Symbiotic, the rising star in the restaking sector, has quickly gained market attention by surpassing $1 billion in TVL within a month. Backed by Lido and led by Paradigm and Cyber Fund, it stands as a formidable competitor to EigenLayer. The following content compares Symbiotic and EigenLayer, exploring their similarities and differences in terms of types of restaking assets, underlying philosophies, and design approaches.

Introduction

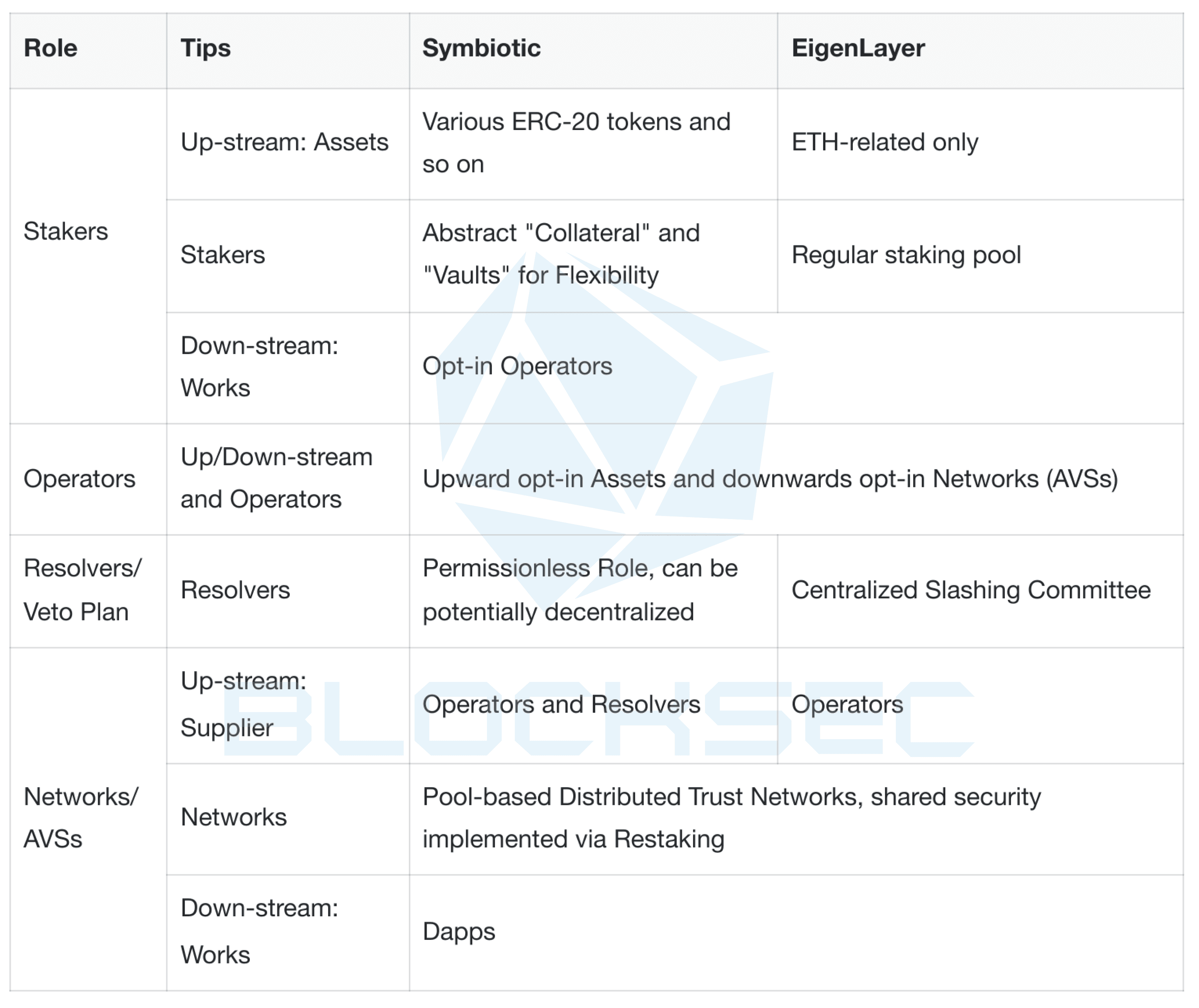

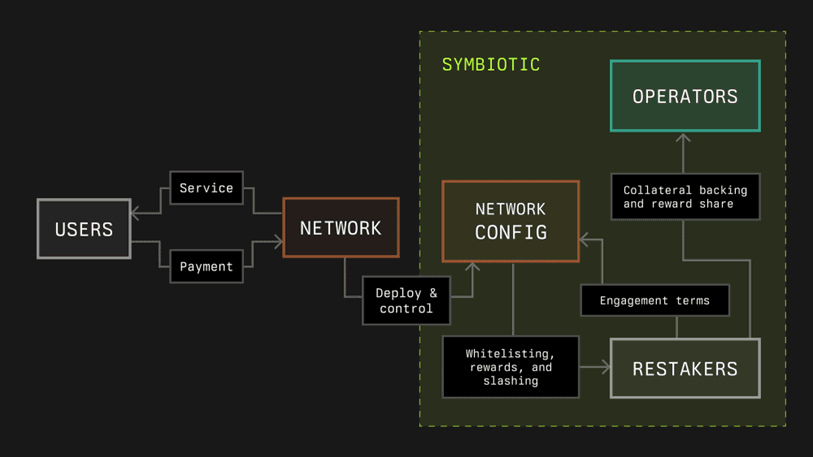

Symbiotic and EigenLayer are two platforms that provide shared security through restaking. Both aim to enhance the security and efficiency of distributed trust networks from Ethereum's ecosystem by allowing "operators" to leverage their staked assets across multiple "networks". Despite these functional similarities, i.e. restaking, these two platforms have obvious differences:

-

Types of Restaking Assets: Symbiotic claims in their documentation that their platform supports nearly all ERC-20 tokens, positioning itself as a DeFi service. In contrast, EigenLayer focuses solely on ETH-related staking, emphasizing building the foundational ecosystem for blockchains and distancing itself from DeFi.

-

Underlying Philosophies: Symbiotic embraces a broader definition of restaking and aims to create a flexible open DeFi market. EigenLayer, on the other hand, focuses on leveraging the existing trust within Ethereum's PoS system to maintain a stable and trusted foundation.

-

Design Approaches: Symbiotic's design is more modular and decentralized, supporting a wider range of assets and allowing extensive customization. EigenLayer maintains a comparatively more centralized approach, prioritizing the robustness and security of Ethereum’s PoS system.

Their similarities and differences reflect the distinct philosophies and design approaches of Symbiotic and EigenLayer, which will be explored further in the following sections.

Functional Similarities

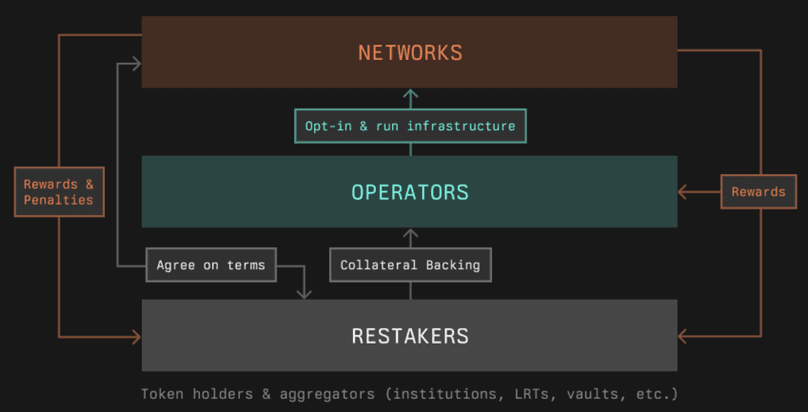

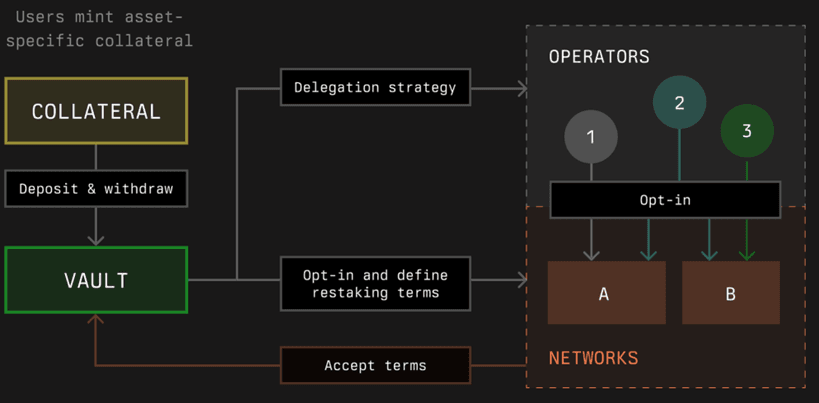

Both Symbiotic and EigenLayer facilitate shared security, which helps reduce the bootstrap costs for distributed trust networks and encourages innovation on blockchains. Their restaking mechanisms allow operators to be backed up with assets from restakers and use these assets across multiple networks, perform multiple tasks, and earn multiple rewards while taking on multiple risks. The restaking procedure of Symbiotic involves the following process:

- Restakers: Users (Restakers) restake their assets.

- Operators: Restakers' assets are delegated to operators who undertake the calculation.

- Networks: Operators opt-In to chosen networks, accepting cooperative terms to provide node services for a distributed trust network.

In comparison, the restaking provided by EigenLayer is extremely similar. They term the distributed "networks" as Actively Validated Services (AVSs). It is worth noting that in the narrative of EigenLayer, they do not separate operators and restakers as clearly. This distinction will be discussed in more detail later.

Philosophical Differences

At the highest level of abstraction, EigenLayer and Symbiotic have different attitudes towards the problem of Fractured Trust in the realm of Ethereum PoS, which was raised by the founder of EigenLayer. Stemming from this difference, they show distinct approaches regarding the use of restaking:

- EigenLayer: Aims to leverage restaking to attract users and build a better blockchain ecosystem with Ethereum as the foundation. It emphasizes the reuse of Ethereum PoS trust, allowing only ETH-related staking, and protecting the Ethereum PoS from the problem of fractured trust. They position themselves as foundational services to enhance the Ethereum ecosystem.

- Symbiotic: Seeks to embrace the leverage of restaking to attract as many users as possible, with the goal of creating a flexible and open DeFi market where everyone can earn. It supports the restaking of various ERC-20 tokens and views itself as a DeFi service, maximizing opportunities for earning and capital efficiency. Symbiotic does not prioritize the problem of Fractured Trust seriously and even stands in contrast to solving this problem. Their growing TVL (Total Value Locked) could pose a threat to the Ethereum PoS.

Furthermore, Symbiotic separates the role of staker from operator. This is likely because they have Lido as their background, which has the best resources of operators. As a result, users only need to focus on staking instead of delegation. This separation also encourages users to stake as much money as possible.

Design and Service Differences

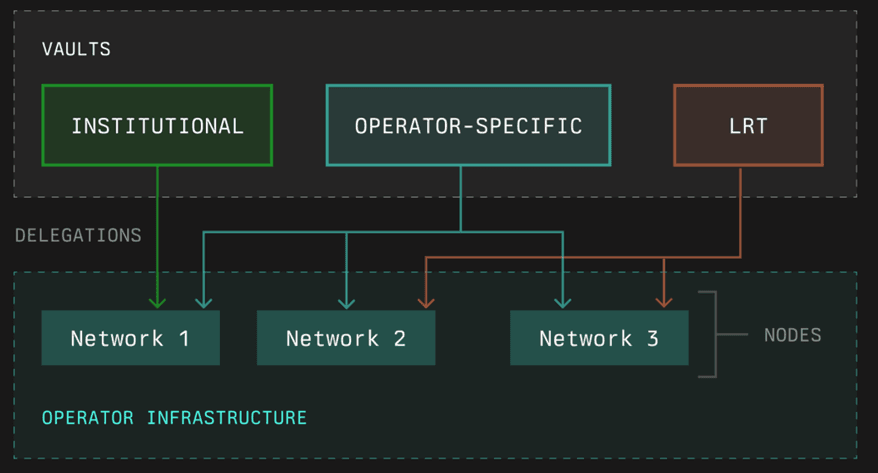

Symbiotic's design is characterized by its emphasis on an open, modular, and flexible DeFi market with clear role distinctions. Key features include:

- Open: Supports multi-asset restaking, enhancing asset utilization by allowing various ERC-20 tokens to be staked.

- Modular: Features a system with clear role divisions, making it more developer-friendly by separating responsibilities among different actors.

- Flexible: Allows extensive customization, enabling top-level networks to control their underlying services fully.

- Permissionless: With minimized core implementations of Symbiotic itself, roles involved are all permissionless, can be deployed by the developer themselves.

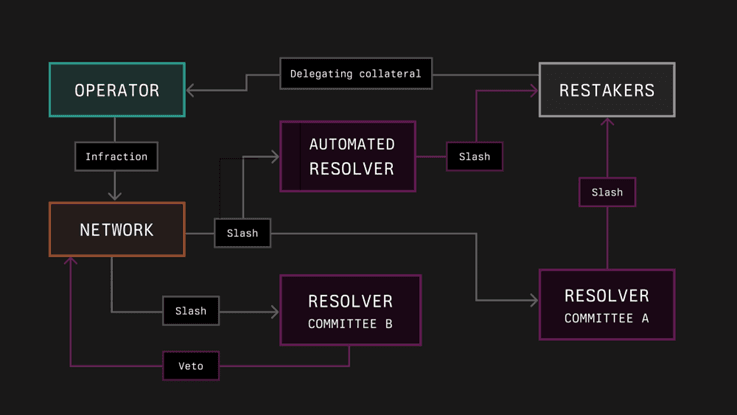

In contrast, EigenLayer, which is not that modular as Symbiotic, retains some centralized elements. One typical example is about slashing supervision. Symbiotic uses the role of resolvers for customized decentralized arbitration, providing a more flexible and decentralized solution compared to EigenLayer’s slashing committee. Let's delve a little bit into the flexible and modular design of Symbiotic.

Key Components of Symbiotic

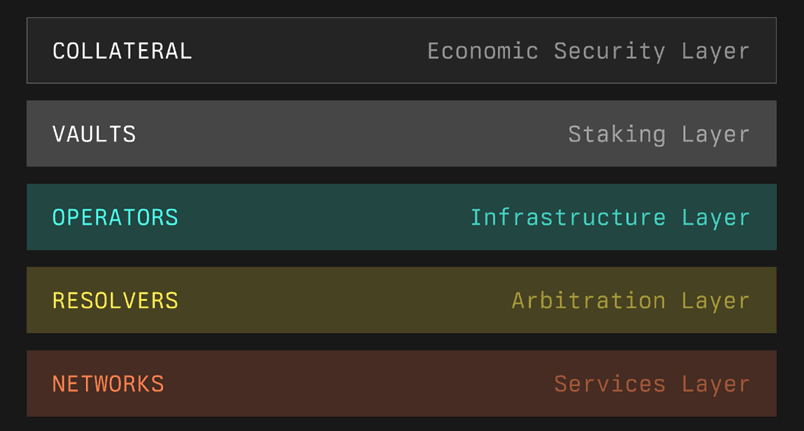

The modular design of Symbiotic involves 5 main roles: Collateral, Vaults, Operators, Resolvers and Networks. We will give a brief introduction of these roles.

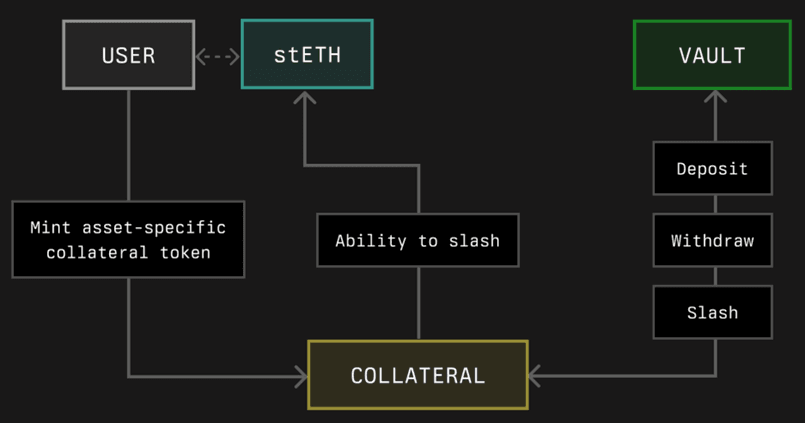

- Collateral: Represents the assets to be staked, supporting various types of assets and creating a collateral token (ERC-20 with slashing) for staking purposes. This token separates the asset itself from the ability to access and apply rewards or penalties. Such separation abstracts assets to collateral tokens and makes it possible to further support various assets even outside the Ethereum Mainnet.

- Vaults: Manage deposited collateral tokens. They handle the delegation of tokens to operators and enforce reward and punishment mechanisms based on predefined agreements. Vaults are usually created by operators according to the terms they accept from the requirements of Networks.

- Operators: Nodes that provide calculation services. Being backed with assets in various Vaults, they accept terms specified by Networks and opt into them. Operators are essential in the decentralized ecosystem.

- Resolvers: Customizable arbitrators for slashing decisions. They can be centralized addresses, slashing committees, or decentralized entities, offering flexibility in arbitration.

- Networks: Services that require distributed trust networks as foundation. Similar with AVS in the term of EigenLayer.

Current Status

As of now, Symbiotic has only opened its restaking functionality. The delegation of staked assets to distributed services requiring shared security is not yet available. Similarly, EigenLayer is also behind schedule, with critical features such as slashing and payment still pending release. As for TVL, EigenLayer remains a dominant player in the market with a substantial $13.981 billion, while Symbiotic has rapidly gained traction, reaching $1.037 billion in less than a month, as of July 8, 2024.

Security Risks

ERC-20 Token-Based Pool Security

The most straightforward security risk involves incorporating all ERC-20 tokens into the restaking area. Staking pools generally prefer using more stable assets, such as native ETH, to minimize risk and ensure consistent returns. Unlike EigenLayer, which primarily supports native ETH, Symbiotic allows for a broader variety of ERC-20 assets. This approach increases user choice but also introduces potential security risks. The varying stability and high volatility of ERC-20 tokens could undermine the safety of the staking pools and potentially lead to financial instability. Allowing nearly all ERC-20 tokens as collateral may expose the platform to these volatility risks, compromising the overall stability of the ecosystem.

To mitigate such security risks, a systematic Token Interdependency Monitoring should be established to assess whether the price collapse of one token might trigger a chain reaction affecting other tokens or the entire pool within the ecosystem. Then related Collaterals can propose workarounds as soon as possible. And of course, "Networks" in Symbiotic should also think twice on their supported restaking assets.

Fractured Trust

The problem of Fractured Trust was introduced by the founder of EigenLayer, and we have detailed this in a blog post. EigenLayer argues that the blockchain ecosystem has invested substantial efforts in bootstrapping distributed trust networks. Currently, many of these networks serve as infrastructure for Dapps on the Ethereum mainnet and have attracted significant assets. However, the security of everything on the Ethereum mainnet is ensured by the staking assets in Ethereum’s PoS staking pool. These Dapps’ infrastructures divert many staking assets into their own staking pools while still serving the Ethereum mainnet, creating a paradox. To address this, EigenLayer proposed the Restaking collective, which aims to redirect PoS staking assets to the distributed trust network infrastructure. This reusing of Ethereum PoS staking assets can lead to assets in third-party staking pools flowing back into the Ethereum PoS staking pool, presenting a strong strategy for mitigating the problem of Fractured Trust. In contrast, Symbiotic takes an opposite approach to solving this problem. By allowing non-ETH restaking in their own "Collateral", the growing TVL in these assets could pose a threat to the security of the Ethereum PoS consensus.

Embracing Leverage

EigenLayer allows limited ETH-related assets to be restaked, enabling a single asset to be staked across multiple AVS services. This already introduces some leverage risk to the ecosystem. Symbiotic goes even further, fully embracing leverage by allowing the restaking of any ERC-20 asset. As mentioned earlier, ERC-20 tokens inherently carry higher risk and greater volatility. Restaking an ERC-20 token multiple times across different networks will only amplify this risk.

Resolver Appointment Risks

Symbiotic's permissionless and modular design creates a more open and free DeFi market, but it also conceals greater risks. Every role within the framework can be deployed without permission, which increases exposure to potential security issues. For instance, the role of the Resolver, a significant differentiator from EigenLayer, allows Networks to appoint specific Resolvers to oversee the rewards and slashing for their subordinate Operators. This design enhances the system's decentralization and customizability but also opens the door for potential malicious Resolvers. To prevent such malicious Resolvers, security audits and further eyes of monitoring can be conducted to ensure the basic reliability of appointed resolvers.

Similar Risks with EigenLayer

EigenLayer will bear the following risks:

- Security risks related to malicious AVS under bi-directional free market selection;

- Security risks of excessive malicious fund utilization due to restaking;

- Security risks of core contract implementation by the platform itself;

- Potential security risks to Ethereum PoS Staking Pools allowing the platform to utilize and reward/slash assets; With similar restaking capability, these risks also exist with Symbiotic.

Conclusion

Symbiotic and EigenLayer, while functionally similar in providing shared security through restaking, differ significantly in their approach to asset support and system design. Symbiotic’s broader asset support and modular, decentralized design cater to a more flexible and open DeFi market. In contrast, EigenLayer focuses on leveraging the existing trust within Ethereum's PoS system, maintaining a more centralized yet secure platform. These differences highlight the unique value propositions of each platform, catering to different segments of the decentralized ecosystem.

About BlockSec

BlockSec is a full-stack Web3 security service provider. The company is committed to enhancing security and usability for the emerging Web3 world in order to facilitate its mass adoption. To this end, BlockSec provides smart contract and EVM chain security auditing services, the Phalcon platform for security development and blocking threats proactively, the MetaSleuth platform for fund tracking and investigation, and MetaSuites extension for web3 builders surfing efficiently in the crypto world.

To date, the company has served over 300 clients such as Uniswap Foundation, Compound, Forta, and PancakeSwap, and received tens of millions of US dollars in two rounds of financing from preeminent investors, including Matrix Partners, Vitalbridge Capital, and Fenbushi Capital.

-

Website: https://blocksec.com/

-

Email: [email protected]

-

Twitter:https://twitter.com/BlockSecTeam

-

MetaSleuth: https://metasleuth.io/

-

MetaSuites: https://blocksec.com/metasuites