacy laws still require someone to be responsible.

The safest approach is not to store personal data on-chain at all. Sensitive information should stay off-chain, encrypted, and under strict access controls. Hashing data or using zero-knowledge proofs can reduce exposure, but they do not automatically remove legal responsibility.

If you design a system without thinking about data deletion and control, you may discover that your “permanent ledger” becomes a permanent liability.

Compliance takeaway: Avoid storing personally identifiable information on-chain and clearly allocate data controller responsibilities within your architecture.

Proof to keep: Retain data mapping documentation, privacy impact assessments, encryption policies, access control logs, and documented responses to data subject requests.

RWA (Real World Assets) and the "Registration Gap"

RWA is the hottest trend in crypto right now. Everyone wants to tokenize "real stuff" like houses, gold, or fine art. The idea is cool: you buy a token on your phone, and now you own a piece of a luxury apartment in New York. But there is a huge, invisible wall in the way. I call it the "Registration Gap."

Here is the problem. In the real world, "ownership" isn't kept on a blockchain; it’s kept in dusty government offices. If you buy a token representing a house, but the local government’s Land Registry still has the old owner’s name on the paper deed, who really owns the house?

Definitely, the paper wins. In a fight, a judge will follow the government’s registry, not your smart contract. This means you could hold a token that says "Owner," but physically, you have zero rights to the property. This is a massive "landmine" for RWA projects. If the on-chain world and the off-chain world don't talk to each other, the token is just a digital receipt for something you don't actually control.

How do projects fix this? They use a Legal Wrapper. This is a special legal setup, like a company or a trust, that owns the physical asset and then issues tokens that give you rights to that company. The benefit is making the link to the real world legal. Yet it exists a drawback, making the project centralized again. You have to trust the company to keep the "link" alive.

If you are looking at an RWA project, ask this: "If the website disappears tomorrow, does the law still say I own this asset?" If the answer is "I don't know," then you aren't buying an asset, but rather, a pinky promise.

Compliance takeaway: Legally link token ownership to enforceable off-chain rights through structured entities or trust frameworks.

Proof to keep: Maintain asset ownership documentation, legal wrapper agreements, tokenholder rights disclosures, and registry alignment verification records.

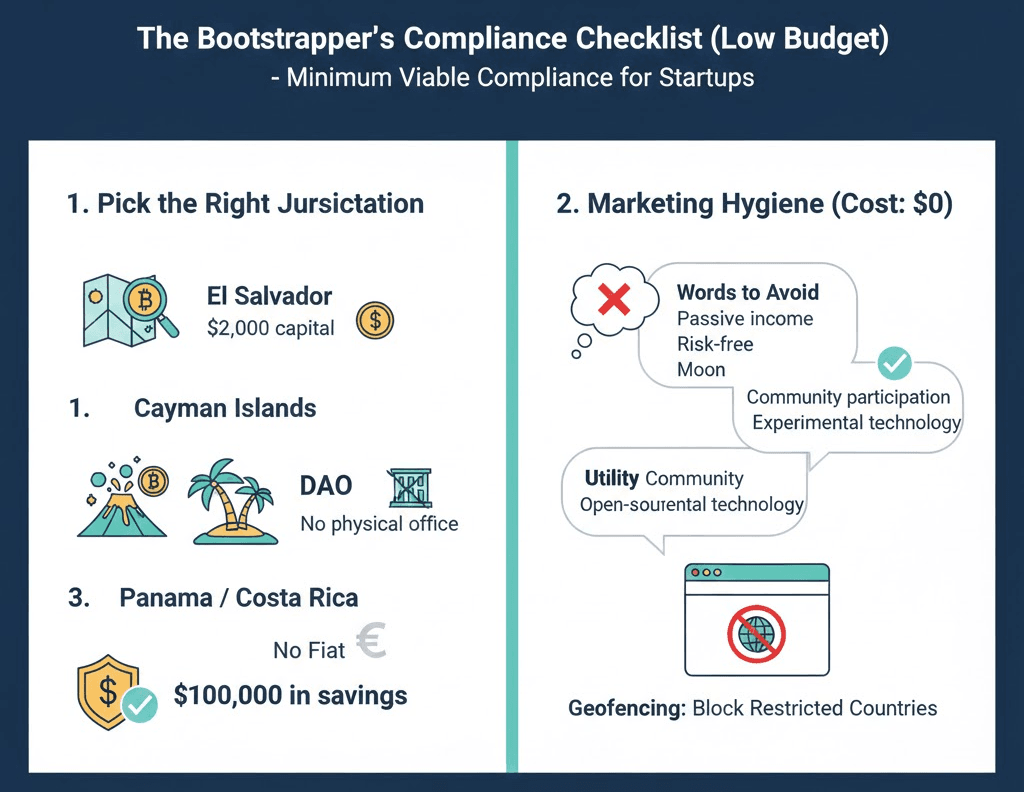

The "Bootstrapper’s" Compliance Checklist (Low Budget)

Most legal guides assume you have a million dollars sitting in the bank. But what if you’re just a small team with a great idea and a tiny budget? You can’t afford a 50-person legal team, but you also don't want to end up in a jail cell.

This is where Minimum Viable Compliance (MVC) comes in. Think of MVC as a "legal life vest." It’s the bare minimum you need to keep your head above water while you build your project. You don't need to be perfect on day one, but you do need to show the government that you are "trying in good faith." If you have zero compliance, you look like a criminal. If you have MVC, you look like a startup.

The first step of your MVC is picking the right Jurisdiction. Don't just launch from your bedroom in a country with strict crypto laws (like the US or UK) without a plan. If you are low on cash, look at "Founders' Favorites" for 2026:

El Salvador: They love Bitcoin and have made it very easy and cheap ($2,000 capital) to get a basic license.

The Cayman Islands: Great for DAOs or investment projects because you don't need a physical office or a huge staff to start.

Panama or Costa Rica: If you aren't touching "fiat" (regular money like Dollars or Euros) yet, these are flexible and low-cost places to register your brand.

Picking the right home for your code can save you $100,000 in legal fights later.

The second part of MVC is Marketing Hygiene. This costs $0, but it’s the most important thing you can do. Most crypto projects get shut down because of the "Trigger Words" they use on Twitter or Discord. If a regulator sees these words, they will flag you immediately.

Words to Avoid: "Guaranteed returns," "Passive income," "Risk-free," "Investment," or "Moon."

Words to Use: "Utility," "Community participation," "Open-source tool," and "Experimental technology."

The Golden Rule for Bootstrappers: Never promise that your token will make people rich. Instead, talk about what your tool actually does. If you focus on the tech and the utility, you are much safer.

Also, always put a simple "Geofence" on your website to block users from countries where you don't have a license yet. It’s not a perfect shield, but it proves to a judge that you weren't trying to break the rules on purpose.

Compliance takeaway: Implement staged compliance controls aligned with your growth phase rather than operating without structure.

Proof to keep: Preserve incorporation filings, legal opinions, geofencing logs, marketing communication records, and compliance roadmap documentation.

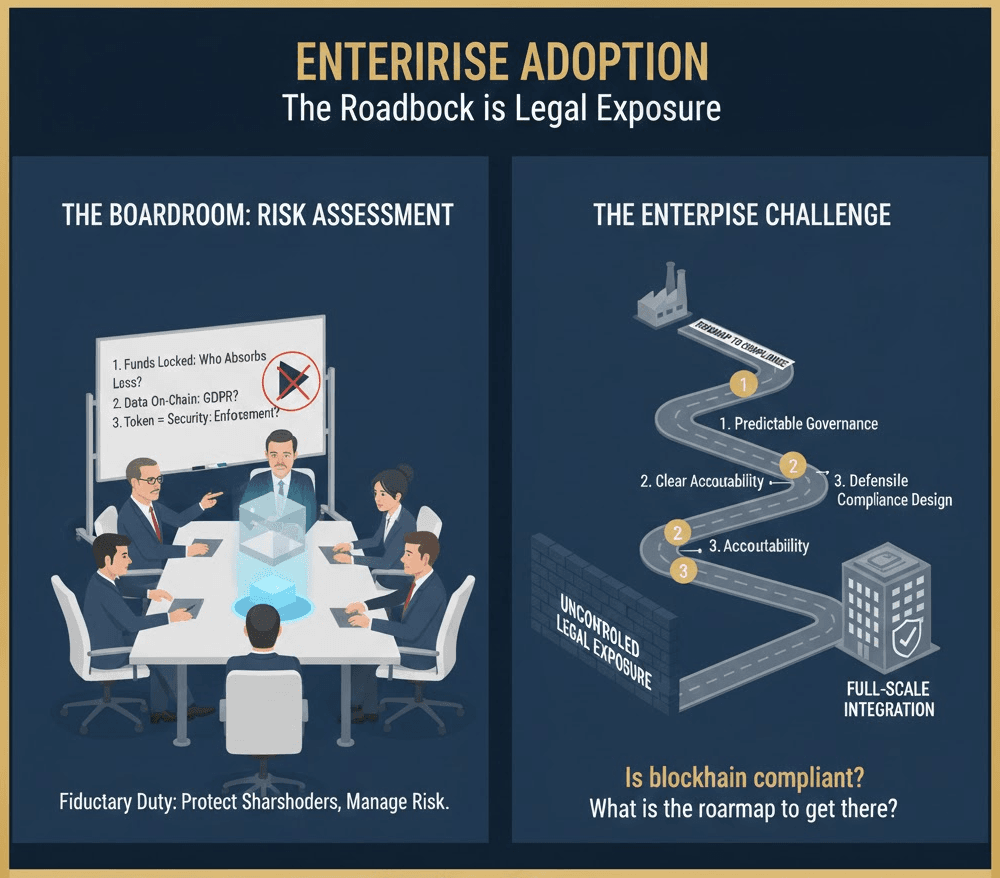

Enterprise Adoption

From the outside, blockchain looks efficient, transparent, and innovative. Many enterprises see faster settlements, lower operational costs, and better audit trails. But when the idea reaches the boardroom, the conversation changes. Excitement turns into risk assessment.

Board members are not asking whether the technology works. They are asking who is legally responsible if something goes wrong.

● If a smart contract fails and locks customer funds, who absorbs the loss?

● If personal data is written on-chain and cannot be erased, who answers to regulators?

● If a token is later classified as a security, who faces enforcement?

These questions are not technical. They are fiduciary.

Large organizations operate under strict governance duties. Directors have legal obligations to protect shareholders and manage risk prudently. Deploying blockchain systems without clear compliance frameworks can look reckless.

There is also the reputational factor. Enterprises cannot afford to be associated with hacks, sanctions violations, or regulatory investigations. A single compliance failure can damage years of brand trust. For a startup, that is painful. For a public company, it can be catastrophic.

This is why enterprise adoption moves slowly. It is not fear of innovation. It is fear of uncontrolled legal exposure. Until blockchain systems demonstrate predictable governance, clear accountability, and defensible compliance design, many boards will continue to pause before they approve full-scale integration.

This is why serious enterprises do not ask, “Is blockchain compliant?” They ask, “What is the roadmap to get there?” Compliance is not a switch. It is a staged build.

The Compliance Roadmap (Timeline)

The Three Stages of "Minimum Viable Compliance" (MVC)

You don't need a million-dollar legal team on Day 1. Follow this staged approach to manage your budget:

- Phase 1: Seed (The Shield)

○ Implement Geofencing (block high-risk regions).

○ Enforce Marketing Hygiene (no "moon" or "investment" promises).

-

Phase 2: Funding (The Structure)

○ Incorporate a Legal Entity (Foundation or LLC).

○ Obtain a formal Legal Opinion from a law firm regarding your token’s status.

-

Phase 3: Growth (The Fortress)

○ Apply for specific licenses (VASP or MSB) if handling user funds.

○ Undergo a Full Regulatory Audit alongside your technical audit.

Compliance takeaway: Build governance, monitoring, and reporting systems that allow directors to demonstrate prudent oversight.

Proof to keep: Keep board risk assessments, compliance reporting dashboards, regulatory communication logs, and documented internal control reviews.

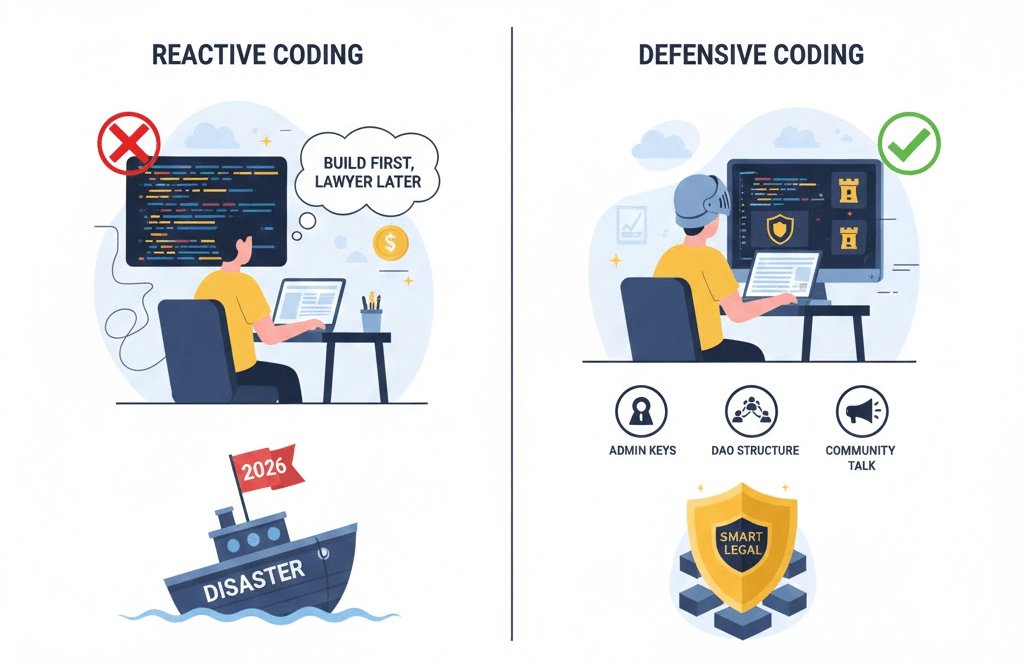

Conclusion: From Reactive to Defensive Coding

Blockchain Legal Compliance is changing. In the old days, developers would build first and ask lawyers for help later. That’s "Reactive Coding," and in 2026, it’s a recipe for disaster.

The new way to win is Defensive Coding. This means you stop treating the law like an enemy and start treating it like a technical requirement. Just like you write code to defend against hackers, you must write code that defends your project against legal risks. Whether it’s how you handle admin keys, how you structure your DAO, or how you talk to your community, every choice you make today determines if you’ll still be around tomorrow.

Don’t let the "Compliance Mirage" fool you. Building a great app isn't enough; you have to build an app that can survive the real world. You don’t need to be a lawyer, but you do need to be smart. Start small, use the MVC checklist, and always keep an eye on the "Registration Gap."

FAQ

1. Does offering staking or yield services create additional Blockchain Legal Compliance risks?

Yes. The moment you promise yield, regulators may ask whether you are offering a securities product or an investment contract. Even if the staking happens on-chain, the way you market it matters. If users rely on your operational efforts to generate profit, legal classification risk increases. Compliance is not just about how the protocol works. It is also about how you present and structure the service.

2. How should enterprises handle crypto accounting under Blockchain Legal Compliance frameworks?

Accounting is often ignored until audit season. Holding tokens, stablecoins, or customer assets raises questions about valuation, impairment, and revenue recognition. Different jurisdictions treat crypto differently in financial statements. If your accounting treatment is unclear, investors and regulators may see it as governance weakness. Strong Blockchain Legal Compliance includes audit-ready financial policies, not just transaction monitoring.

3. If we use MPC or shared custody technology, are we still considered a custodian?

Possibly. Regulators look at control, not just labels. If your infrastructure allows you to influence, recover, or block transactions, authorities may argue you exercise “control” over assets. That can trigger custody obligations, licensing requirements, or fiduciary duties. In Blockchain Legal Compliance, technical architecture directly affects regulatory classification.

4. What happens after a security breach from a compliance perspective?

A hack is not just a technical crisis. It becomes a legal event. Many jurisdictions require incident reporting within strict timelines. You may need to notify regulators, affected users, banking partners, and sometimes even the public. Without a pre-designed compliance response plan, a breach can quickly escalate into enforcement action and reputational damage.

5. Does open-source development protect founders from legal liability?

Not automatically. Publishing code under an open-source license does not remove responsibility if regulators believe you are operating or facilitating a regulated activity. Courts examine involvement, governance influence, and economic benefit. Blockchain Legal Compliance depends on actual control and operational behavior, not just whether the code is public.