Introduction

Stablecoins play a crucial role in the crypto industry, currently boasting a market capitalization of approximately $165 billion as of July 25, 2024. This represents a significant portion of the overall cryptocurrency market, which stands at $2.417 trillion. And Tether(USDT) is the third largest Token based on market capitalization, behind Bitcoin and Ether. This article aims to delve deep into stablecoins, providing an in-depth understanding of their definitions, classifications, and vital role within the digital currency landscape. Using Ethena's USDe as a case study, we will explore its operational mechanisms and examine potential risks associated with stablecoins, shedding light on whether USDe can be considered an "upgraded" Luna in the competitive realm of stablecoins.

Definition: What are stablecoins?

Stablecoins are defined as "a cryptocurrency that aims to maintain a stable value relative to a specified asset, or a pool or basket of assets", according to the Financial Stability Board and Bank for International Settlements. In real-world practices, stablecoins are typically pegged to fiat currencies, such as the US dollar.

Motivation: Why do we need stablecoins?

Yes, many people in Web3 are discussing stablecoins. The primary question is: Why do we need stablecoins?

Compared with Conventional Assets

Firstly, in the context of Web3 massive adoption, digital assets offer more convenient exchangeability compared to conventional assets. Stablecoins facilitate everyday transactions by serving as a stable medium of exchange, while one the other hand enable quick and cost-effective cross-border payments, avoiding the delays and high fees associated with traditional banking systems.

Compared with Other Cryptocurrencies

Secondly, stablecoins facilitate the reduction of volatility. Popular cryptocurrencies like BTC or ETH are unsuitable as stablecoins due to their inherent volatility. During periods of market turbulence, stablecoins provide stability, acting as a refuge for value preservation.

Classification: How do stablecoins maintain "stability"?

Collateralized Stablecoins

Collateralized stablecoins are fully backed by other assets, ensuring their value is supported by other forms of collateral. Assuming they are managed in good faith and have a mechanism for redeeming the underlying assets, these stablecoins are unlikely to drop below the value of their underlying assets due to potential arbitrage opportunities. Typical examples of such stablecoins include:

- Fiat-collateralized stablecoins are backed by reserves of fiat currencies, such as the US dollar. Typical examples include Tether USD (USDT) and USD Coin (USDC), which are the top two stablecoins in terms of market capitalization. As of July 2024, they account for more than 90% of the total stablecoin market capitalization.

- Commodity-collateralized stablecoins are backed by reserves of commodities such as gold or other real-world assets. A typical example is Tether Gold (XAUt), which uses gold as collateral.

- Cryptocurrency-collateralized stablecoins are backed by reserves of other cryptocurrencies such as BTC or ETH. A notable example is DAI, developed by MakerDAO, which uses ETH and other Ethereum-based approved assets as collateral.

Algorithmic Stablecoins

Algorithmic stablecoins maintain stability by algorithmically ensuring collateral security or adjusting market circulations (supply and demand dynamics). Typical methods include:

- Liquidation: To ensure that the value of all outstanding stablecoin debt is always fully collateralized, some stablecoins employ a liquidation mechanism. This process involves liquidating risky collateral whose value drops below that of the corresponding issued stablecoins through auctions. This mechanism generally includes over-collateralization (e.g., a 150% ratio), which provides a buffer between the value of the collateral and the corresponding stablecoins. Typical examples include DAI, currently the largest algorithmic stablecoin.

- Burning and minting: This is to burn the existing tokens to decrease total supply or mint new tokens to increase total supply, assuming the total demand remains unchanged during adjustment. Let’s say the stablecoin drops from the target price of $1 to $0.9, the algorithm will automatically burn a tranche of tokens to introduce more scarcity, leading to less circulation and pushing up the price of the stablecoin. Typical examples include TerraUSD (UST), which utilized a fixed exchange rate to facilitate an arbitrage opportunity through burning and minting; however, during significant market downturns, the protocol failed to maintain stability, leading to the largest loss of over $40 billion in Web3 history.

- Adjusting borrowing interest: This is to increase or decrease the borrowing interest ratio to control the supply of stablecoins within a borrowing-and-earning framework (essentially a yield opportunity for stablecoin holders), assuming people are profit-seeking. Let’s say the stablecoin drops from the target price of $1 to $0.9, the algorithm will automatically increase the borrowing interest ratio and attract (or lock) more circulation in this mechanism, thus pushing up the price of the stablecoin. Typical examples include Beanstalk (BEAN), which operates a credit-based system with an adjustable total loan amount (referred to as Soil) to manage the circulation of BEAN.

Notes

It is notable that these classification measurements are not mutually exclusive. Stablecoins can implement multiple mechanisms to maintain stability. For instance, DAI is backed by collaterals in terms of cryptocurrencies while simultaneously employing algorithmic adjustments (i.e., liquidation). This combination of strategies can enhance the stability and reliability of the stablecoin by leveraging the strengths of each mechanism to mitigate potential weaknesses.

Security Risks and Solutions

Collateral Transparency

For fiat or commodity-collateralized stablecoins, users may question whether the collateral is securely preserved and available for redemption at all times. Many stablecoins address this concern by placing collateral in escrow with third-party custodians such as banks, conducting regular audits, and publishing reserve attestation reports. These measures can enhance the transparency of collateral management and mitigate public skepticism.

Collateral Value Fluctuation

For cryptocurrency-collateralized stablecoins, whose underlying assets are more volatile than fiat or commodities, fluctuations in collateral value can lead to unexpected collateral shortfalls, resulting in insufficient backing. To address this issue, many stablecoins implement over-collateralization and liquidation mechanisms to mitigate the negative impacts of collateral fluctuations. Over-collateralization to some extent ensures that the collateral value remains within a safe range during market fluctuations, as the initial value of the cryptocurrency reserves exceeds the value of the issued stablecoins. The liquidation mechanism allows for the liquidation of under-collateralized stablecoins by others, thereby maintaining stability.

Smart Contract Vulnerability

Stablecoins rely on complex smart contracts to implement their stabilization designs, particularly for algorithmic ones. However, these smart contracts can also introduce new risks of code-level vulnerabilities, such as reentrancy attacks, logic bugs, or governance exploits, which can lead to severe consequences. Therefore, rigorous security auditing and ongoing security assessments are crucial for ensuring the safety and reliability of these protocols.

Market Volatility

Extreme volatility in stablecoins and stablecoin-related tokens, such as a sudden crash within a short time frame, can erode trust and disrupt stability. In rapidly changing market conditions, such as during a black swan event, stabilization mechanisms might not respond swiftly enough, causing significant price deviations. During high demand or panic situations, the automated market maker (AMM) design of stablecoins can lead to liquidity shortages in liquidity pools, exacerbating price swings. Illiquid markets are particularly vulnerable to manipulation. Additionally, stablecoins rely on oracles to determine external prices (e.g., USD or ETH). Incorrect oracle data can result in mispriced stablecoins, creating a new attack surface that can distort the system.

Top Stablecoins

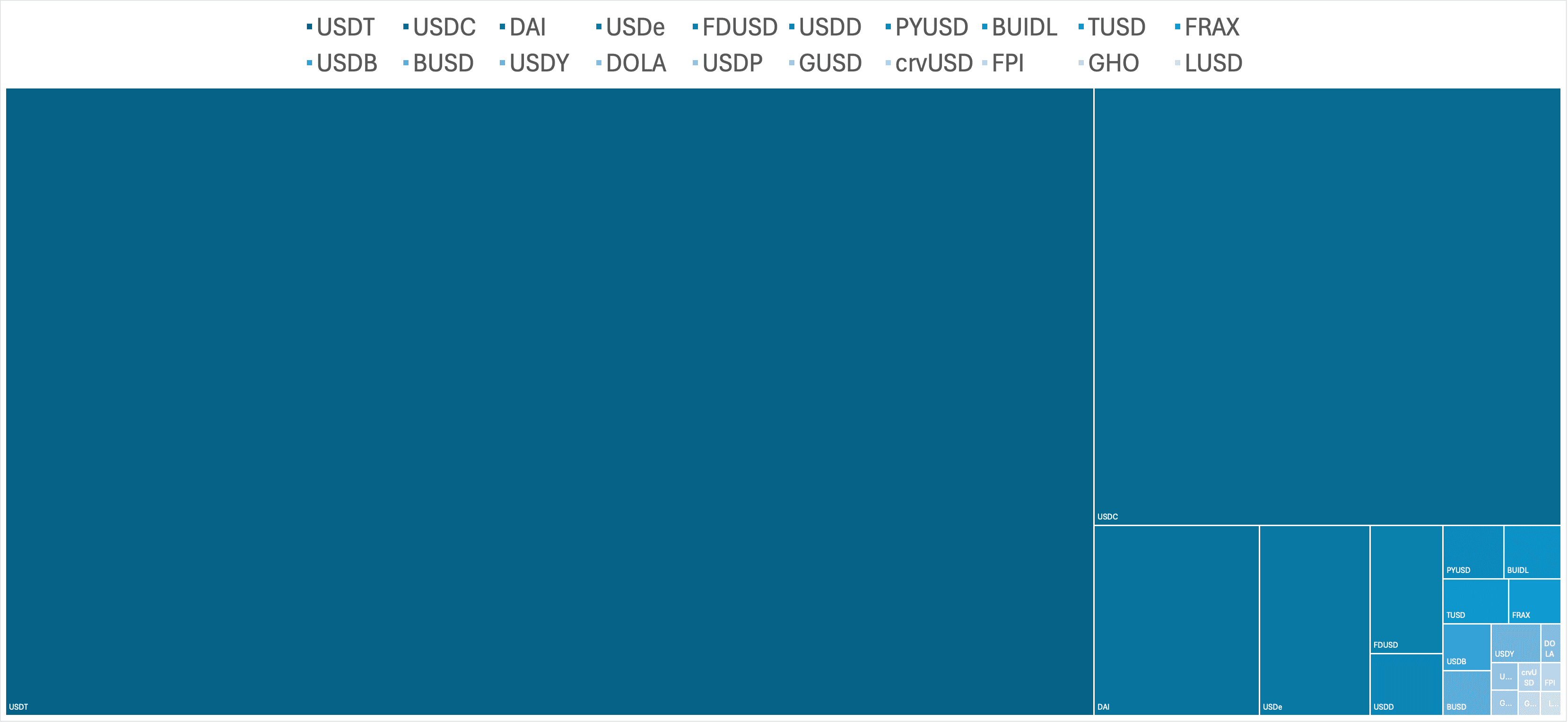

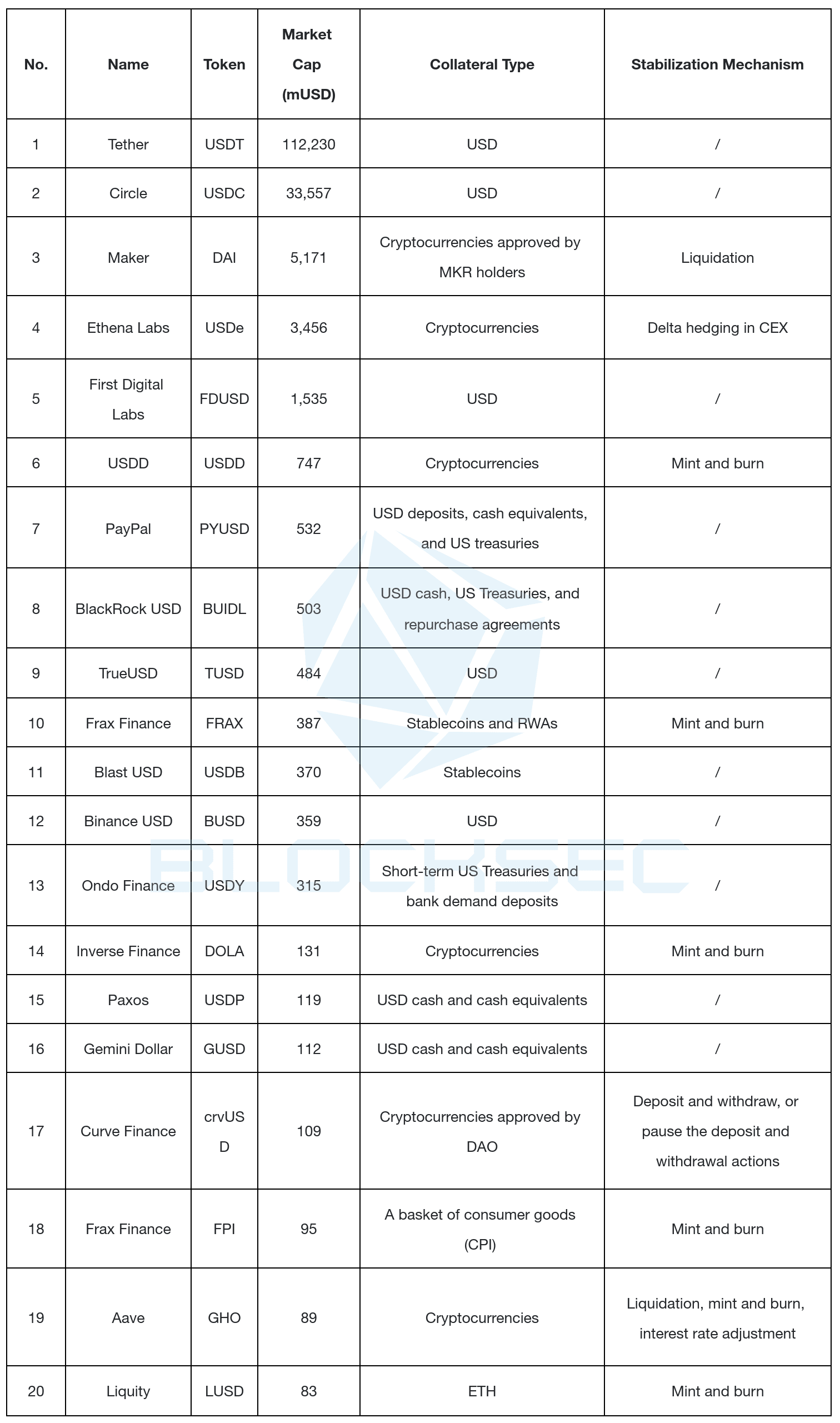

We select the top 20 stablecoins from DefiLlama, which collectively account for over 99% of the total market capitalization of stablecoins (as of July 2024), as illustrated in the following figure.

The market capitalization for these stablecoins exhibits a high level of concentration, with the top 5 stablecoins (i.e., USDT, USDC, DAI, USDe, and FDUSD) accounting for 96% of the total market capitalization and the top 20 stablecoins accounting for 99%. This indicates a market highly dominated by a few key players, consistent with the Pareto Principle.

Among the top 20 stablecoins, all are collateralized by certain assets, such as US dollars, US treasuries, or other cryptocurrencies. Additionally, 9 of these stablecoins also incorporate an algorithmic stabilization mechanism to adjust circulation (supply) or ensure collateral security.

This phenomenon indicates a prevailing preference among users for fully collateralized stablecoins, particularly those backed by fiat currencies, despite the claims of algorithmic stablecoins regarding their well-designed and stable mechanisms. As Sam Kazemian, the founder of Frax, stated, "If you want to create a very large stablecoin, you want to become safer as you get bigger, not the other way around; as people use money, you want it to be safer."

Case Study: Ethena Labs - USDe

In the past year, USDe, issued by Ethena Labs, has garnered significant attention and, as of July 2024, ranks as the fourth-largest stablecoin according to DefiLlama. This section examines USDe as a case study, exploring its operational mechanisms and potential risks.

Theorem

USDe is designed as a centralized exchange (CEX)-based stablecoin, with its stability mechanism currently heavily rely on CEX's operational stability. Specifically, USDe uses mainstream cryptocurrencies as collateral and employs a "delta hedging" strategy to maintain stability.

So what is "delta hedging"? Let's consider the following example. When 1 ETH is transferred upon the minting of USDe, the stablecoin is exposed to a "positive delta of 1 ETH," meaning its value is fully sensitive to the spot market price of ETH. Ideally, as a stablecoin, the goal is to minimize this sensitivity, aiming for a "delta of 0" to ensure stability. To achieve this, Ethena employs delta hedging by "going short" on a perpetual contract with a nominal position size equal to 1 ETH. This strategy neutralizes the exposure of the collateral's value to market fluctuations. Consequently, regardless of how the market price of ETH changes, the collateral value remains stable.

The yield of USDe comprises two main components: staking yield, which is the native yield from ETH staking, and earnings from delta-hedging derivatives positions. The second component further breaks down into two parts: 1) earnings from the funding rate, which are the periodic payments between long and short positions on CEXs, and 2) earnings from the basis spread, which are the profits derived from the price difference between the spot market and futures contracts. According to historical data analysis by Ethena, this combination of yields remains positive even during bearish market conditions, such as the Terra incident and the FTX collapse.

Security Risks

Centralization Risk

The primary security issue stems from the reliance on CEXs for delta hedging and the custody method of "off-exchange settlement". We name this issue as the centralization risk. This dependency creates a vulnerability where the failure of these exchanges—whether due to operational issues or a bank run—could jeopardize the stability of the stablecoin. Despite the distribution of collaterals across multiple exchanges, over 90% are concentrated in three major exchanges: Binance, OKX, and Bybit.

Market Risk

Additionally, the market risk should not be neglected. The yield mechanism of USDe may encounter periods of persistently negative funding rates, which can lead to some components of Ethena's yield design becoming negative. Although historical data indicates that such negative periods have been relatively brief (less than two weeks), it is crucial to account for the possibility of prolonged adverse conditions in the future. Therefore, adequate countermeasures, such as reserve funds, should always be well prepared for this tough duration.

Conclusion

In summary, stablecoins play a crucial role in the cryptocurrency ecosystem by providing stability and facilitating transactions in a volatile market. Their classifications, from fiat-collateralized to algorithmic mechanisms like Ethena Labs' USDe, to RWA-backed stablecoin like Ondo, address various needs within the crypto community but also present risks like collateral transparency, value fluctuations, and smart contract vulnerabilities. As Ethena Labs continues to refine and innovate with USDe, a critical question emerges: will USDe navigate market volatility without experiencing the collapse seen with Luna? The crypto community closely observes whether USDe can indeed maintain stability and potentially claim a leading role in the competitive stablecoin landscape. Given the significant market capitalization and impact of stablecoins, it is crucial to focus on their security risks. Continuous audits and diligent oversight are imperative to maintain stability and trust in the market.

About BlockSec

BlockSec is a full-stack Web3 security service provider. The company is committed to enhancing security and usability for the emerging Web3 world in order to facilitate its mass adoption. To this end, BlockSec provides smart contract and EVM chain security auditing services, the Phalcon platform for security development and blocking threats proactively, the MetaSleuth platform for fund tracking and investigation, and MetaSuites extension for web3 builders surfing efficiently in the crypto world.

To date, the company has served over 300 clients such as Uniswap Foundation, Compound, Forta, and PancakeSwap, and received tens of millions of US dollars in two rounds of financing from preeminent investors, including Matrix Partners, Vitalbridge Capital, and Fenbushi Capital.

-

Website: https://blocksec.com/

-

Email: [email protected]

-

Twitter:https://twitter.com/BlockSecTeam

-

MetaSleuth: https://metasleuth.io/

-

MetaSuites: https://blocksec.com/metasuites