0x.1 Background

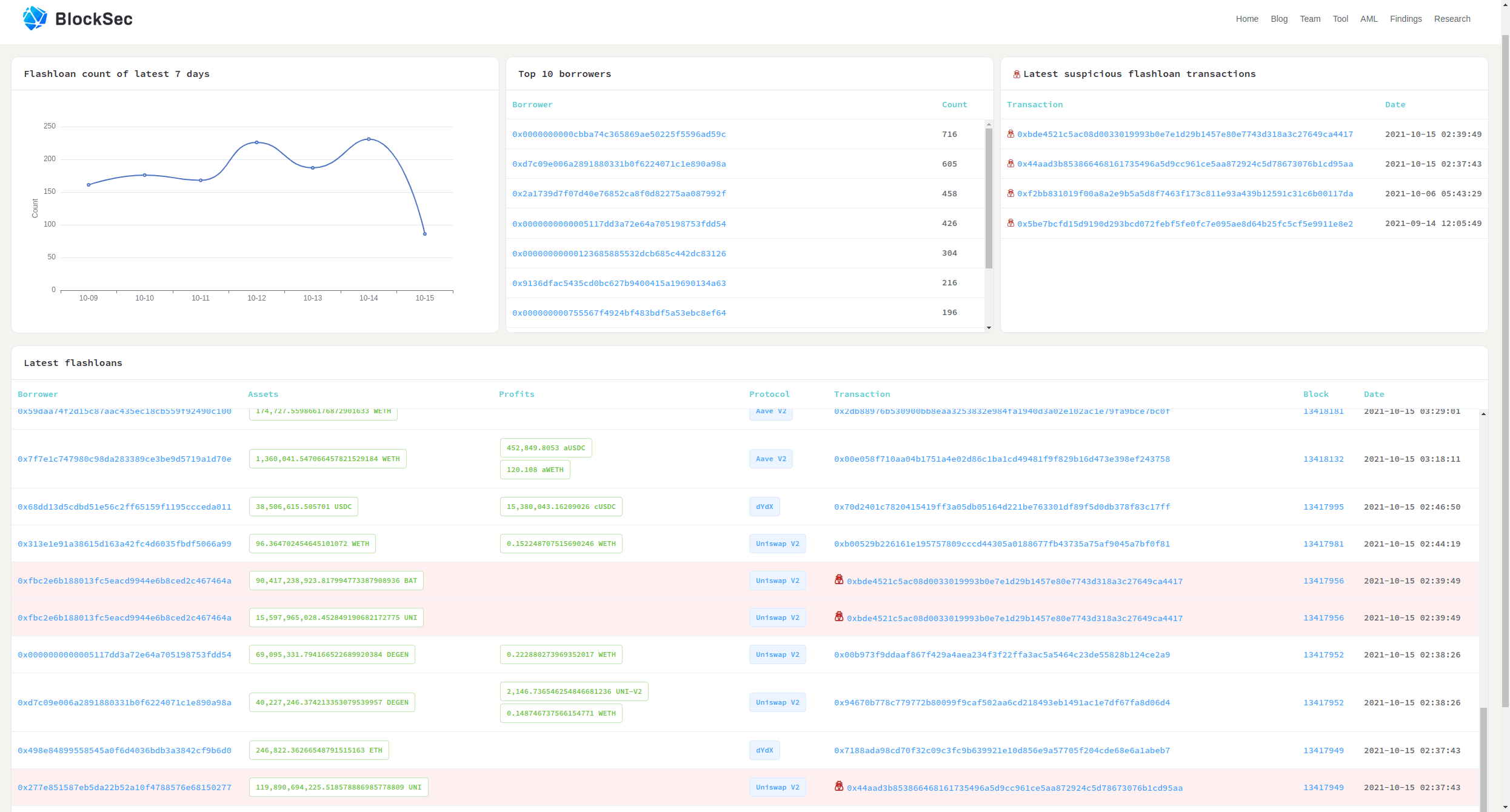

At 02:38 (UTC+8) on Oct 15th, 2021, our internal monitoring system caught suspicious flashloan transactions:

After investigation, we found that it was a price manipulation attack targeting Indexed Finance. Specifically, the attacker launched the attack by exploiting the flawed formula (that is used to calculate the price) of this project, and gained $16 million profit.

There already exist some discussion on the social media, while the project has released an official post-mortem (Indexed Attack Post-Mortem. However, existing analyses do not give a full understanding of this security incident. As such, in this blog, we aim to provide a comprehensive analysis, including the mechanism of the project, the vulnerability, the attack and the profit.

0x1.1 Relevant Contract Addresses

-

MarketCapSqrtController: 0x120c6956d292b800a835cb935c9dd326bdb4e011

-

DEFI5: 0xfa6de2697d59e88ed7fc4dfe5a33dac43565ea41

-

CC10: 0x17ac188e09a7890a1844e5e65471fe8b0ccfadf3

0x1.2 Attack Transactions

-

Attack TX-I: 0x44aad3b853866468161735496a5d9cc961ce5aa872924c5d78673076b1cd95aa

-

Attack TX-II: 0xbde4521c5ac08d0033019993b0e7e1d29b1457e80e7743d318a3c27649ca4417

0x2. Mechanism of Indexed Finance

To better understand the vulnerability/attack, we use DEFI5 (i.e., the pool hacked by the attacker) to demonstrate the mechanism of Indexed Finance.

0x2.1 Binding Token

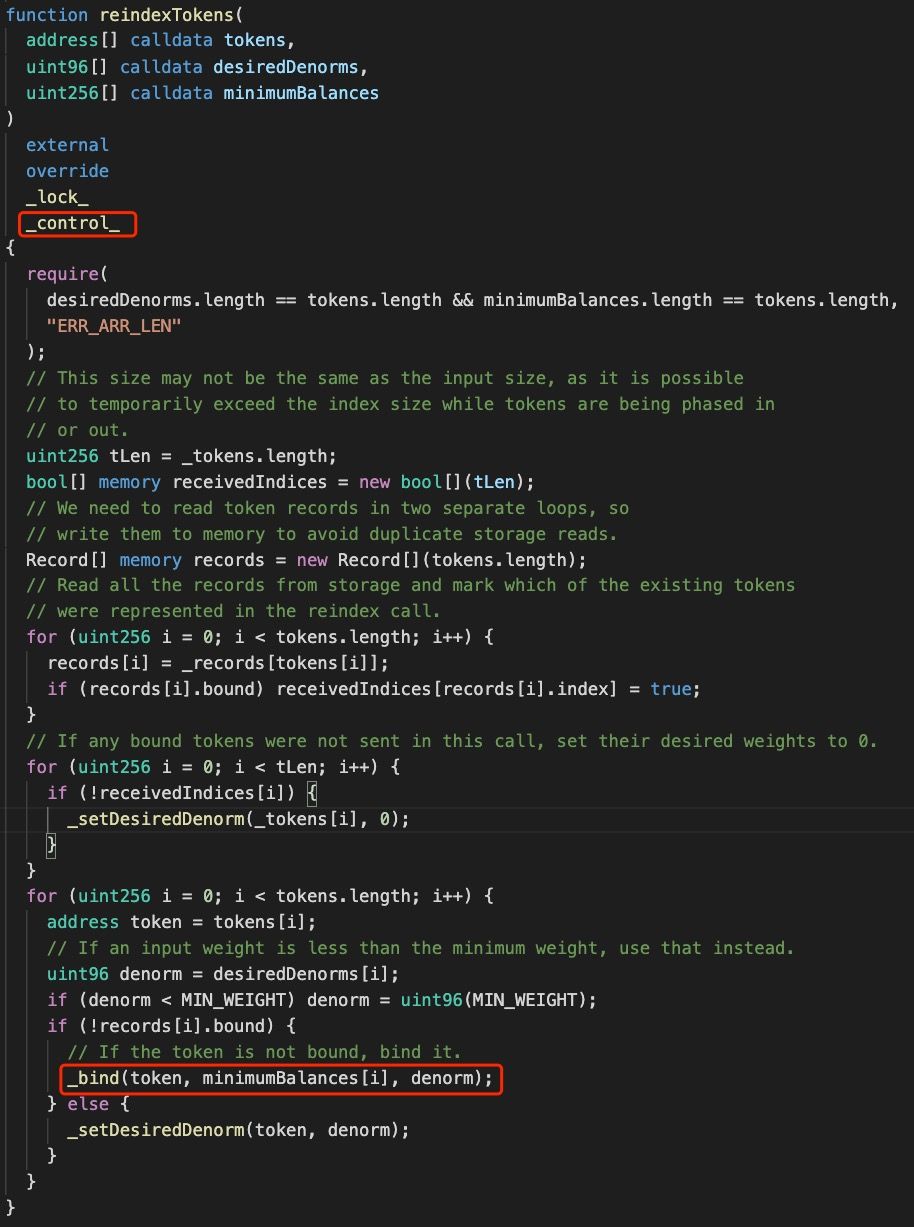

DEFI5 is designed to provide the trade service for Top 5 tokens of DeFi projects of Ethereum. Specifically, Indexed Finance will update the token rankings based on their market cap through MarketCapSqrtController. Because the sort of Top 5 tokens might change as time goes by, the number of tokens used by the DEFI5 pool may bigger than 5, as shown in the following code:

Figure 1 shows that, to bind a new token, DEFI5 has to trigger the _bind function invoked by the reindexTokens function, which can only be invoked by the reindexPools function of MarketCapSqrtController:

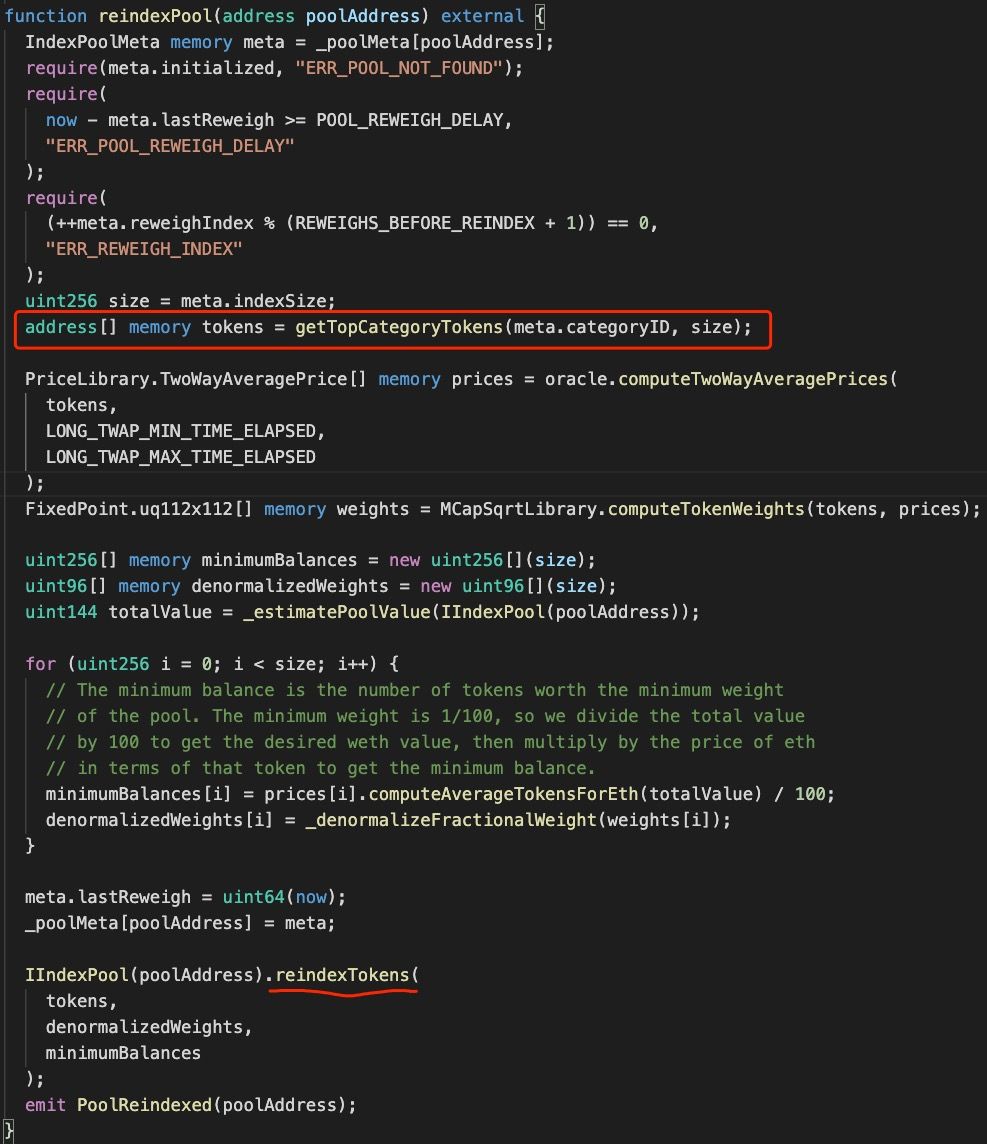

Figure 2 demonstrates that, MarketCapSqrtController first fetches token information (including the TotalSupply and the price) from the markets, and then calculates the ranking based on their market capacity. When invoking the reindexPool function, the addresses of the top tokens will be passed as arguments to invoke the reindexTokens function. Note that the new added token will be bound to DEFI5 without replacing the original tokens of DEFI5.

0x2.2 What is the Next?

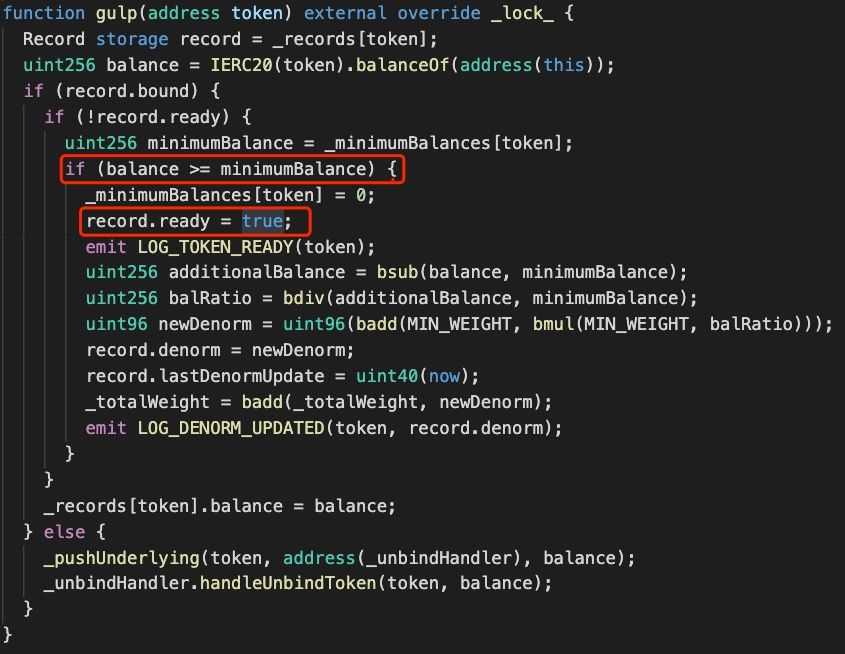

After the token binding, DEFI5 has to set a variable named ready (that indicates the token status) to to be true to enable the trade:

According to the code logic, apart from the contract initialization, the ready can only be set in the gulp function.

As shown in Figure 3, it happens when the token balance in DEFI5 is greater or equal to _minimumBalances.

Meanwhile, the initial token weight (i.e., denorm) will be calculated based on the following formula:

0x3. Vulnerability Analysis

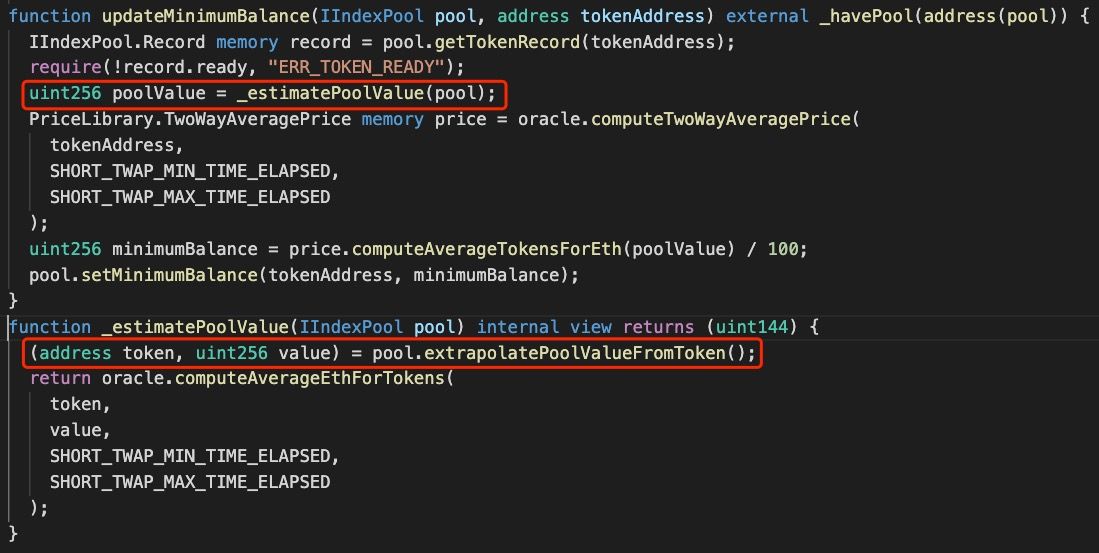

The vulnerable code belongs to updateMinimumBalance function of MarketCapSqrtController.

As shown in Figure 4,updateMinimumBalance can change the minimumBalance of a token whose ready is false to 1/100 of poolValue. The calculation of poolValue is the key of the vulnerability.

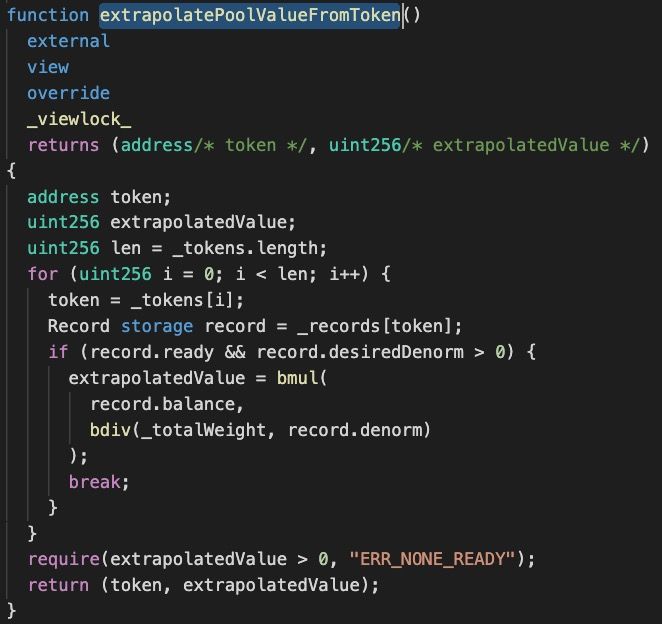

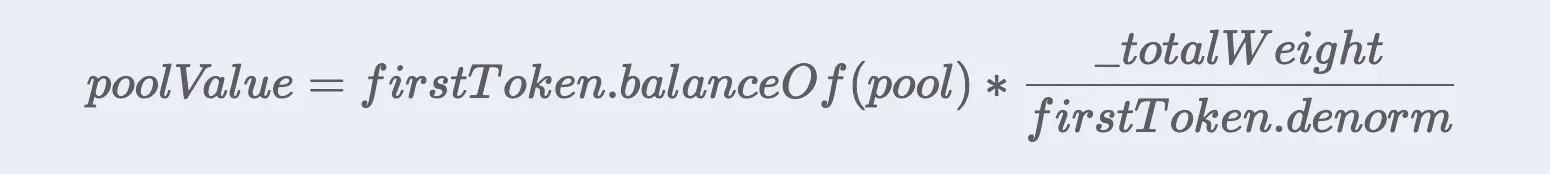

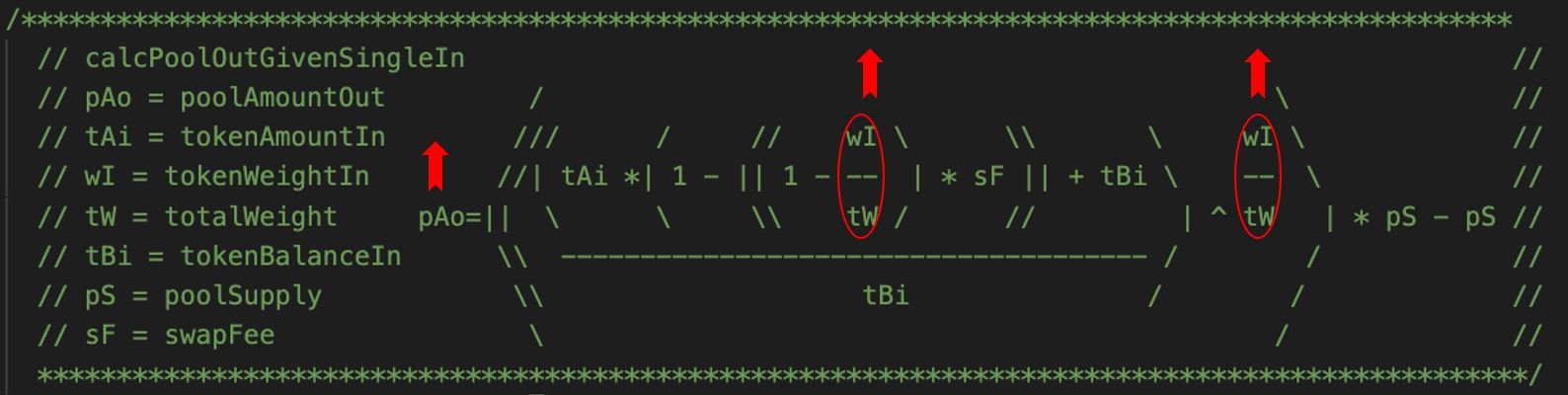

The calculation of Figure 5 just implements the following formula:

However, there exist two potential problems in this formula:

- using one token's liquidity to estimate the value of the entire pool;

- the weights of the pool (

_totalWeight) and the token (token.denorm) are not affected by the change of the liquidity. As a matter of fact, they are influenced by the Market Capacity of the external markets. Besides, their change is limited by the time period, i.e., increase or decrease 1% per hour.

In short, the attacker is able to manipulate poolValue by using the flashloan to instantly cause a big change to the liquidity of a token, while the weights of the pool and the token remain unchanged accordingly.

By doing so, minimumBalance of the token (whose ready is false) can be manipulated to launch the price manipulation attack.

0x4. Attack Analysis

The attack consists of the following 9 steps:

Step 1: invoking the reindexPool function to bind SUSHI. Before the invocation, there are 6 tokens in DEFI5 pool, including UNI, AAVE, COMP, SNX, CRV and MKR. As the Market Capacity of SUSHI becomes Top 5, SUSHI will be added to the pool.

Step 2: lending all 6 tokens (UNI, AAVE, COMP, SNX, CRV and MKR) supported by IndexPool through SushiSwap.

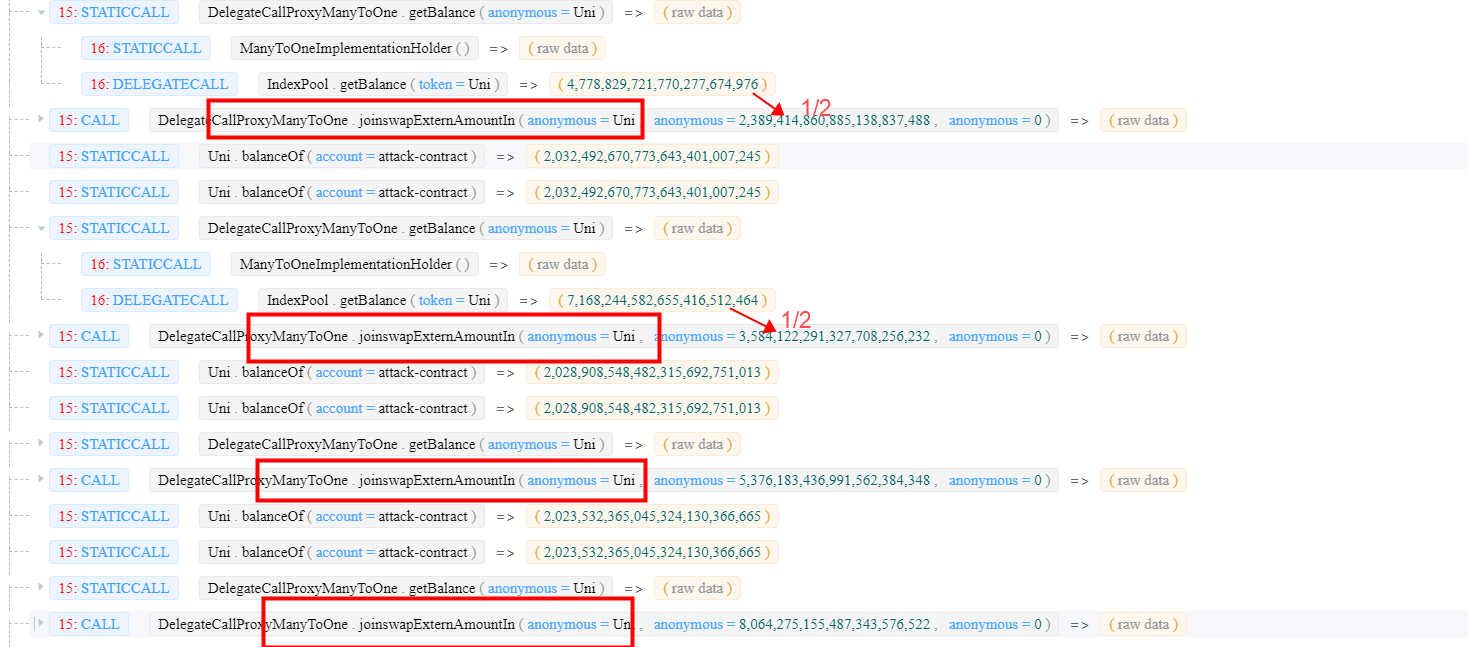

Step 3: swapping UNI by invoking the swapExactAmountIn function multiple times with the borrowed tokens (take CMOP as an example).

Notice 1: here multiple times are due to the constraint of

MAX_IN_RATIO, one can only swap half of the token balance at most.Notice 2: in this step,

poolValuewill be greatly underestimated, because the balance of UNI (as thefirstToken) in the pool decreases a lot.

Step 4: modifying minimumBalance of SUSHI by invoking the updateMinimumBalance function.

Note that

minimumBalanceis smaller than the normal value since the abnormalpoolValuecalculated in step 3.

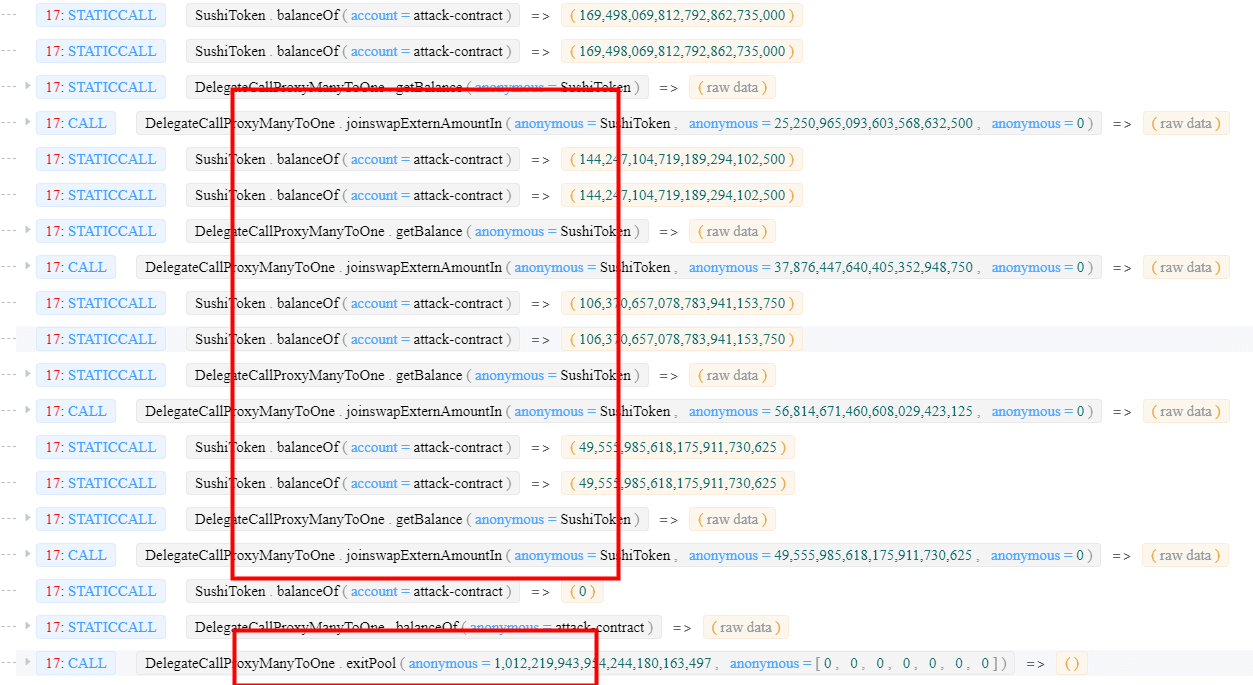

Step 5: preparing LP tokens by invoking the joinswapExternAmountIn function to provide liquidity. We will see that these LP tokens are used to swap back more SUSHI.

Note that: the

joinswapExternAmountInfunction needs to be invoked multiple times due to the impact ofMAX_IN_RATIO.

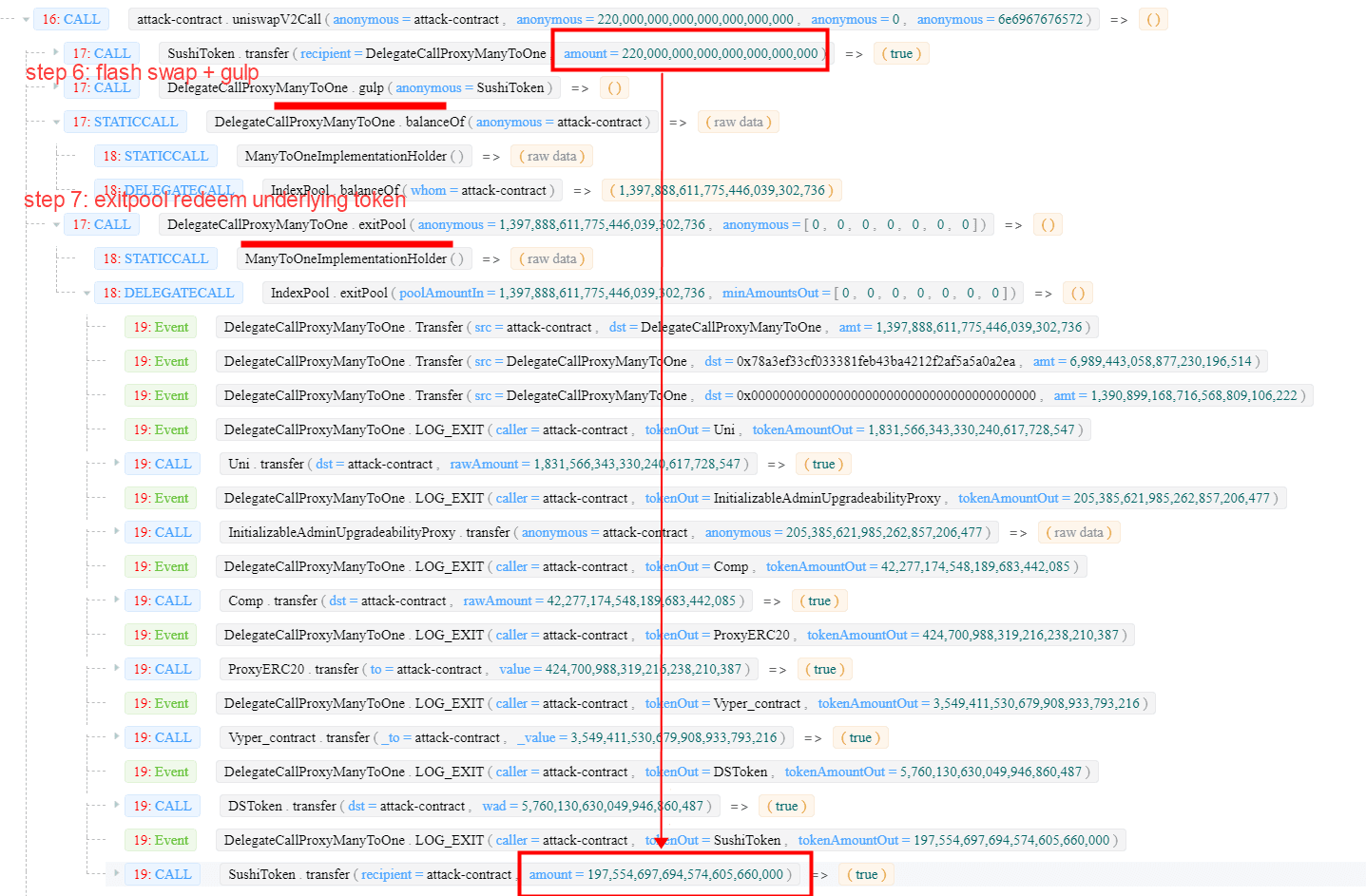

Step 6: manipulating the wight of SUSHI in DEFI5 pool by first lending a huge amount of SUSHI and transferring them to the pool, and then invoking the gulp function to set SUSHI's ready to true. By doing so, the initial weight of SUSHI (denorm) becomes a high value.

Step 7: swapping LP tokens back to underlying tokens (UNI, AAVE, COMP, SNX, CRV, MKR and SUSHI) by invoking the exitPool function.

Note that the

exitPoolfunction does NOT consider the weight of each token, as a result, the underlying tokens will be returned back with an equal proportion.

Step 8: swapping LP tokens by invoking the joinswapExternAmountIn function with SUSHI to provide liquidity. More LP tokens can be harvested due to the abnormal weight of SUSHI at the moment.

Note that the joinswapPoolAmountIn function will mint the LP token based on the weight of received underlying token (SUSHI in this case).

Step 9: draining the pool by invoking the exitPool function with the harvested LP tokens in step 8.

0x5. Profit Analysis

Our investigation shows that all money (including the transaction fees) used by the attacker comes from Tornado Cash.

Totally, there are two attack transactions:

-

In the first transaction, the attacker gained:6,226.8 AAVE, 15 ETH, 192,358.6 UNI, 5,459.5 COMP, 721,611.3 CRV, 16,680.6 SNX, 406.5 MKR.

-

In the second transaction, the attacker harvested:109.6 MKR, 17,844 UMA, 1,002.4 COMP, 34,602.5 UNI, 131,645.4 BAT, 28,754.1 SNX, 1,273.6 AAVE, 124,194.2 CRV, 33,215.4 LINK, 5.24 YFI.

Besides, the attacker also had several failed attempts.

As of this writing, the profit made by the attacker values $16 million USDs, and has not been transferred yet.

About BlockSec

BlockSec is a pioneering blockchain security company established in 2021 by a group of globally distinguished security experts. The company is committed to enhancing security and usability for the emerging Web3 world in order to facilitate its mass adoption. To this end, BlockSec provides smart contract and EVM chain security auditing services, the Phalcon platform for security development and blocking threats proactively, the MetaSleuth platform for fund tracking and investigation, and MetaSuites extension for web3 builders surfing efficiently in the crypto world.

To date, the company has served over 300 esteemed clients such as MetaMask, Uniswap Foundation, Compound, Forta, and PancakeSwap, and received tens of millions of US dollars in two rounds of financing from preeminent investors, including Matrix Partners, Vitalbridge Capital, and Fenbushi Capital.

Official website: https://blocksec.com/

Official Twitter account: https://twitter.com/BlockSecTeam