At present, it is blockchain legal issues that are exactly blocking your growth. You may run crypto payments or financial services while blockchain legal issues keep showing up, bothering you constantly. Unclear AML rules, sanctioned wallets, potential dirty fund flows...... All of these problems nearly drive you crazy!

You don’t know which transactions are safe. Every alert feels risky. One wrong move can mean fines, audits, or frozen funds. Manual checks are slow. Reports take days. Stress keeps piling up.

Phalcon Compliance can fix this, ease your burden and prevent you from screwing things that you care up .You can see real-time risk, full fund flows, and exact reasons instantly, clearly and precisely. Generate regulator-ready reports in just one click.

What Are Blockchain Legal Issues And Why They Are Different From Traditional Tech Law

Blockchain legal issues are different because blockchain systems move value, cross borders, and execute automatically without a central operator.

Traditional tech law usually focuses on websites, data, and editable contracts. Blockchain legal compliance, by contrast, sits at the intersection of financial regulation, data protection, and programmable infrastructure.

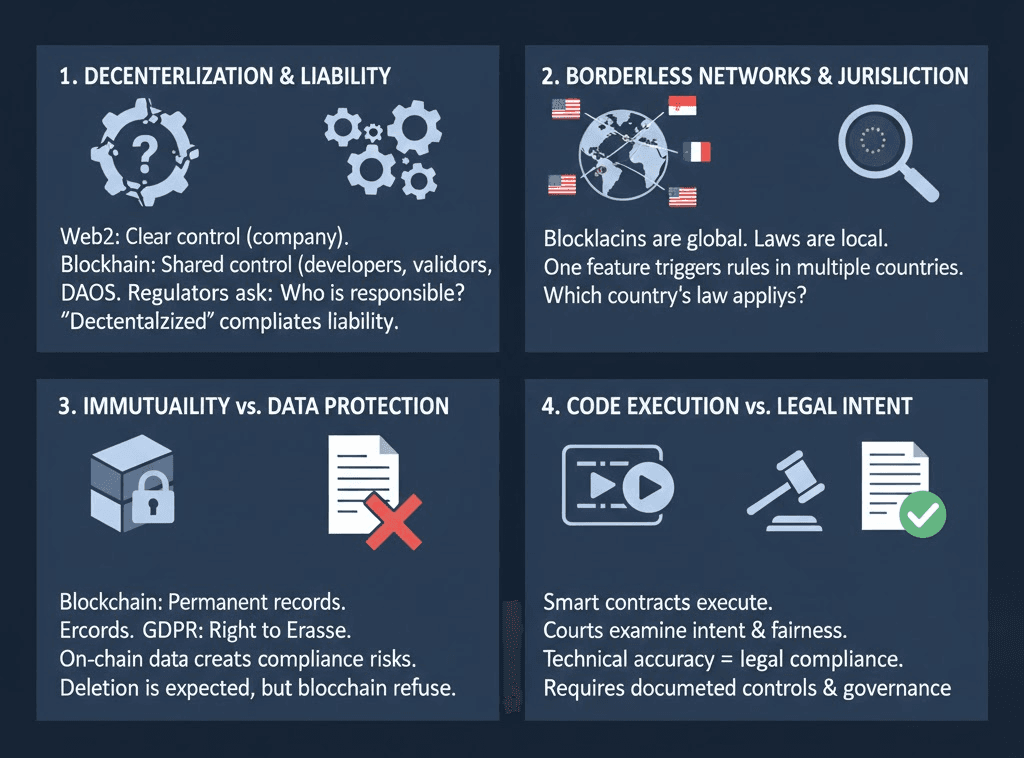

Decentralization and unclear responsibility

In Web2, a company runs the servers and controls the product. In blockchain, control may sit with developers, validators, token holders, or a DAO. When something goes wrong, regulators still look for a responsible party. They ask who built it, who profits, and who can change it. “Decentralized” does not remove liability; it complicates it.

Borderless networks and jurisdiction conflicts

Blockchains are global, but laws are local. A single token or feature can trigger securities, payments, or licensing rules in multiple countries at once. The core blockchain legal compliance question becomes not only what the rule is, but which country’s rule applies to you.

Immutability vs. data protection

Blockchains are designed to be permanent. Privacy laws, such as GDPR, are designed to allow correction and deletion. If personal data or identifiable wallet information appears on-chain, compliance risks arise even without storing names.

Code execution vs. legal intent

Smart contracts execute automatically, but courts examine intent, disclosure, and fairness. Code can function perfectly and still create legal disputes. Blockchain legal compliance therefore requires more than technical accuracy. It requires documented controls, monitoring, and defensible governance.

The 12 Core Categories of Blockchain Legal Issues

If you search for blockchain legal issues, most articles give you generic lists. In reality, enforcement cases show patterns. The same legal fault lines appear again and again across exchanges, DeFi protocols, stablecoin issuers, DAOs, custody providers, and token projects.

Below are the twelve risk categories that repeatedly surface in cryptocurrency law and real regulatory actions. The key is not memorizing them. The key is recognizing where your project is exposed.

1. Regulatory uncertainty

Regulatory uncertainty in blockchain is not abstract. It shows up when agencies reinterpret existing laws to cover new token models or DeFi mechanics. A token launched as “utility” in 2022 may be treated as a security in 2026 after a court decision reshapes the Howey analysis.

A staking service may operate freely for years, then suddenly face enforcement for offering unregistered investment products. In some jurisdictions, regulators issue guidance; in others, they regulate through fines first and clarification later.

This forces projects to design for legal flexibility. Product features, revenue models, and even governance structures must anticipate regulatory shifts, not just current rules.

2. Token and securities laws

Token and securities risk usually turns on economic reality, not branding. A governance token that promises future protocol revenue, buybacks, or staking yield can resemble an investment contract, even if you never call it “equity.” Regulators apply tests like Howey in the U.S., asking whether buyers invest money in a common enterprise with an expectation of profit from the efforts of others.

Marketing language, token allocation, vesting schedules, and insider control all matter. Pre-sales to VCs, airdrops tied to future value, and roadmap promises can strengthen the “reliance” argument. Once classified as a security, registration, disclosure, broker-dealer, and exchange rules may apply.

3. AML / CFT and sanctions

AML, CFT, and sanctions risk do not disappear just because transactions happen on-chain. If your platform facilitates transfers of value, regulators may expect controls similar to those applied to financial institutions. That means screening wallet addresses against sanctions lists such as OFAC(Office of Foreign Assets Control) , monitoring transaction patterns for structuring or layering behavior, and filing Suspicious Activity Reports when thresholds are met.

Cross-chain bridges and mixers increase scrutiny because they are frequently used to obscure fund origin. Even decentralized interfaces can attract enforcement if teams actively maintain front ends or profit from fees. The key legal question is not whether you intended to support illicit activity, but whether you implemented reasonable controls to detect and respond to it.

4. Smart contract enforceability

Smart contracts execute automatically, but legal enforceability depends on more than execution. Courts typically look for offer, acceptance, clear terms, and intent to create legal relations. If a protocol’s code conflicts with its website disclosures or terms of service, judges may prioritize written agreements over raw code.

Problems also arise when exploits, oracle failures, or unexpected logic produce outcomes users did not reasonably anticipate. In disputes, courts examine what users understood at the time of interaction, not just what the bytecode performed.

Automatic settlement does not eliminate claims based on fraud, misrepresentation, mistake, or unfair terms. The legal risk increases when significant value is involved and disclosures are vague or inconsistent.

5. Liability and accountability

Decentralization does not eliminate liability; it redistributes it. Regulators and courts analyze who exercises real control, who makes key decisions, and who benefits financially. Founders who design tokenomics, developers who push upgrades, multisig signers who control treasuries, and operators who run front-ends can all face exposure.

Even DAO voters may be scrutinized if governance decisions directly cause harm, such as approving unlawful token sales or risky treasury actions. Legal assessments focus less on titles and more on functional authority, like who can intervene, pause contracts, modify parameters, or influence user behavior.

Governance structure, upgrade rights, and operational control therefore shape how responsibility is assigned in enforcement actions and civil disputes.

6. Data privacy

Data privacy is one of the most misunderstood blockchain legal issues. Many teams assume that if they never store names or emails, they avoid privacy risk.

That is not always true. Under laws like GDPR (General Data Protection Regulation), a wallet address can become personal data if it can be linked, directly or indirectly, to a real person. Front-end logs, IP addresses, KYC records, and analytics tools can also create identifiable data trails.

The legal question is not just what you store on-chain, but who controls the data and how long it is retained. Regulators may ask whether you minimized collection, encrypted sensitive records, and provided deletion or access rights where required. Immutability does not override privacy obligations; it complicates them.

7. Financial crime and illicit use

One of the top concerns behind searches for blockchain legal issues is simple. That is, what happens if criminals use your protocol? Even if you never intended it, hacks, phishing scams, ransomware proceeds, or sanctioned funds can move through your contracts.

Regulators will not only ask what the attacker did. They will ask what you did. Did you monitor suspicious flows? Did you respond after being alerted? Did you profit from transaction fees tied to illicit activity? In enforcement cases, “we didn’t know” is rarely enough.

Projects that ignore transaction monitoring, sanctions screening, or reporting workflows may face accusations of facilitating laundering. Legal risk grows not from intent, but from failure to detect and act.

8. Consumer protection

When people search blockchain legal issues, they often want to know what happens if users lose money. Consumer protection law is where that question lands. If your interface suggests low risk, stable returns, or “safe” mechanics, regulators will compare those statements to what actually happened. Were risks clearly disclosed? Were smart contract limits explained? Did you warn users about volatility, liquidation thresholds, or upgrade authority?

In many jurisdictions, misleading marketing, hidden fees, or vague terms can trigger enforcement even if the code worked exactly as designed. Silence is not neutral. If users reasonably misunderstood the product, liability can follow. Clear disclosures, transparent documentation, and accurate communication are not marketing choices. They are legal defenses.

9. Taxation

When users search blockchain legal issues, taxation is usually one of the first real-world concerns. Every token transfer, swap, staking reward, or airdrop can trigger tax consequences.

In many countries, crypto-to-crypto trades are taxable events, even if no fiat is involved. Staking rewards may be treated as income at the time of receipt. Token issuers may face corporate tax, VAT, or withholding obligations depending on structure.

Exchanges and platforms can also face reporting duties under frameworks like CARF (Crypto-Asset Reporting Framework) or local information-sharing rules. Ignoring tax treatment does not make it disappear.

Poor recordkeeping, unclear transaction history, or missing documentation can create audit risk for both users and operators. Clear reporting infrastructure and traceable transaction data are now part of compliance, not optional extras.

10. Intellectual Property (IP) and Open-Source Risks

When people search blockchain legal issues, Intellectual Property (IP) risks are often underestimated. Open-source does not mean “no ownership.” Most blockchain projects rely on licenses such as MIT, GPL (General Public License), or Apache.

Each license carries conditions. For example, GPL may require you to disclose your modified source code if you distribute it. Violating these terms can lead to legal claims, forced disclosure, or injunctions that disrupt operations.

Trademarks are another IP risk. Reusing a protocol’s name, logo, or brand identity can trigger disputes, even in decentralized ecosystems. Forking code is technically simple but legally complex. Investors and enterprise partners increasingly conduct IP due diligence before funding or integration.

Hidden licensing conflicts or unclear ownership of core code can delay token listings, partnerships, or acquisitions. In blockchain, open source accelerates innovation, but unmanaged IP exposure creates real legal and commercial risk.

11. Cross-border operations

Cross-border exposure is one of the most searched blockchain legal issues because blockchain products are global by default. The moment users from multiple countries access your protocol, you may trigger multiple regulatory regimes at once.

A token sale open to U.S. users can raise SEC concerns. The same feature marketed in the EU may fall under MiCA. Data collected from European users may activate GDPR obligations, even if your company is registered elsewhere.

Payment flows can also create local licensing risk. Providing exchange or custody services into certain jurisdictions may require VASP or MSB registration. Marketing language, language localization, and even accepting local currency can be used as evidence that you “targeted” a specific market.

Cross-border compliance is not abstract. It directly affects enforcement risk, banking relationships, and fundraising. Without jurisdiction controls and documented compliance strategy, global access can quickly turn into global liability.

12. Governance and control

When people search blockchain legal issues, they often overlook governance. But regulators do not. Governance determines who actually holds power. If a small group can upgrade contracts, pause the protocol, or move treasury funds, regulators may treat them as responsible operators, not neutral developers.

Multisig signers, core contributors, and foundation directors can all be viewed as control points. Even if decisions are made through token voting, authorities may ask who drafted proposals, who controls the front end, and who has emergency powers. The legal focus is often upon who can intervene.

Control triggers expectations. If you can intervene, regulators may expect risk management, AML oversight, and consumer protection safeguards. Governance design is therefore not just a technical architecture choice. It directly shapes liability, compliance duties, and enforcement exposure.

Knowing the risks is the first step; structuring your project to survive them is the second. Use the following Compliance Matrix to match your project type with the necessary legal defense:

| Project Type | Core Legal Tension | Practical Solution (Legal Wrapper) |

|---|---|---|

| DeFi | MSB / Licensing | Cayman Foundation / Non-Custodial Proof |

| RWA | Property Title Linkage | SPV / Trust Structure |

| DAO | General Partnership Liability | LLC / Purpose Trust Wrapper |

Token, DeFi, and DAO

Not all blockchain projects face the same level of legal risk. In practice, tokens, DeFi protocols, and DAOs attract the most attention from regulators.

They touch money, governance, and user expectations. That combination sits at the center of cryptocurrency law and cryptocurrency regulations.

When tokens trigger securities laws

Tokens are often the first legal red flag. Many teams believe that calling a token “utility” is enough. In reality, regulators look at how the token works, not what you call it.

A token may trigger securities laws when people buy it expecting profit, its value depends on the work of a team or core developers, it offers yield, rewards, or revenue sharing and it plays a role in fundraising or growth incentives.

Governance tokens, reward points, and staking tokens are not automatically safe. If they look like investments, they can be treated as securities. This is why token design, distribution, and messaging matter so much. Small choices can create large legal exposure.

DeFi protocols and financial regulation

DeFi aims to remove intermediaries. But financial laws focus on function, not labels. If a protocol enables lending, borrowing, trading, or derivatives, regulators may view it as a financial service. That can trigger licensing, disclosure, or compliance obligations.

Legal risk often increases when there is a hosted front end, a team controls upgrades or parameters, fees flow to a known group and users rely on the protocol for income. Even if the smart contracts are decentralized, the surrounding system may not be.

This is why many DeFi legal issues focus on structure, not code alone.

DAO governance and legal exposure

DAOs are designed to distribute decision-making. But the law still looks for accountability. Key legal questions include whether the DAO is a legal entity, who controls the treasury, who can propose or approve changes, and who benefits from the system.

In many cases, active participants face more risk than passive token holders. Multisig signers, core contributors, and frequent voters may carry higher liability. Governance choices shape legal outcomes. They influence how regulators assign responsibility when things go wrong.

The core takeaway

Tokens, DeFi, and DAOs concentrate legal risk because they combine value, control, and users. Most enforcement actions do not start with ideology.

They start with economic reality. Understanding these risks early helps teams avoid surprises later.

Who Is Legally Responsible in Blockchain Systems

A core blockchain legal issue is usually about when something goes wrong, who is responsible? Decentralization spreads control, but the law still looks for accountable people.

Founders, developers, and operators

In Web3, these roles often overlap. Founders design the roadmap and token model. Developers write and may maintain the code. Operators run front ends or infrastructure users rely on. Regulators focus less on titles and more on actions. They ask who makes key decisions, who benefits financially, who users depend on, and who can change the system.

Open source is not a shield

Publishing code does not remove liability if you control upgrades, operate the main interface, promote the protocol, or collect fees. Open source can reduce risk, but it does not eliminate accountability.

Control signals responsibility

The strongest legal signal is control. If you can pause contracts, upgrade logic, or restrict access, regulators may view you as responsible. Governance design is therefore not just technical. It shapes how the law defines your role.

AML, Sanctions, and Illicit Use

If there is one area where regulators act fast, it is AML and sanctions. Across cryptocurrency regulations, this is the most enforced issue today. Not securities. Not governance. Financial crime risk comes first.

Why AML / CFT is the primary enforcement focus in blockchain

Blockchain systems move value quickly and globally.That makes them attractive for abuse. Regulators worry about money laundering, terrorist financing (CFT), ransomware payments and sanctioned entities moving funds.

When these risks appear, intent matters less than impact. Even neutral infrastructure can face scrutiny if it enables illicit flows. This is why AML sits at the center of blockchain compliance. It is about protecting the financial system, not judging technology.

FATF expectations for virtual asset activities

The FATF sets the global tone for crypto regulation. Many countries align their rules with its guidance. Under FATF standards, activities involving digital assets may trigger obligations when they transfer value, custody assets, facilitate exchange, and support ongoing financial activity.

The key idea is simple. If a system plays a real role in value movement, regulators expect safeguards. That includes risk assessment, monitoring, and reporting. Not once. Continuously.

Why decentralization does not remove monitoring obligations

This is where many teams get confused. Decentralization changes how systems are built. It does not erase legal expectations. Regulators focus on risk exposure, not architecture diagrams. If illicit funds move through a system, they ask what was visible and what was ignored.

In practice, regulators expect continuous monitoring of wallet activity, identification of high-risk addresses, and the ability to trace fund flows linked to illicit activity, not just static policy statements.

That expectation applies even when no single party controls everything.What matters is whether risks were detectable and whether reasonable steps were taken.

The practical reality

Most blockchain enforcement cases today start the same way. Illicit activity is traced on-chain. Then authorities ask who could see it and who could act. That is why AML, sanctions screening, and transaction monitoring are no longer optional topics in crypto law. They are the foundation of modern blockchain legal risk management.

Turning AML/CFT Legal Obligations into Operational Controls

Understanding AML / CFT rules is not enough. The real challenge is turning legal obligations into daily actions. This is where many blockchain teams fail.

Not because they ignore the law, but because their controls are too shallow.

Why one-time screening is not legally sufficient

Many projects rely on simple checks at onboarding. That is no longer enough. Blockchain risk is dynamic. A wallet that looks clean today can become high-risk tomorrow. Static checks create three major problems:

-

They miss new sanctions and emerging threats

-

They cannot catch risk that appears after a transaction

-

They offer little explainability when regulators ask questions

From a legal view, lack of visibility is a risk itself. If you cannot explain why a transaction was allowed, that becomes a compliance issue. Regulators expect ongoing oversight, not snapshots.

What effective AML/CFT controls look like in practice

Modern blockchain compliance is operational, not theoretical. Effective controls usually include precise identification of risky and sanctioned addresses, behavior-based risk analysis, not simple blacklists, full fund tracing from source to destination, and clear records that explain what happened and why These actions help teams detect problems early. They also help prove good-faith compliance during reviews or investigations.

Phalcon Compliance is designed specifically around these AML/CFT requirements. It provides real-time address identification, continuously updated risk signals, unlimited fund flow tracing, and seamless generation of regulator-grade STRs and audit reports. This approach turns compliance from a manual burden into a repeatable process.

Risk-Based Actions

Compliance is not all-or-nothing. Regulators expect risk-based decisions. That means your response should match the level of risk you see.

High risk actions

When risk is clear and serious, action must be strong. This can include restricting transactions, returning funds, and freezing interaction paths. These steps show that you can stop harm, not just observe it.

Medium risk actions

Some activity is suspicious but not confirmed. Common responses include isolating wallets or flows, enhanced verification, and periodic rescreening. The goal is to reduce uncertainty while keeping visibility.

Low risk actions

Low-risk activity does not mean no oversight. Typical treatment is allowing transactions, keeping ongoing monitoring, and watching for behavior changes.

Risk-based actions demonstrate proportional control, which is a key factor regulators assess when determining compliance adequacy.

Smart Contracts, Incidents, and Legal Consequences

Smart contracts automate outcomes. But automation does not remove legal responsibility.

Smart contract bugs and responsibility

When code fails, people still ask questions. Who designed the logic? Who approved the deployment? Who had the power to upgrade or pause? Legal responsibility often follows control, not intent.

Legal expectations after hacks or illicit fund exposure

After an incident, silence creates risk. Regulators expect timely internal investigation, cooperation when required, and clear understanding of fund movement Doing nothing is rarely seen as neutral.

Evidence preservation and traceability

Facts matter after incidents. Transaction records, timelines, and fund paths become critical. On-chain traceability supports investigations and helps explain what really happened.

Cross-Border and Jurisdictional Challenges

Blockchain systems are global by design. Law is not.

Why jurisdiction still applies

Even without borders, legal authority still exists. Jurisdiction may be linked to where users are, where teams operate, andwhere control points exist. Decentralization does not cancel jurisdiction.

Regulatory divergence

Rules differ across regions. What is allowed in one country may be restricted in another. This creates uncertainty for tokens, DeFi protocols, and governance systems. Teams must design with divergence in mind.

Practical restriction strategies

Many projects reduce risk by limiting access from certain regions, adjusting features by market, and applying progressive compliance controls These are legal decisions, not just technical ones.

Jurisdiction is a strategic choice, not a random one. In 2026, your decision logic should be:

-

Need Funding? Use Singapore or Delaware.

-

Need Decentralization? Look at Switzerland or Panama.

-

Dealing with Securities? You must document your Howey Test analysis before launch.

Legal Risk in Blockchain Is Managed Through Visibility and Control

Legal compliance in blockchain is evidence-driven. Not slogan-driven. Monitoring shows awareness. Traceability shows understanding. Reporting shows responsibility. Tools only matter if they support real regulatory expectations. In blockchain law, what you can prove often matters more than what you claim.

FAQ

1. Is blockchain legal in my country?

In most countries, blockchain technology itself is legal. Legal risk depends on how blockchain is used, not on the technology alone. Activities like payments, DeFi, token issuance, and custody may trigger specific laws. So blockchain is generally allowed, but regulated when it supports financial or commercial activity.

2. Do developers face liability?

Yes, developers can face legal liability in some cases. Risk increases when developers control upgrades or admin functions, operate front ends or infrastructure, and actively manage or promote the system. In blockchain law, control and influence matter more than titles.

3. Do DeFi protocols need AML controls?

Often, yes. If a DeFi protocol enables value transfer or financial activity, regulators usually expect AML-related safeguards. Decentralization does not remove this expectation. Regulators focus on risk exposure and detectability, not architecture.

4. What do regulators actually look for?

Regulators focus on visibility, control, and evidence. They want to see identifiable risks, reasonable actions taken, and decisions documented. Compliance is judged by what you can show, not what you claim.

5. What is the biggest problem with blockchain?

The biggest problem is unclear responsibility. Blockchain distributes control, but the law still expects accountability. When no one appears responsible, legal risk increases.

6. Can I get my money back from blockchain?

Usually, no. Blockchain transactions are irreversible by design.Recovery is possible only in limited cases, such as early intervention, exchange involvement, or legal orders. Prevention is far more effective than recovery.

7. Can police seize your crypto?

Yes. Law enforcement can seize crypto if assets are held by custodians, private keys are obtained, and funds are linked to illegal activity. Blockchain does not guarantee immunity from enforcement.