In one of the largest crypto crime crackdowns in history, the U.S. Department of Justice (DOJ) has seized over 💲15 billion in Bitcoin tied to massive Southeast Asian scam operations. The coordinated action—led by OFAC, FinCEN, and the U.K.’s FCDO—targets Prince Group, Huione Group, and associated entities accused of running large-scale “pig butchering” scams and laundering billions through the crypto ecosystem.

A Coordinated Global Action

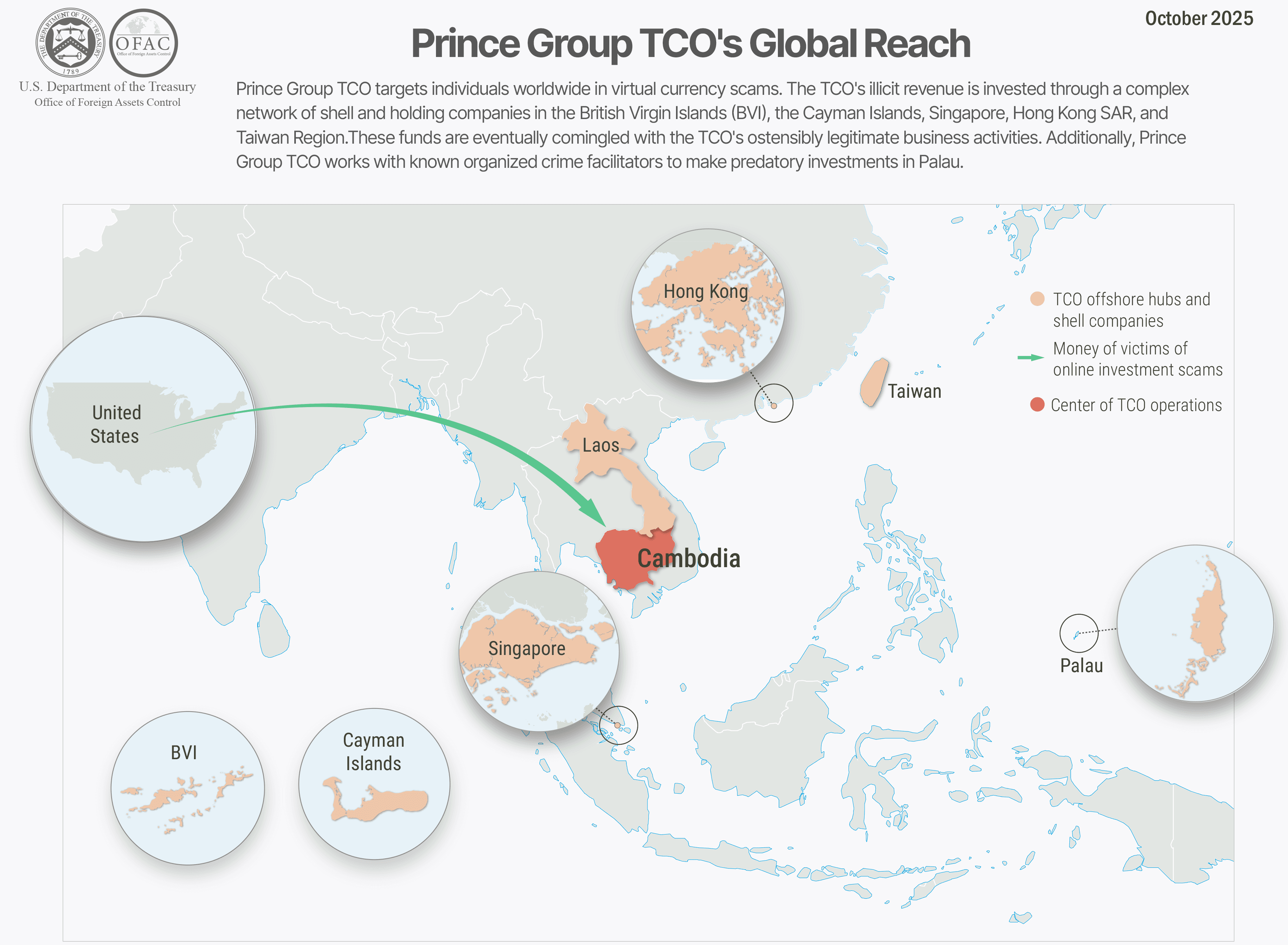

On October 14, 2025, U.S. and U.K. authorities jointly sanctioned 146 entities and individuals associated with the Prince Group Transnational Criminal Organization (TCO).

The network’s criminal activities span fraud, extortion, forced labor, and human trafficking, with proceeds funneled through a complex web of crypto mining, OTC trading, and digital wallets.

The Huione Group, a key financial facilitator for these schemes, reportedly laundered over $4 billion in illicit crypto between 2021 and 2025, handling nearly $98 billion in total inflows across that period. Its subsidiary HuionePay allegedly provided financial infrastructure for pig-butchering rings, darknet markets, and even North Korean cybercrime groups.

As part of the same operation, the U.K.’s OFSI sanctioned Byex Exchange, which is linked to both Prince Group and Huione, accusing it of processing and obfuscating illicit transfers through multiple jurisdictions.

Bitcoin Flows and Illicit Infrastructure

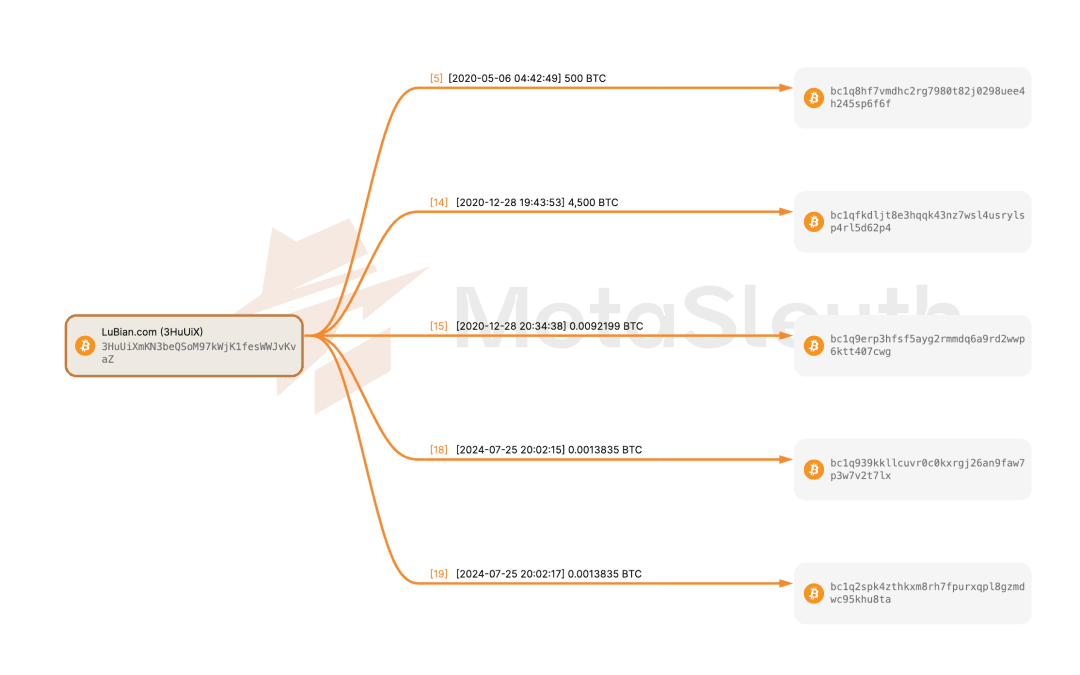

Investigators traced over 127,000 Bitcoin—valued at roughly 💲15 billion—to addresses directly controlled by Prince Group chairman Chen Zhi.

The group also operated a Bitcoin mining operation in Laos via Warp Data Technology, using it to launder criminal proceeds under the guise of legitimate mining.

Prince Group’s activities extended far beyond Cambodia. In Palau, the organization attempted to legitimize its image through a luxury resort project, “Grand Legend,” while continuing to move illicit funds through offshore wallets.

Crypto’s Dark Underbelly: Pig Butchering and Money Laundering

The crackdown exposes how large-scale scam networks abuse digital assets to mix illicit and legitimate funds, creating a vast underground economy that is difficult to trace without advanced blockchain analytics.

Authorities found that pig-butchering scams, online gambling, and trafficking rings frequently convert stolen funds into stablecoins or Bitcoin, move them through Huione-linked payment channels, and disperse them across multiple blockchains via bridges and swaps.

This massive seizure not only disrupts one of the most entrenched criminal ecosystems in Southeast Asia—it also highlights the growing capability of law enforcement to trace, freeze, and forfeit illicit crypto assets on-chain.

Compliance Implications: A Wake-Up Call for the Industry

The investigation underscores a critical reality:

Crypto compliance is no longer optional—it’s existential.

Financial institutions, exchanges, payment processors, and even individual traders must screen their adresses and transactions against sanction lists and high-risk entities such as Huione Group to avoid exposure to tainted assets.

Failing to do so could lead to frozen funds, blacklisting, or even criminal liability in jurisdictions with strict AML/CFT enforcement.

BlockSec’s Response: Empowering Safer On-Chain Activity

At BlockSec, we have integrated all newly sanctioned individuals and entities—including those from the Prince Group and Huione network—into our threat intelligence database.

These updates are now reflected across the Phalcon Compliance platform, enabling instant detection of associated wallets and transactions.

To support both individual users and SMEs, we’ve launched the Phalcon Compliance Self-Service Platform—a streamlined KYT/KYA solution offering:

-

● Accurate risk labeling across 400M+ addresses

-

● Millisecond-level response for single or batch screening

-

● Deep fund flow analysis to trace and interpret illicit money trails

Whether you’re managing exchange inflows, operating a crypto payment service, or simply verifying wallet safety, Phalcon Compliance helps ensure your transactions are clean and compliant with FATF standards across the U.S., Europe, Hong Kong SAR, and 27+ jurisdictions.

Stay Vigilant: Check Before You Transact

Users and institutions should remain vigilant when handling crypto transfers, especially from Cambodian guarantee platforms like Huione and other informal OTC markets. Always verify the legitimacy of fund sources before accepting or converting them to avoid potential freezes or prosecution.

With Phalcon Compliance, anyone can perform instant, on-chain risk screening—no demo or integration required.

👉 Scan Now to Check for “Black U” (Illicit USDT): https://blocksec.com/phalcon/compliance

Conclusion

The record-breaking $15 billion seizure is a watershed moment for crypto enforcement and compliance.

It proves that even the most sophisticated laundering networks leave digital fingerprints—and with the right tools, they can be traced, exposed, and dismantled.

At BlockSec, we remain committed to helping users, institutions, and regulators build a safer, more transparent blockchain ecosystem.