Background

On January 10th, Eastern Standard Time, the SEC officially approved 11 Bitcoin spot ETFs! This historic moment is destined to be recorded in the annals of the cryptocurrency industry. Alongside Bitcoin, a brand-new concept known as "Inscriptions" has frequently appeared before investors worldwide. These inscriptions, enriched by numerous wealth legends and favored by the continuous influx of capital, are claimed to revolutionize the Bitcoin ecosystem, and their popularity has surged alongside the increasing market value of Bitcoin.

However, the majority of people only have a superficial understanding of these inscriptions. As the price soars, many overlook the underlying technology, which undeniably adds to the uncertainty of their investments. So, what exactly are Bitcoin inscriptions? What potential security risks do they pose in the current ecosystem, and how can users safeguard themselves?

Don't worry; this article will take about 10 minutes of your reading time to provide you with a comprehensive explanation of inscription safety.

What are Bitcoin Inscriptions?

The Origin of Bitcoin Inscriptions

In January 2023, Casey Rodarmor introduced the Ordinals protocol, marking the birth of Bitcoin inscriptions. The protocol enables users to write data such as text, images, videos, and contracts directly onto the Bitcoin blockchain.

At first glance, this might seem like Bitcoin's version of NFTs. But haven't Layer 2 networks, such as Stacks, already achieved this? Wait! It's crucial to note that Ordinals writes directly to the Bitcoin mainnet, not a Layer 2 network. This change significantly impacts the vast financial entity that is Bitcoin, with implications far beyond what Layer 2 could offer.

But how is this even possible? Bitcoin lacks a full smart contract execution environment (EVM), so how can a new protocol be added?

The answer lies in the design principles of the entire BTC network and its repeatedly updated protocols. In Satoshi Nakamoto's original design, the Bitcoin ecosystem featured the smallest indivisible unit—the satoshi (1/100,000,000 of a bitcoin), each minted by miners through PoW (Proof of Work), inherently carrying a unique serial number. Using this unique serial, one can trace its creator and owner. The Taproot protocol upgrade in 2021 allowed for embedding more complex information in transaction scripts and expanded a block's information storage limit from 1MB to 4MB, providing the technical potential to write richer information into the Bitcoin blockchain.

The essence of the Ordinals protocol is the expansion of the serial information on satoshis. Specifically, it utilizes the unique characteristics of satoshis, extending their single serial numbers to include text, images, videos, and contract data. This turns each satoshi into a carrier of unique information, storing data on the Bitcoin blockchain and ensuring its immutability.

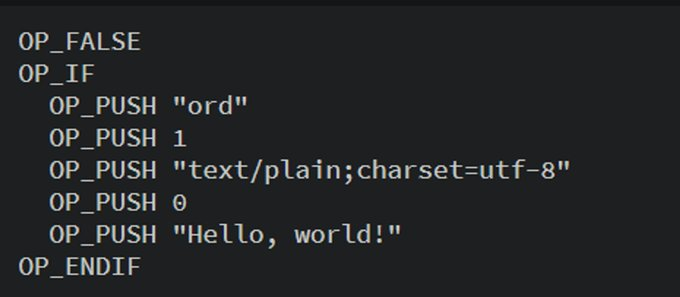

For instance, let's take a UTXO (Unspent Transaction Output) and inscribe it with the message "hello, world!". We need to record the Ordinals information in the Taproot script, and during the transaction, we engrave these details onto the first inscription of the UTXO. This process records the content of the inscription on the blockchain. (Of course, this content must be serialized before being deployed on the chain.)

In the event that a transaction lacks a memo or the transaction fails due to special circumstances, the memo message will not be considered valid content.

In the early stages following the proposal of the Ordinals protocol, many users adopted it as a vehicle for NFTs. However, with the introduction of the BRC20 protocol on March 8, 2023, a token standard similar to ERC20 was proposed on top of the Ordinals protocol, which began to shape the market for inscriptions. To illustrate the process of BRC20 token ecosystem transactions, let's use a simple example from ordiscan

Firstly, a project needs to deploy a series of inscription assets, allowing others to mint assets from this series. How is this done? The project, following the Ordinals protocol, records executable code compliant with the BRC20 standards onto a satoshi, creating an inscription. This inscribed satoshi is then sent to the blockchain.

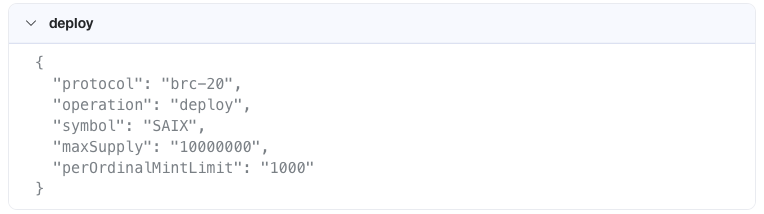

Specifically, the project team used the BRC20 protocol to deploy a series of tokens named SAIX, with a defined maximum supply of 10,000,000. This is the information that was inscribed onto a satoshi.

On the blockchain, this satoshi with the inscribed code was sent out and recorded by the Bitcoin blockchain. At the same time, off-chain servers monitoring the Bitcoin blockchain for Ordinals protocol transactions detected this code that conforms to the protocol. Consequently, an off-chain virtual machine executed this code. In other words, the off-chain virtual machine deployed a BRC20 token named SAIX and completed the configuration of all its properties. After this, other users could use the minting method to create their own inscribed assets.

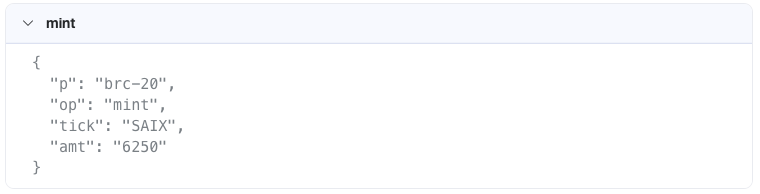

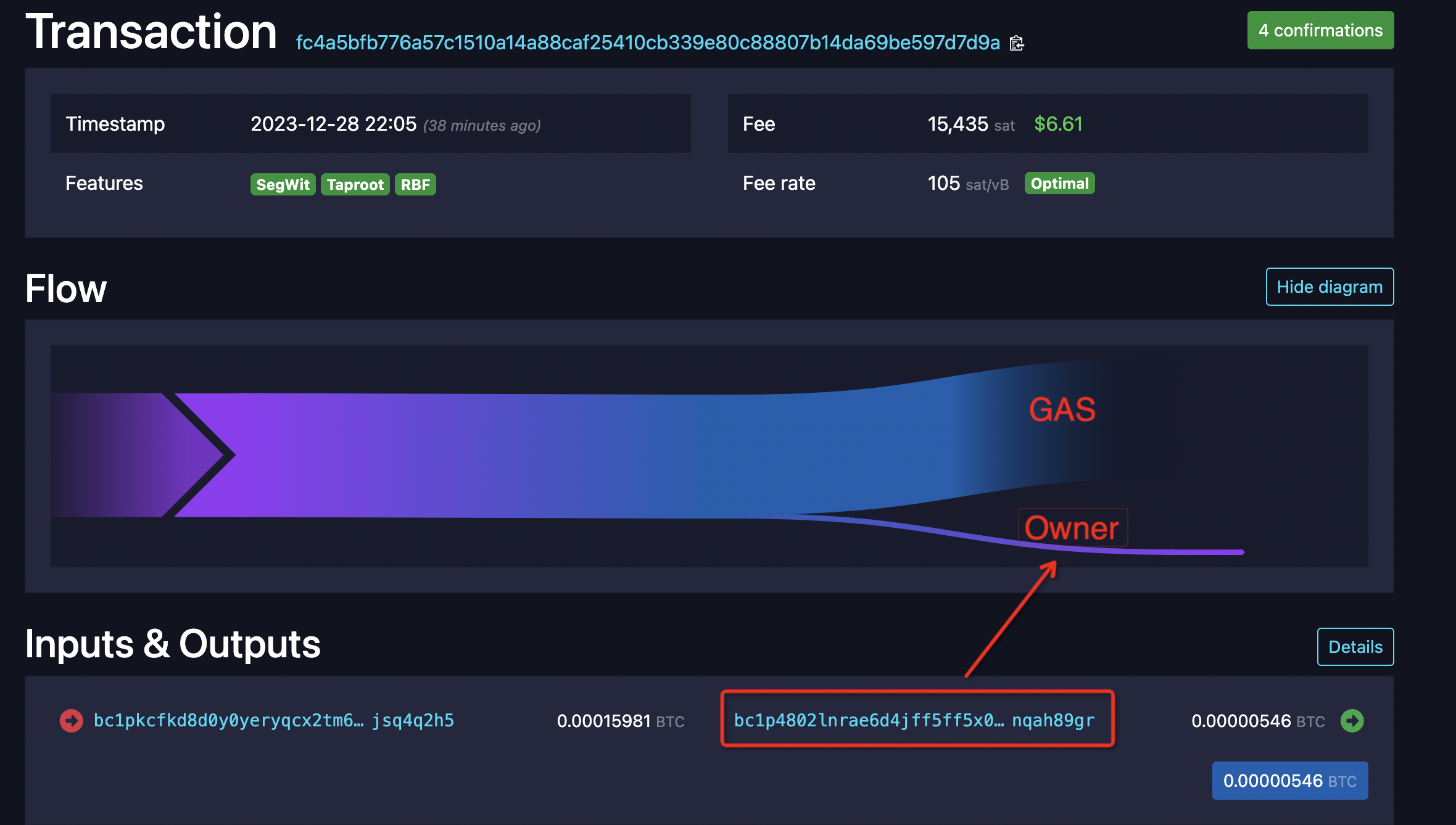

After that, users who want to mint inscription assets can utilize the BRC-20 protocol in their transactions to create their personalized inscribed assets. For instance, a user may invoke the minting action, thereby minting 6,250 SAIX tokens. The owner of the inscription at this point is the receiving address after the transaction is initiated, minus the GAS fee; for example, the address shown in the diagram as bc1p4802...nqah89gr.

After successfully minting, if users wish to transfer their inscription assets, they can inscribe a BRC-20 transfer action onto a satoshi, to transfer out 6,250 BERU tokens, as stated in the aforementioned code. Of course, the target address of this Bitcoin transaction would naturally become the owner of these BRC-20 tokens.

Therefore, we can roughly understand that inscriptions within the Bitcoin ecosystem rely on the Ordinals protocol and represent a different kind of virtual asset recorded on the Bitcoin blockchain. Project teams inscribe information of the inscription (including images, web pages, token names, etc.) onto a satoshi according to the protocol. Then users can carry out financial operations such as asset minting (mint) and transferring (transfer) through special codes in transactions. Compared to previous Layer 2 solutions, the significance of Bitcoin inscriptions lies in directly expanding the significantly funded Bitcoin mainnet, introducing the possibility of diversified assets and enhancing the flexibility of the Bitcoin ecosystem, thereby tapping into the potential of the Bitcoin ecosystem.

EVM Inscriptions: An Evolution from Bitcoin's Ordinals

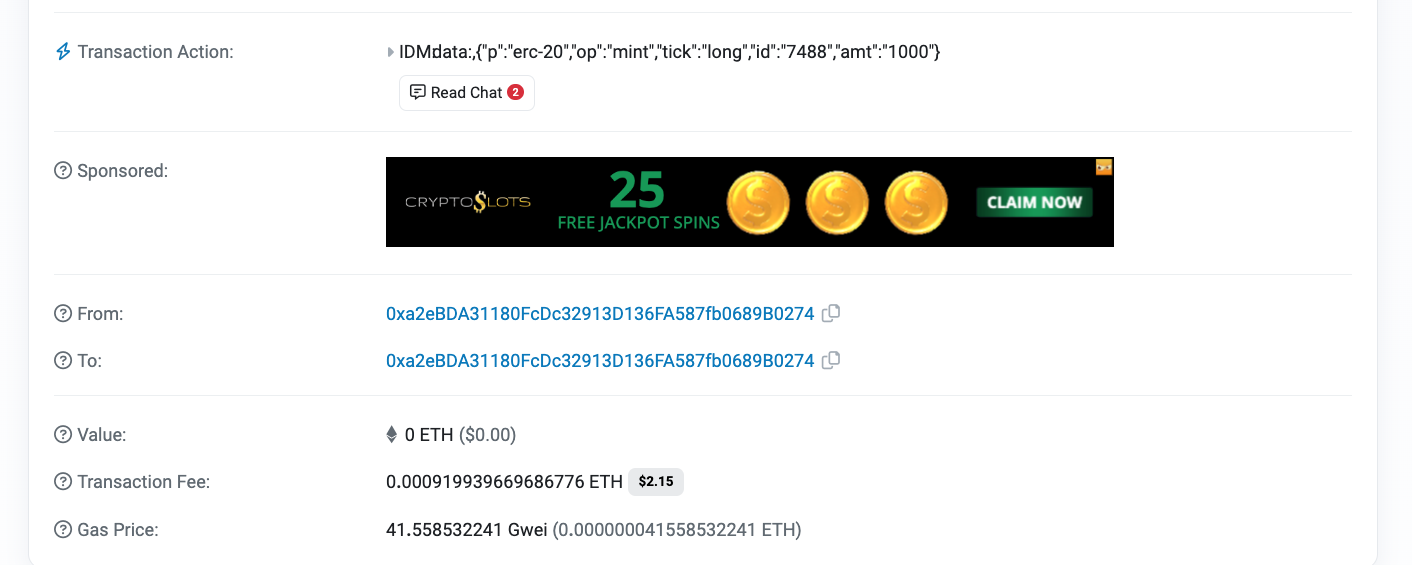

After the sensational rise of Bitcoin inscriptions, EVM (Ethereum Virtual Machine) compatible blockchains introduced their version of the concept. However, given that EVM chains already support smart contracts, the diversity of functions brought about by inscription design has been previously achievable with smart contracts. Thus, the narrative surrounding EVM inscriptions differs from that of Bitcoin. In Ethereum, due to the Gas system of smart contracts, any successful contract interaction requires a Gas fee of at least 21,000, which has imposed significant costs on the ecosystem's users. To circumvent this, Ethereum inscriptions bypass smart contract execution altogether, aiming to move the required operations off-chain by sending data to an Externally Owned Account (EOA). When the off-chain inscription virtual machine detects on-chain data that conforms to the protocol rules, it executes the transaction, matches the result to the hash of the transaction that was sent, and thus saves on on-chain execution fees. Let's illustrate this with an ERC-20 inscription protocol example. A user initiates a transaction by sending 0 ETH to their EOA, which triggers the listening mechanism of the ERC-20 inscription and prompts the inscription server to parse the content of the calldata. This calldata is structured similarly to the BRC-20 protocol, prescribing a protocol (p), an operation (op), a tick representing the token set, an ID for the current token, and an amount (amt) for the operation. Upon detecting this transaction, the off-chain EVM inscription server executes the transaction details, mints the corresponding tokens for the current EOA, and records this token in the off-chain index.

By adopting this system, EVM inscriptions offer a novel way to handle tokenized assets, potentially reducing Gas costs and streamlining operations within the Ethereum ecosystem. As we continue to monitor these developments, it's clear that the flexibility and innovative approaches of EVM inscriptions are enhancing the capabilities and efficiencies of blockchain technology.

Currently, the primary purpose of EVM inscription operations is to reduce the expensive transaction fees on some EVM chains, thereby making transaction costs significantly cheaper. While such a design may easily remind one of Layer 2 solutions, it is important to note that Layer 2 primarily expands the mainnet and possesses a complete smart contract execution environment. In contrast, EVM inscriptions focus mainly on reducing transaction fees and do not provide a full smart contract execution environment. Therefore, the design of EVM inscriptions, as it stands, primarily emphasizes the reduction of transaction fees on EVM chains.

Common Inscription Protocols

The Ordinals protocol is the cornerstone of the Bitcoin inscription protocols. Beyond the Ordinals protocol, many common Bitcoin inscription protocols have been developed. **Bitcoin-related - Notable Projects **- BRC-20: Ordi, sats, rats

- ARC-20: ATOM, Realm

- Bitmap

- Rune: Pipe

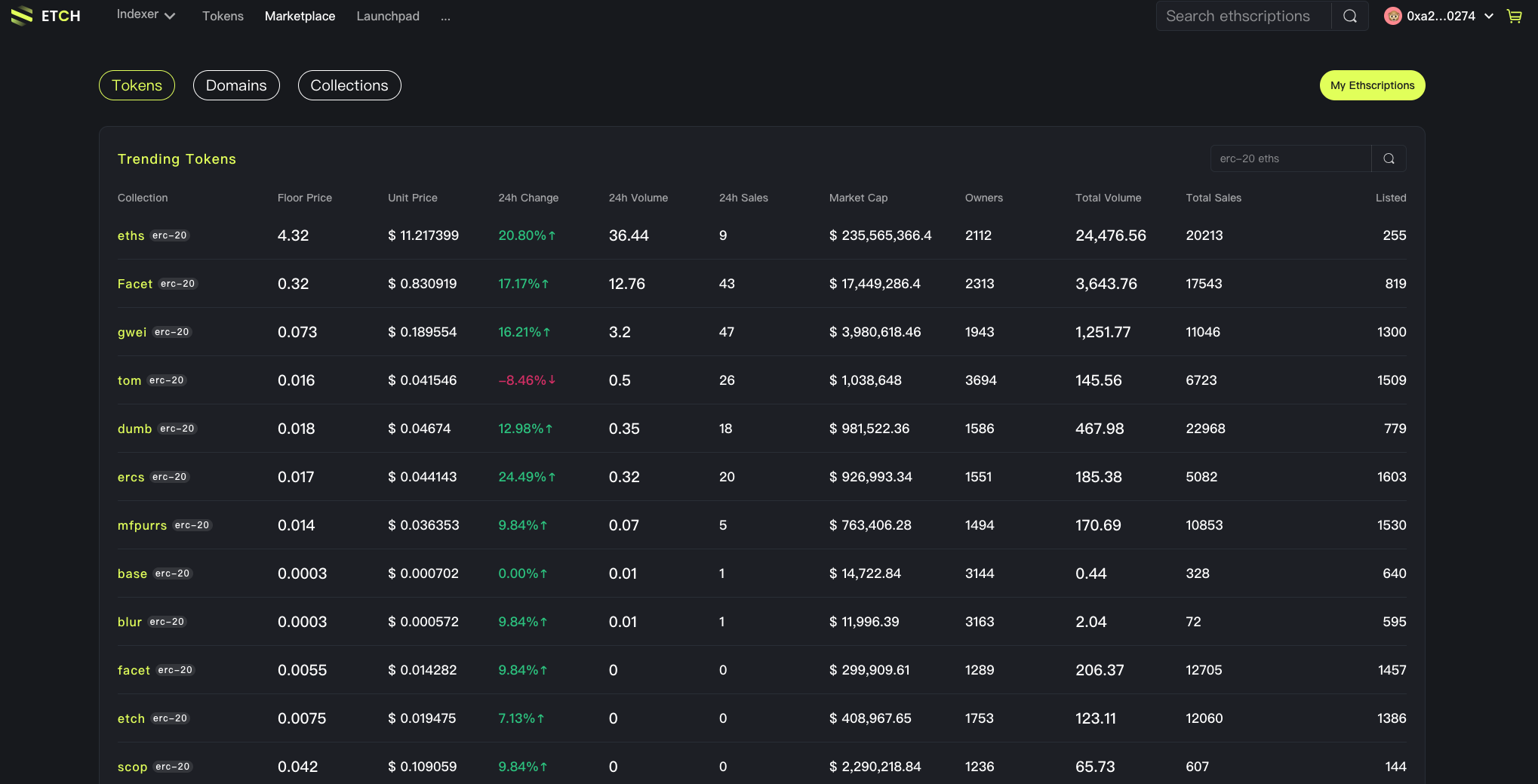

**Ethereum-related - Notable Projects **- Ethscription: eths, Facet

- IERC-20: ethi

The Current State of the Inscription Ecosystem

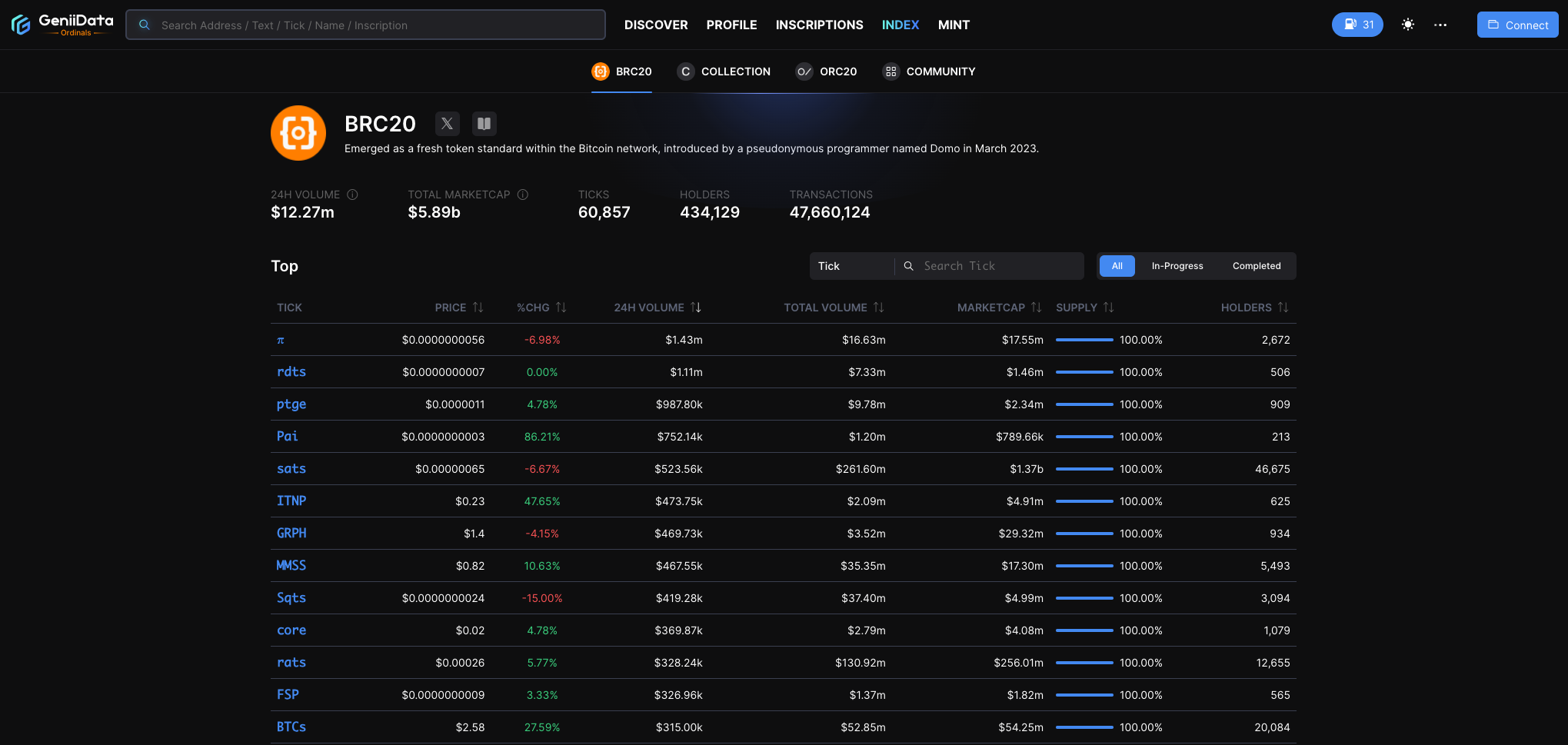

As of January 11, 2024, the trade volume on the BRC-20 inscription ecosystem has reached nearly $12.27M in the past 24 hours.

As for the inscription ecosystem on ETH, as of January 1, 2024, the 24-hour trade volume was close to 53.66 ETH ($139,516).

Overall, the current inscription ecosystem is still dominated by the Bitcoin ecosystem, with growing trading fervor, substantial transaction volume, and a significant increase in total capitalization.

Overall, the current inscription ecosystem is still dominated by the Bitcoin ecosystem, with growing trading fervor, substantial transaction volume, and a significant increase in total capitalization.

Summary

By delving into the principles of inscriptions and their innovative role in the Bitcoin ecosystem, it's evident that the introduction of inscription technology is not just a momentary gimmick or a simple technical iteration. It represents a significant step forward for the Bitcoin network in terms of security, scalability, and practical utility. The implementation of protocols such as Ordinals and BRC20 has opened up new application scenarios for the Bitcoin blockchain. However, users must remain cautious, as the market for inscription assets is still in its infancy, with its value and transaction rules continuously evolving. Therefore, a deep understanding of how these new technologies work is crucial for anyone looking to invest in or innovate within this domain.

About MetaSleuth

MetaSleuth is a comprehensive platform developed by BlockSec to assist users in effectively tracking and investigating all crypto activities. With MetaSleuth, users can easily track funds, visualize fund flows, monitor real-time fund movements, save important information, and collaborate by sharing their findings with others. Currently, we support 13 different blockchains, including Bitcoin (BTC), Ethereum (ETH), Tron (TRX), Polygon (MATIC), and more.

Website: https://metasleuth.io/

Twitter: @MetaSleuth

Telegram: https://t.me/MetaSleuthTeam