Industry Landscape & Future Trends

Current Status

The U-card sector is experiencing rapid expansion, yet frequent exits highlight the industry’s volatility. While more crypto platforms are launching U-card programs, their reliance on upstream partners and regulatory pressure drives high attrition rates.

The industry value chain is highly complex, involving multiple stakeholders across compliance, clearing, card manufacturing, payment network integration, risk management, and fiat–crypto conversion. Each link is tightly interconnected.

Opportunities remain significant, with innovation-driven projects combining yield products and on-chain asset applications to enhance stickiness and create new value.

Risks persist, including FX exposure, taxation issues, AML/CFT scrutiny, and fraud-related regulations. These remain key barriers to business scalability.

Growth Drivers & Challenges

Drivers

Rising demand from Web3 users for seamless payments positions U-cards as a critical bridge between digital assets and everyday consumption.

Exchanges and ecosystem projects leverage their user base and product synergies to accelerate U-card adoption and expand use cases.

Challenges

Lack of stable and reliable upstream payment networks and issuing partners makes it hard to scale sustainably.

Fragmented regulation across countries requires continuous investment in risk control.

Industry is still immature; relying only on airdrops or quick incentives cannot build long-term user value.

About Interlace

Founded in 2019, Interlace is serving as the backbone for stablecoin utilization in cross-border payments, enabling efficient and scalable financial transactions worldwide.

Interlace provides institutional clients such as wallets, exchanges and brokers with its extensive open APIs, enabling easy and seamless embedded financial integration. It also directly serves customers across industries such as cross-border e-commerce, B2B trade, ads agencies, gaming companies and Web3 startups.

Operating in strict compliance with global regulations, Interlace holds the highest security certification in the international card payment industry, PCI-DSS Level-1, and is licensed in the United States, Hong Kong SAR, and Lithuania.

Challenges

-

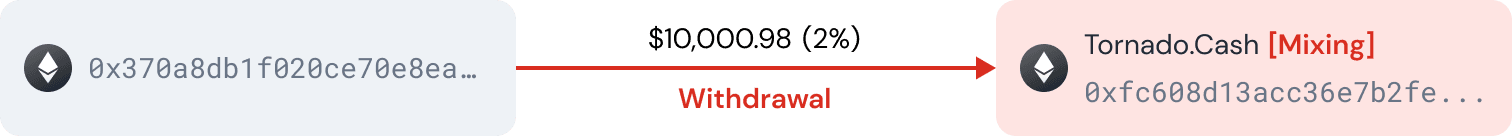

Complex inbound flows – Large volumes of deposits often come from risky sources (mixers, hacked protocols, darknet markets, sanctioned addresses). Manual reviews are slow, unreliable, and not real-time.

-

Uncertain outbound flows – Hard to detect if withdrawal addresses belong to hackers, phishing wallets, or OFAC-sanctioned entities, creating compliance and reputation risks.

-

Balancing control and user experience – Strict rules harm good users and block growth, while loose rules are ineffective. Precise and tiered risk management is needed.

Deposit Risk Management

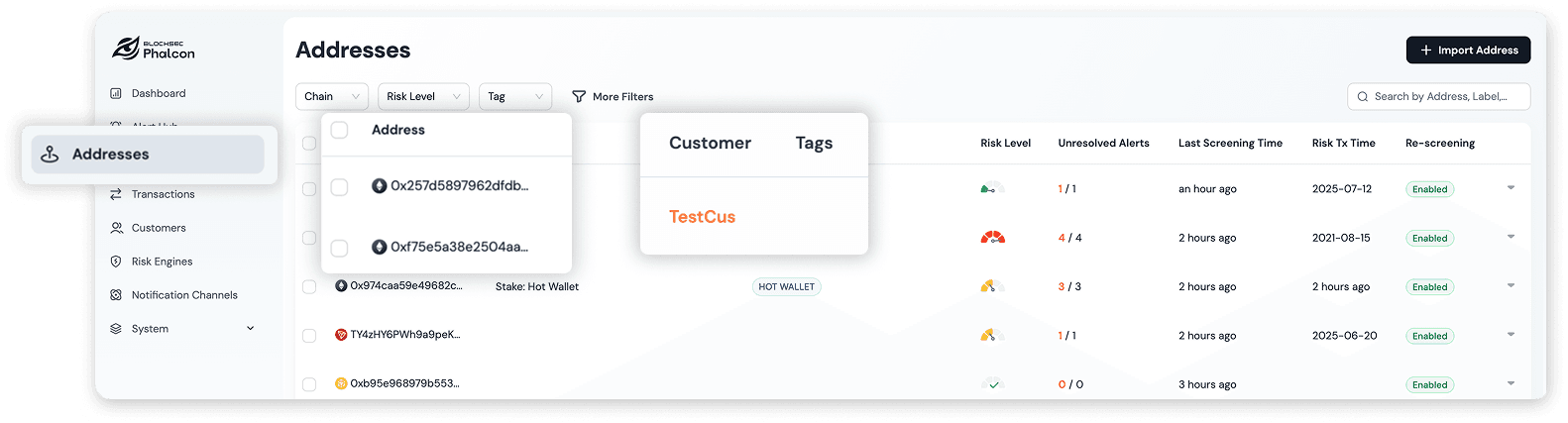

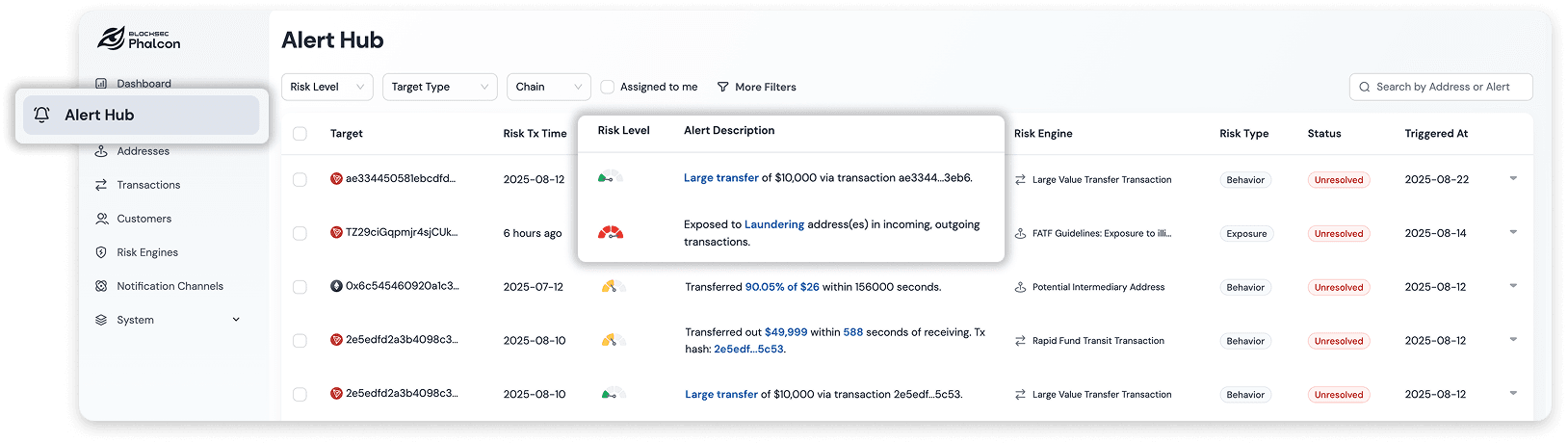

Counterparty Screening

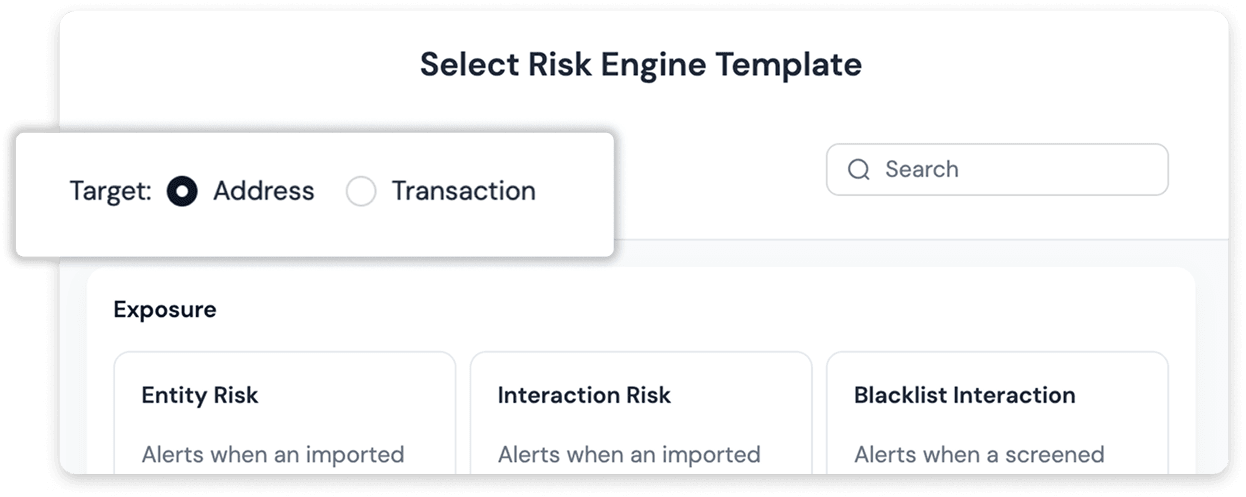

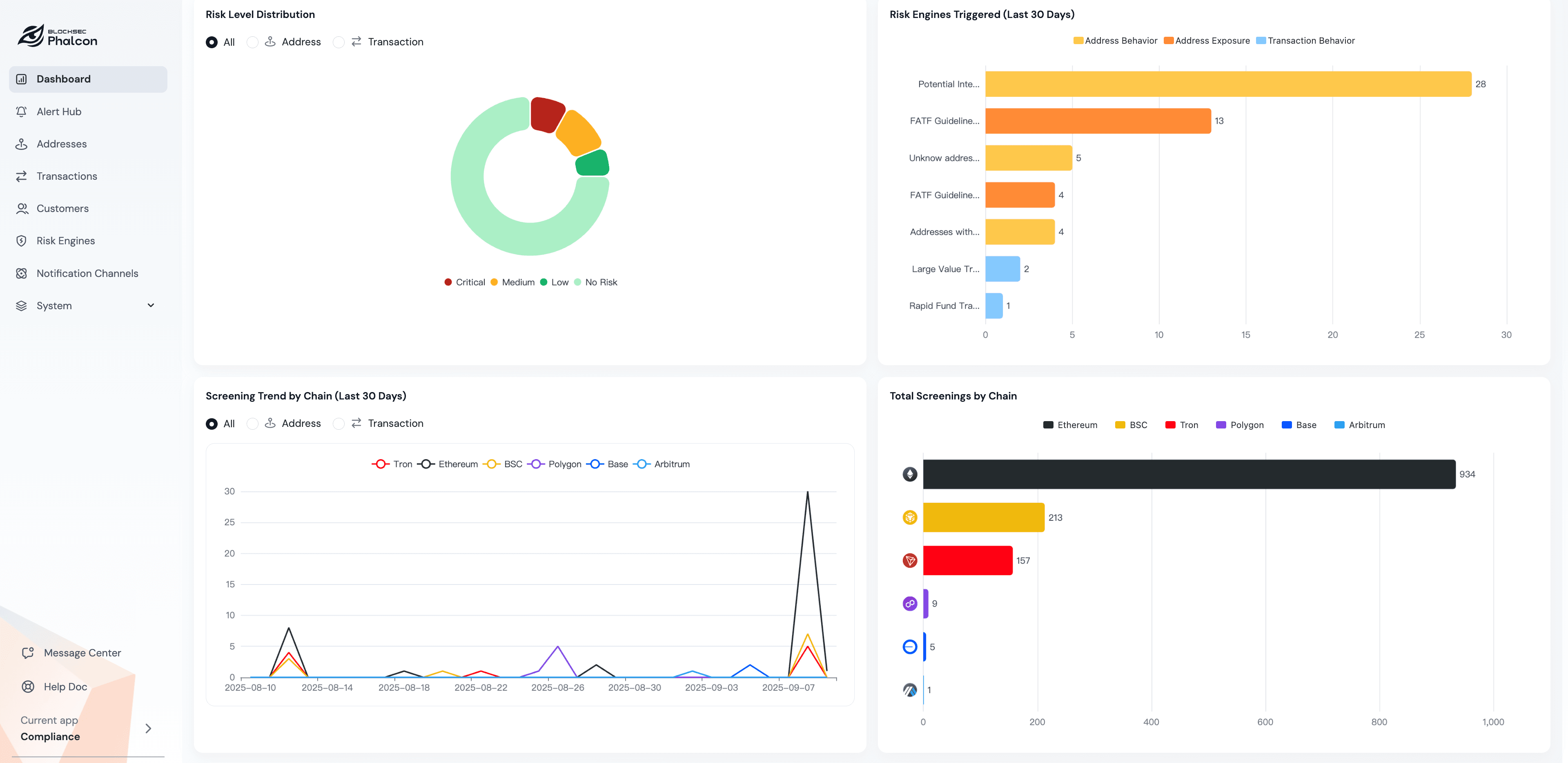

Leveraging KYA (Know Your Address) and KYT (Know Your Transaction), Phalcon Compliance can help Interlace:

Identify counterparties and fund sources in real time.

Analyze address history, fund flows, and tagging data to pinpoint high-risk funds with accuracy.

Analyze address history, fund flows, and tagging data to pinpoint high-risk funds with accuracy.

Results:

Review efficiency improved by 70%, freeing compliance teams from repetitive checks.

Tiered Risk Handling

High / Severe Risk Funds: Deposits restricted; customers must provide proof of fund origin. Funds may be returned or frozen for 7–30 days per regulatory requirements.

Medium Risk Funds: Subject to periodic retrospective checks with dynamic reassessment.

Results:

Prevented many deposit attempts from mixers and stolen funds.

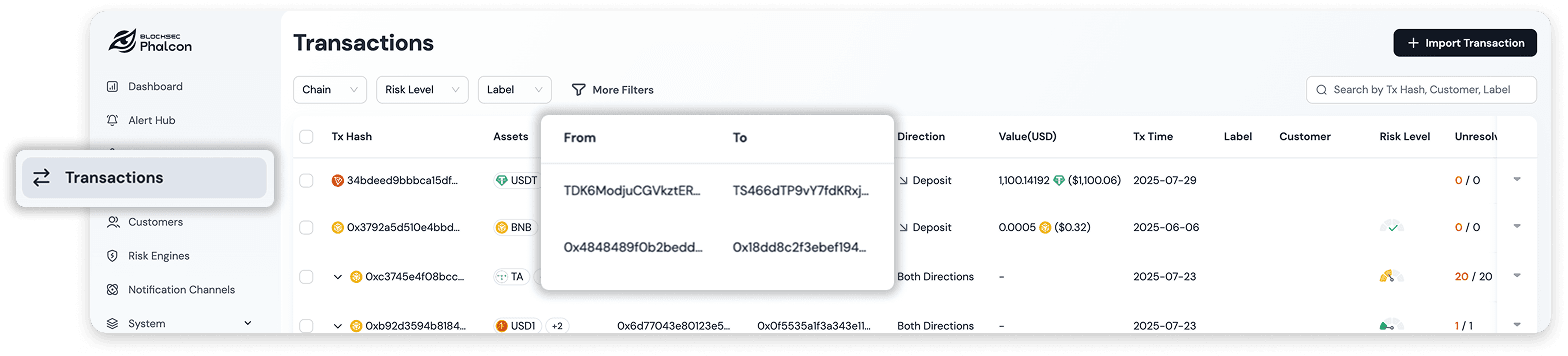

Withdrawal Risk Management

High-Risk Address Restrictions

Withdrawals to addresses flagged as severe or high risk are blocked outright.

Results:

Achieved a 99.9% interception rate for high-risk withdrawals, cutting off illicit fund flows at the source.

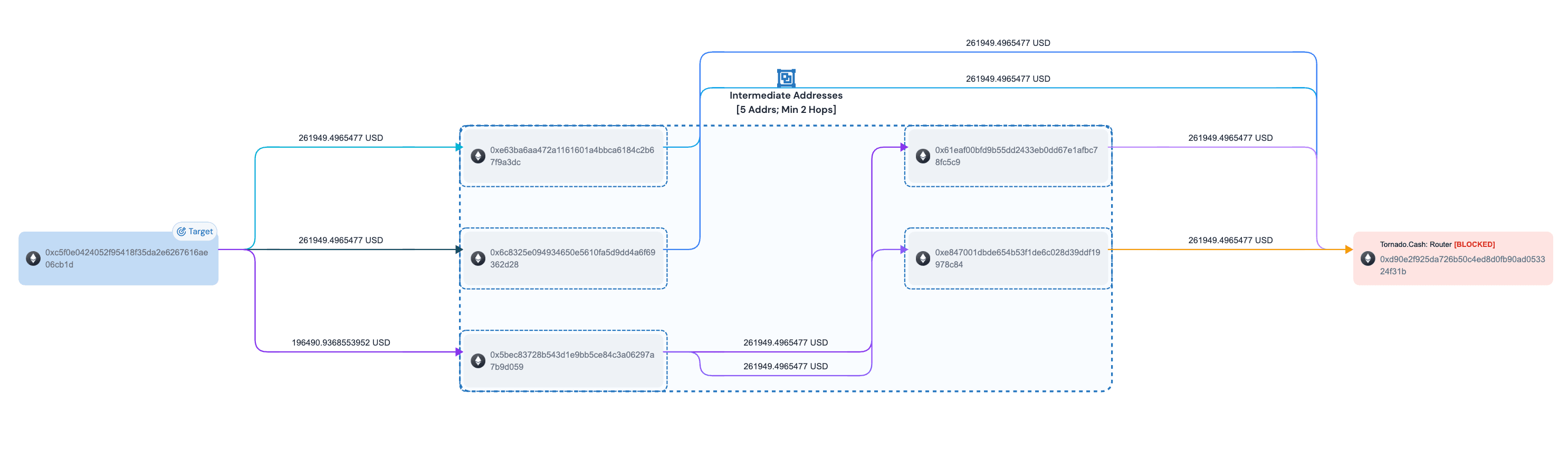

Dynamic Screening & Monitoring

Periodic retrospective checks ensure all withdrawal addresses remain up-to-date against risk lists.

On-chain tracing technology monitors fund flows and potential risk pathways.

Results:

Achieved zero security incidents, with platform funds safeguarded at industry-leading compliance levels.

Real-Time Risk Interception

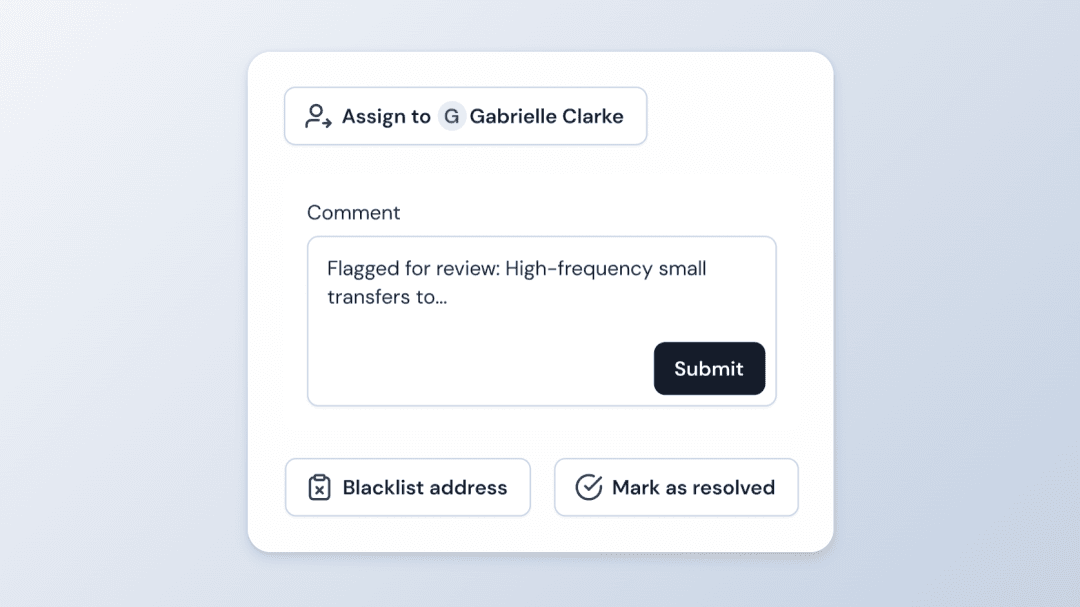

Outbound transactions automatically intercepted pre-execution if deemed suspicious.

Escalation to manual review workflows for flagged cases.

Results:

Improved transparency and reduced exposure to money laundering and illicit activities.

User-Centric Risk Controls

BlockSec’s solution ensures:

Granular risk scoring and tiered handling instead of one-size-fits-all.

Millisecond-level checks for normal users, ensuring smooth UX.

Targeted stops only for high-risk transactions.

Results:

Interlace boosted compliance while keeping high user satisfaction and retention—supporting long-term growth.

Client Testimonial

Partnering with BlockSec has significantly strengthened the security of our platform. Real-time deposit and withdrawal risk management has prevented numerous high-risk transactions. BlockSec’s solution not only improved our compliance capabilities but also preserved user experience—critical for our long-term growth.

— Romy, Interlace CPO

Q&A

Q1: How can we integrate BlockSec’s KYA/KYT solution into our system?

A: Use our RESTful APIs at deposit/withdrawal points to get real-time risk checks. Docs, sample code, and support ensure fast deployment—usually within days.

Q2: How many blockchain addresses does BlockSec cover, and how often is it updated?

A: Covers 400M+ blockchain addresses, including sanctions, mixers, hacks, scams, and exchanges. Updated 24/7 via monitoring, AI, and expert review.

Q3: Does Phalcon Compliance meet global regulatory standards?

A: It aligns with FATF AML/CFT standards. Supports audit logs, one-click STR reports, and flexible compliance templates.